The Goldman Sachs Group reiterated their buy rating on shares of Alaska Air Group (NYSE:ALK - Free Report) in a research report report published on Friday, Marketbeat Ratings reports. The Goldman Sachs Group currently has a $70.00 price objective on the transportation company's stock.

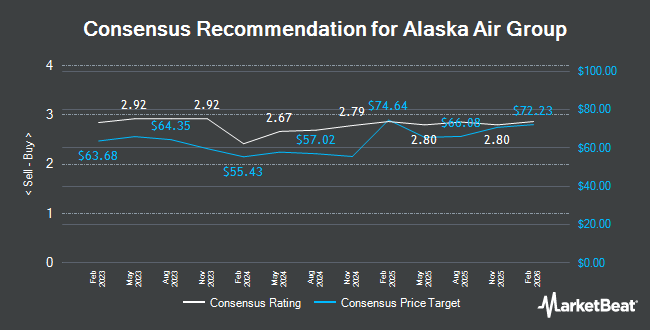

Several other equities analysts have also issued reports on the company. Melius Research upgraded Alaska Air Group from a "hold" rating to a "buy" rating and set a $56.00 price target on the stock in a research report on Monday, October 28th. Evercore ISI decreased their target price on shares of Alaska Air Group from $60.00 to $55.00 and set an "outperform" rating on the stock in a research note on Thursday, October 3rd. TD Cowen dropped their price target on shares of Alaska Air Group from $52.00 to $50.00 and set a "buy" rating for the company in a research report on Thursday, October 3rd. Barclays upped their target price on Alaska Air Group from $55.00 to $80.00 and gave the stock an "overweight" rating in a report on Thursday. Finally, Morgan Stanley lowered their target price on Alaska Air Group from $75.00 to $70.00 and set an "overweight" rating for the company in a research note on Monday, July 22nd. Three research analysts have rated the stock with a hold rating and twelve have given a buy rating to the company. According to data from MarketBeat.com, the company has an average rating of "Moderate Buy" and a consensus target price of $57.31.

View Our Latest Stock Report on ALK

Alaska Air Group Price Performance

NYSE:ALK traded up $0.97 during midday trading on Friday, hitting $53.85. The company had a trading volume of 1,580,198 shares, compared to its average volume of 2,269,119. The company has a market capitalization of $6.84 billion, a PE ratio of 21.32, a P/E/G ratio of 1.17 and a beta of 1.59. The company has a quick ratio of 0.57, a current ratio of 0.60 and a debt-to-equity ratio of 0.93. Alaska Air Group has a 52-week low of $32.00 and a 52-week high of $53.98. The stock's fifty day moving average price is $44.85 and its 200-day moving average price is $41.28.

Alaska Air Group (NYSE:ALK - Get Free Report) last announced its quarterly earnings data on Thursday, October 31st. The transportation company reported $2.25 earnings per share for the quarter, beating analysts' consensus estimates of $2.22 by $0.03. The company had revenue of $3.07 billion for the quarter, compared to analysts' expectations of $3 billion. Alaska Air Group had a return on equity of 12.81% and a net margin of 2.99%. Alaska Air Group's revenue for the quarter was up 8.2% compared to the same quarter last year. During the same period last year, the firm posted $1.83 EPS. As a group, research analysts expect that Alaska Air Group will post 4.26 earnings per share for the current year.

Hedge Funds Weigh In On Alaska Air Group

Hedge funds have recently added to or reduced their stakes in the company. Altshuler Shaham Ltd bought a new position in shares of Alaska Air Group during the second quarter valued at $28,000. Venturi Wealth Management LLC lifted its stake in Alaska Air Group by 86.0% during the 3rd quarter. Venturi Wealth Management LLC now owns 1,025 shares of the transportation company's stock valued at $46,000 after acquiring an additional 474 shares during the period. Pacifica Partners Inc. lifted its stake in Alaska Air Group by 952.4% during the 3rd quarter. Pacifica Partners Inc. now owns 1,105 shares of the transportation company's stock valued at $50,000 after acquiring an additional 1,000 shares during the period. True Wealth Design LLC purchased a new stake in shares of Alaska Air Group during the 3rd quarter valued at about $52,000. Finally, Quarry LP grew its stake in shares of Alaska Air Group by 259.3% in the third quarter. Quarry LP now owns 1,175 shares of the transportation company's stock worth $53,000 after acquiring an additional 848 shares during the period. 81.90% of the stock is currently owned by hedge funds and other institutional investors.

About Alaska Air Group

(

Get Free Report)

Alaska Air Group, Inc, through its subsidiaries, operates airlines. It operates through three segments: Mainline, Regional, and Horizon. The company offers scheduled air transportation services on Boeing jet aircraft for passengers and cargo in the United States, and in parts of Canada, Mexico, Costa Rica, Belize, Guatemala, and the Bahamas; and for passengers across a shorter distance network within the United States, Canada, and Mexico.

Featured Stories

Before you consider Alaska Air Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alaska Air Group wasn't on the list.

While Alaska Air Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.