Victory Capital Management Inc. trimmed its stake in shares of The Hartford Financial Services Group, Inc. (NYSE:HIG - Free Report) by 9.9% in the third quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 4,499,188 shares of the insurance provider's stock after selling 496,062 shares during the quarter. The Hartford Financial Services Group comprises approximately 0.5% of Victory Capital Management Inc.'s investment portfolio, making the stock its 21st biggest position. Victory Capital Management Inc. owned about 1.55% of The Hartford Financial Services Group worth $529,150,000 as of its most recent SEC filing.

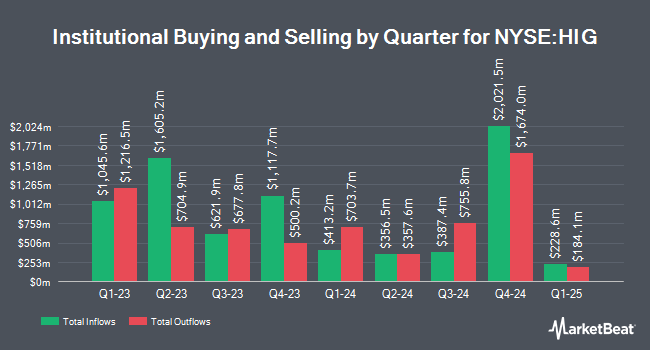

A number of other hedge funds and other institutional investors have also recently added to or reduced their stakes in HIG. Concurrent Investment Advisors LLC bought a new stake in shares of The Hartford Financial Services Group in the second quarter valued at about $213,000. Sei Investments Co. boosted its position in shares of The Hartford Financial Services Group by 5.6% in the first quarter. Sei Investments Co. now owns 229,305 shares of the insurance provider's stock valued at $23,629,000 after acquiring an additional 12,067 shares during the period. Skandinaviska Enskilda Banken AB publ boosted its position in shares of The Hartford Financial Services Group by 27.6% in the second quarter. Skandinaviska Enskilda Banken AB publ now owns 221,896 shares of the insurance provider's stock valued at $22,309,000 after acquiring an additional 48,004 shares during the period. Twin Tree Management LP acquired a new position in The Hartford Financial Services Group in the first quarter valued at about $3,133,000. Finally, State Board of Administration of Florida Retirement System raised its stake in The Hartford Financial Services Group by 6.1% in the first quarter. State Board of Administration of Florida Retirement System now owns 421,431 shares of the insurance provider's stock valued at $43,428,000 after purchasing an additional 24,326 shares in the last quarter. 93.42% of the stock is owned by institutional investors.

Analyst Ratings Changes

HIG has been the subject of a number of analyst reports. Bank of America boosted their price target on The Hartford Financial Services Group from $121.00 to $124.00 and gave the company a "neutral" rating in a research note on Thursday, October 10th. StockNews.com downgraded The Hartford Financial Services Group from a "buy" rating to a "hold" rating in a research note on Thursday, November 7th. UBS Group boosted their price target on The Hartford Financial Services Group from $134.00 to $135.00 and gave the company a "buy" rating in a research note on Tuesday, October 15th. Keefe, Bruyette & Woods boosted their target price on The Hartford Financial Services Group from $133.00 to $135.00 and gave the stock an "outperform" rating in a research note on Tuesday, October 29th. Finally, Royal Bank of Canada boosted their target price on The Hartford Financial Services Group from $105.00 to $115.00 and gave the stock a "sector perform" rating in a research note on Monday, July 29th. Eleven investment analysts have rated the stock with a hold rating, seven have assigned a buy rating and one has given a strong buy rating to the company's stock. According to MarketBeat.com, The Hartford Financial Services Group presently has a consensus rating of "Hold" and a consensus target price of $120.88.

Read Our Latest Stock Report on The Hartford Financial Services Group

The Hartford Financial Services Group Trading Up 0.2 %

HIG stock traded up $0.19 during trading on Tuesday, hitting $117.89. The company had a trading volume of 1,414,828 shares, compared to its average volume of 1,604,185. The business has a 50-day moving average of $116.35 and a 200-day moving average of $108.17. The Hartford Financial Services Group, Inc. has a one year low of $73.92 and a one year high of $123.23. The stock has a market cap of $34.18 billion, a PE ratio of 11.79, a PEG ratio of 0.96 and a beta of 0.94. The company has a current ratio of 0.32, a quick ratio of 0.32 and a debt-to-equity ratio of 0.26.

The Hartford Financial Services Group Increases Dividend

The firm also recently declared a quarterly dividend, which will be paid on Friday, January 3rd. Shareholders of record on Monday, December 2nd will be issued a dividend of $0.52 per share. This represents a $2.08 dividend on an annualized basis and a dividend yield of 1.76%. This is a boost from The Hartford Financial Services Group's previous quarterly dividend of $0.47. The ex-dividend date of this dividend is Monday, December 2nd. The Hartford Financial Services Group's dividend payout ratio is presently 20.84%.

The Hartford Financial Services Group declared that its board has initiated a share repurchase program on Thursday, July 25th that allows the company to buyback $3.30 billion in outstanding shares. This buyback authorization allows the insurance provider to repurchase up to 10.9% of its stock through open market purchases. Stock buyback programs are generally a sign that the company's board believes its shares are undervalued.

About The Hartford Financial Services Group

(

Free Report)

The Hartford Financial Services Group, Inc, together with its subsidiaries, provides insurance and financial services to individual and business customers in the United States, the United Kingdom, and internationally. Its Commercial Lines segment offers insurance coverages, including workers' compensation, property, automobile, general and professional liability, package business, umbrella, fidelity and surety, marine, livestock, accident, health, and reinsurance through regional offices, branches, sales and policyholder service centers, independent retail agents and brokers, wholesale agents, and reinsurance brokers.

Featured Articles

Before you consider The Hartford Financial Services Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and The Hartford Financial Services Group wasn't on the list.

While The Hartford Financial Services Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.