Vestcor Inc boosted its position in shares of The Interpublic Group of Companies, Inc. (NYSE:IPG - Free Report) by 2,031.5% in the fourth quarter, according to the company in its most recent filing with the SEC. The firm owned 125,907 shares of the business services provider's stock after acquiring an additional 120,000 shares during the quarter. Vestcor Inc's holdings in Interpublic Group of Companies were worth $3,528,000 at the end of the most recent reporting period.

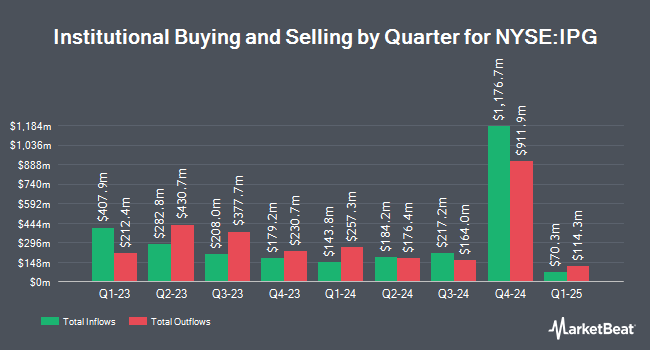

Other large investors have also added to or reduced their stakes in the company. Janney Montgomery Scott LLC boosted its position in Interpublic Group of Companies by 12.4% in the third quarter. Janney Montgomery Scott LLC now owns 31,648 shares of the business services provider's stock valued at $1,001,000 after buying an additional 3,499 shares during the last quarter. Assetmark Inc. boosted its holdings in shares of Interpublic Group of Companies by 48.8% in the 3rd quarter. Assetmark Inc. now owns 41,258 shares of the business services provider's stock valued at $1,305,000 after acquiring an additional 13,537 shares during the last quarter. Los Angeles Capital Management LLC increased its stake in shares of Interpublic Group of Companies by 298.4% in the third quarter. Los Angeles Capital Management LLC now owns 35,194 shares of the business services provider's stock worth $1,113,000 after acquiring an additional 26,360 shares during the period. Ashton Thomas Securities LLC purchased a new position in shares of Interpublic Group of Companies during the third quarter worth $32,000. Finally, Apollon Wealth Management LLC acquired a new position in Interpublic Group of Companies during the third quarter valued at $202,000. Hedge funds and other institutional investors own 98.43% of the company's stock.

Wall Street Analysts Forecast Growth

A number of equities analysts have weighed in on the company. StockNews.com started coverage on Interpublic Group of Companies in a research note on Monday. They set a "hold" rating for the company. Argus cut Interpublic Group of Companies from a "buy" rating to a "hold" rating in a research report on Tuesday, February 18th. JPMorgan Chase & Co. upgraded Interpublic Group of Companies from a "neutral" rating to an "overweight" rating and upped their price objective for the stock from $32.00 to $39.00 in a research report on Monday, January 27th. Barclays raised shares of Interpublic Group of Companies from an "equal weight" rating to an "overweight" rating and lifted their target price for the company from $32.00 to $36.00 in a report on Friday, January 24th. Finally, UBS Group raised shares of Interpublic Group of Companies from a "sell" rating to a "neutral" rating and lowered their price target for the stock from $29.00 to $27.00 in a report on Thursday, February 13th. One research analyst has rated the stock with a sell rating, five have issued a hold rating and four have issued a buy rating to the company's stock. Based on data from MarketBeat, the stock has a consensus rating of "Hold" and an average price target of $33.50.

View Our Latest Report on Interpublic Group of Companies

Insider Transactions at Interpublic Group of Companies

In other news, CFO Ellen Tobi Johnson sold 21,427 shares of the firm's stock in a transaction dated Monday, March 3rd. The shares were sold at an average price of $26.82, for a total value of $574,672.14. Following the transaction, the chief financial officer now directly owns 143,373 shares of the company's stock, valued at approximately $3,845,263.86. This trade represents a 13.00 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is available at this link. Corporate insiders own 0.42% of the company's stock.

Interpublic Group of Companies Price Performance

NYSE IPG traded up $0.36 on Tuesday, hitting $26.59. The company had a trading volume of 8,928,740 shares, compared to its average volume of 4,492,262. The company has a debt-to-equity ratio of 0.77, a current ratio of 1.09 and a quick ratio of 1.09. The company's fifty day moving average price is $27.60 and its 200-day moving average price is $29.24. The company has a market capitalization of $9.91 billion, a PE ratio of 14.53 and a beta of 1.14. The Interpublic Group of Companies, Inc. has a 12-month low of $25.86 and a 12-month high of $33.29.

Interpublic Group of Companies (NYSE:IPG - Get Free Report) last released its earnings results on Wednesday, February 12th. The business services provider reported $1.11 EPS for the quarter, missing analysts' consensus estimates of $1.15 by ($0.04). Interpublic Group of Companies had a return on equity of 27.10% and a net margin of 6.45%. As a group, analysts predict that The Interpublic Group of Companies, Inc. will post 2.66 earnings per share for the current year.

Interpublic Group of Companies Announces Dividend

The company also recently announced a quarterly dividend, which was paid on Monday, March 17th. Stockholders of record on Monday, March 3rd were given a $0.33 dividend. The ex-dividend date was Monday, March 3rd. This represents a $1.32 annualized dividend and a dividend yield of 4.96%. Interpublic Group of Companies's dividend payout ratio (DPR) is presently 72.13%.

Interpublic Group of Companies declared that its board has authorized a share buyback program on Wednesday, February 12th that allows the company to repurchase $155.00 million in outstanding shares. This repurchase authorization allows the business services provider to purchase up to 1.6% of its shares through open market purchases. Shares repurchase programs are generally a sign that the company's board of directors believes its stock is undervalued.

About Interpublic Group of Companies

(

Free Report)

The Interpublic Group of Companies, Inc provides advertising and marketing services worldwide. It operates in three segments: Media, Data & Engagement Solutions, Integrated Advertising & Creativity Led Solutions, and Specialized Communications & Experiential Solutions. The Media, Data & Engagement Solutions segment provides media and communications services, digital services and products, advertising and marketing technology, e-commerce services, data management and analytics, strategic consulting, and digital brand experience under the IPG Mediabrands, UM, Initiative, Kinesso, Acxiom, Huge, MRM, and R/GA brand names.

Featured Articles

Before you consider Interpublic Group of Companies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Interpublic Group of Companies wasn't on the list.

While Interpublic Group of Companies currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report