Five Below (NASDAQ:FIVE - Get Free Report) had its price objective increased by stock analysts at The Goldman Sachs Group from $106.00 to $122.00 in a note issued to investors on Friday,Benzinga reports. The firm presently has a "buy" rating on the specialty retailer's stock. The Goldman Sachs Group's price target would suggest a potential upside of 8.22% from the stock's current price.

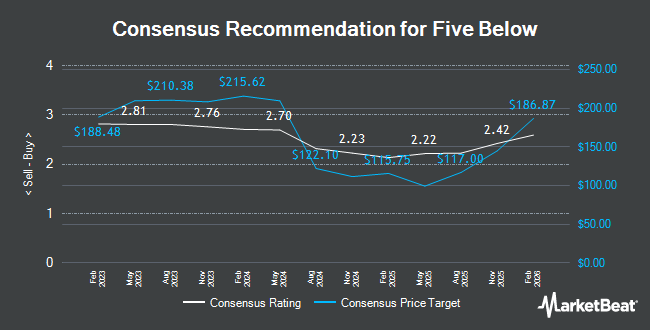

Several other brokerages have also recently weighed in on FIVE. Craig Hallum raised their target price on shares of Five Below from $125.00 to $150.00 and gave the company a "buy" rating in a report on Thursday. KeyCorp lowered shares of Five Below from an "overweight" rating to a "sector weight" rating in a report on Thursday, November 7th. Wells Fargo & Company boosted their target price on shares of Five Below from $115.00 to $135.00 and gave the stock an "overweight" rating in a research note on Thursday. Morgan Stanley raised their price target on Five Below from $100.00 to $120.00 and gave the company an "equal weight" rating in a research note on Thursday. Finally, Melius Research assumed coverage on Five Below in a research report on Monday, September 23rd. They set a "hold" rating and a $100.00 price objective for the company. Two investment analysts have rated the stock with a sell rating, fourteen have assigned a hold rating and six have issued a buy rating to the company's stock. Based on data from MarketBeat, Five Below has an average rating of "Hold" and a consensus price target of $116.15.

Get Our Latest Stock Report on Five Below

Five Below Stock Performance

Shares of NASDAQ:FIVE traded down $3.24 during trading on Friday, hitting $112.73. The company's stock had a trading volume of 2,392,844 shares, compared to its average volume of 1,961,010. Five Below has a fifty-two week low of $64.87 and a fifty-two week high of $216.18. The business has a 50 day moving average price of $91.79 and a two-hundred day moving average price of $94.37. The company has a market capitalization of $6.20 billion, a PE ratio of 23.24, a P/E/G ratio of 1.16 and a beta of 1.18.

Five Below (NASDAQ:FIVE - Get Free Report) last released its earnings results on Wednesday, December 4th. The specialty retailer reported $0.42 EPS for the quarter, topping the consensus estimate of $0.16 by $0.26. Five Below had a return on equity of 18.10% and a net margin of 7.02%. The firm had revenue of $843.71 million during the quarter, compared to analysts' expectations of $801.48 million. During the same period in the previous year, the firm posted $0.26 EPS. Five Below's revenue for the quarter was up 14.6% on a year-over-year basis. As a group, equities analysts expect that Five Below will post 4.93 earnings per share for the current fiscal year.

Hedge Funds Weigh In On Five Below

A number of hedge funds and other institutional investors have recently made changes to their positions in the stock. Paladin Wealth LLC purchased a new position in Five Below in the 3rd quarter valued at $26,000. Brooklyn Investment Group purchased a new stake in shares of Five Below in the third quarter valued at about $30,000. Wilmington Savings Fund Society FSB acquired a new position in shares of Five Below during the third quarter worth about $42,000. Hobbs Group Advisors LLC acquired a new position in shares of Five Below during the second quarter worth about $44,000. Finally, Partnership Wealth Management LLC raised its holdings in Five Below by 63.5% during the third quarter. Partnership Wealth Management LLC now owns 515 shares of the specialty retailer's stock worth $46,000 after purchasing an additional 200 shares in the last quarter.

Five Below Company Profile

(

Get Free Report)

Five Below, Inc operates as a specialty value retailer in the United States. The company offers range of accessories, which includes novelty socks, sunglasses, jewelry, scarves, gloves, hair accessories, athletic tops and bottoms, and t-shirts, as well as nail polish, lip gloss, fragrance, and branded cosmetics; and personalized living space products, such as lamps, posters, frames, fleece blankets, plush items, pillows, candles, incense, lighting, novelty décor, accent furniture, and related items, as well as provides storage options.

Featured Stories

Before you consider Five Below, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Five Below wasn't on the list.

While Five Below currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.