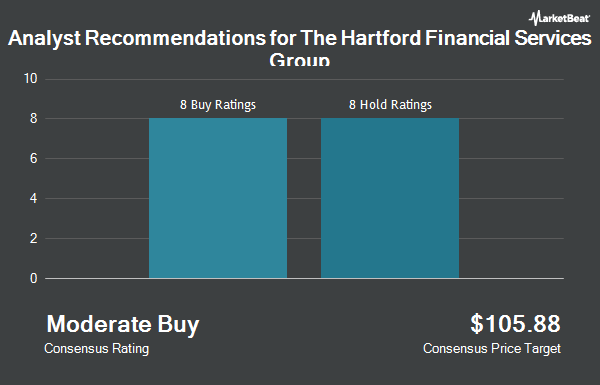

The Hartford Financial Services Group, Inc. (NYSE:HIG - Get Free Report) has been given an average recommendation of "Moderate Buy" by the eighteen ratings firms that are covering the stock, MarketBeat Ratings reports. Ten equities research analysts have rated the stock with a hold recommendation, seven have given a buy recommendation and one has given a strong buy recommendation to the company. The average 1 year price target among brokers that have covered the stock in the last year is $120.88.

Several equities analysts have commented on HIG shares. Wells Fargo & Company increased their price target on shares of The Hartford Financial Services Group from $122.00 to $134.00 and gave the company an "overweight" rating in a research note on Tuesday, September 17th. JPMorgan Chase & Co. raised their target price on The Hartford Financial Services Group from $122.00 to $125.00 and gave the company a "neutral" rating in a report on Friday, October 25th. Jefferies Financial Group lifted their price target on The Hartford Financial Services Group from $113.00 to $127.00 and gave the stock a "hold" rating in a research note on Wednesday, October 9th. Royal Bank of Canada lifted their price objective on The Hartford Financial Services Group from $105.00 to $115.00 and gave the stock a "sector perform" rating in a research report on Monday, July 29th. Finally, StockNews.com cut The Hartford Financial Services Group from a "buy" rating to a "hold" rating in a report on Thursday, November 7th.

View Our Latest Report on The Hartford Financial Services Group

The Hartford Financial Services Group Trading Up 0.2 %

HIG traded up $0.20 on Tuesday, hitting $117.90. The company had a trading volume of 1,414,091 shares, compared to its average volume of 1,604,185. The firm has a market cap of $34.18 billion, a P/E ratio of 11.79, a PEG ratio of 0.96 and a beta of 0.94. The Hartford Financial Services Group has a 1 year low of $73.92 and a 1 year high of $123.23. The company's fifty day moving average price is $116.35 and its 200 day moving average price is $108.17. The company has a current ratio of 0.32, a quick ratio of 0.32 and a debt-to-equity ratio of 0.26.

The Hartford Financial Services Group Increases Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Friday, January 3rd. Investors of record on Monday, December 2nd will be issued a $0.52 dividend. This represents a $2.08 dividend on an annualized basis and a yield of 1.76%. The ex-dividend date is Monday, December 2nd. This is an increase from The Hartford Financial Services Group's previous quarterly dividend of $0.47. The Hartford Financial Services Group's dividend payout ratio is currently 20.84%.

The Hartford Financial Services Group declared that its Board of Directors has approved a stock repurchase plan on Thursday, July 25th that authorizes the company to buyback $3.30 billion in shares. This buyback authorization authorizes the insurance provider to purchase up to 10.9% of its shares through open market purchases. Shares buyback plans are usually a sign that the company's board believes its stock is undervalued.

Institutional Trading of The Hartford Financial Services Group

Several institutional investors and hedge funds have recently bought and sold shares of HIG. DT Investment Partners LLC acquired a new position in shares of The Hartford Financial Services Group during the 3rd quarter worth $26,000. New Covenant Trust Company N.A. acquired a new position in The Hartford Financial Services Group during the 1st quarter worth approximately $26,000. Clean Yield Group purchased a new stake in shares of The Hartford Financial Services Group in the third quarter worth approximately $33,000. Quest Partners LLC raised its stake in shares of The Hartford Financial Services Group by 2,750.0% in the second quarter. Quest Partners LLC now owns 285 shares of the insurance provider's stock worth $29,000 after purchasing an additional 275 shares during the last quarter. Finally, Bank & Trust Co bought a new position in shares of The Hartford Financial Services Group in the second quarter valued at approximately $30,000. Institutional investors own 93.42% of the company's stock.

The Hartford Financial Services Group Company Profile

(

Get Free ReportThe Hartford Financial Services Group, Inc, together with its subsidiaries, provides insurance and financial services to individual and business customers in the United States, the United Kingdom, and internationally. Its Commercial Lines segment offers insurance coverages, including workers' compensation, property, automobile, general and professional liability, package business, umbrella, fidelity and surety, marine, livestock, accident, health, and reinsurance through regional offices, branches, sales and policyholder service centers, independent retail agents and brokers, wholesale agents, and reinsurance brokers.

Recommended Stories

Before you consider The Hartford Financial Services Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and The Hartford Financial Services Group wasn't on the list.

While The Hartford Financial Services Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.