Public Employees Retirement System of Ohio lifted its stake in shares of The Hershey Company (NYSE:HSY - Free Report) by 13.5% during the 3rd quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 63,842 shares of the company's stock after buying an additional 7,580 shares during the quarter. Public Employees Retirement System of Ohio's holdings in Hershey were worth $12,244,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

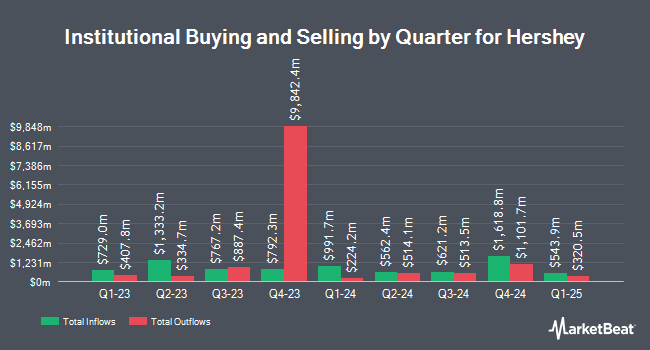

Other institutional investors also recently bought and sold shares of the company. Ashton Thomas Securities LLC bought a new position in Hershey in the third quarter worth $25,000. Capital Advisors Ltd. LLC grew its position in shares of Hershey by 218.2% in the 2nd quarter. Capital Advisors Ltd. LLC now owns 140 shares of the company's stock worth $26,000 after buying an additional 96 shares during the period. GHP Investment Advisors Inc. increased its stake in shares of Hershey by 55.0% in the 2nd quarter. GHP Investment Advisors Inc. now owns 155 shares of the company's stock worth $28,000 after acquiring an additional 55 shares in the last quarter. OFI Invest Asset Management purchased a new position in Hershey during the 2nd quarter valued at about $29,000. Finally, Gradient Investments LLC boosted its stake in Hershey by 71.9% during the second quarter. Gradient Investments LLC now owns 251 shares of the company's stock worth $46,000 after acquiring an additional 105 shares in the last quarter. 57.96% of the stock is owned by institutional investors.

Hershey Stock Performance

HSY stock traded up $6.95 on Thursday, hitting $183.95. The company had a trading volume of 3,726,569 shares, compared to its average volume of 1,820,560. The stock has a market cap of $37.22 billion, a price-to-earnings ratio of 20.71, a P/E/G ratio of 4.18 and a beta of 0.37. The company has a current ratio of 0.85, a quick ratio of 0.54 and a debt-to-equity ratio of 0.76. The stock's 50-day simple moving average is $180.25 and its 200 day simple moving average is $188.54. The Hershey Company has a 12-month low of $168.16 and a 12-month high of $211.92.

Hershey Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Monday, December 16th. Investors of record on Monday, November 18th will be issued a $1.37 dividend. This represents a $5.48 annualized dividend and a dividend yield of 2.98%. The ex-dividend date is Monday, November 18th. Hershey's payout ratio is currently 63.13%.

Wall Street Analysts Forecast Growth

A number of equities analysts have weighed in on the stock. UBS Group downgraded shares of Hershey from a "buy" rating to a "neutral" rating and decreased their target price for the company from $226.00 to $209.00 in a research note on Monday, October 7th. Sanford C. Bernstein lowered Hershey from an "outperform" rating to a "market perform" rating and reduced their price objective for the company from $230.00 to $205.00 in a research report on Monday, October 7th. Wells Fargo & Company downgraded Hershey from an "equal weight" rating to an "underweight" rating and dropped their target price for the stock from $175.00 to $160.00 in a report on Thursday. Redburn Atlantic assumed coverage on Hershey in a report on Tuesday, October 22nd. They set a "sell" rating and a $165.00 price target for the company. Finally, Deutsche Bank Aktiengesellschaft upped their price target on shares of Hershey from $191.00 to $199.00 and gave the stock a "hold" rating in a research note on Tuesday, September 10th. Six research analysts have rated the stock with a sell rating and thirteen have assigned a hold rating to the stock. Based on data from MarketBeat, Hershey presently has an average rating of "Hold" and a consensus price target of $185.17.

View Our Latest Report on Hershey

Hershey Company Profile

(

Free Report)

The Hershey Company, together with its subsidiaries, engages in the manufacture and sale of confectionery products and pantry items in the United States and internationally. The company operates through three segments: North America Confectionery, North America Salty Snacks, and International. It offers chocolate and non-chocolate confectionery products; gum and mint refreshment products, including mints, chewing gums, and bubble gums; protein bars; pantry items, such as baking ingredients, toppings, beverages, and sundae syrups; and snack items comprising spreads, bars, snack bites, mixes, popcorn, and pretzels.

Featured Articles

Before you consider Hershey, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hershey wasn't on the list.

While Hershey currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.