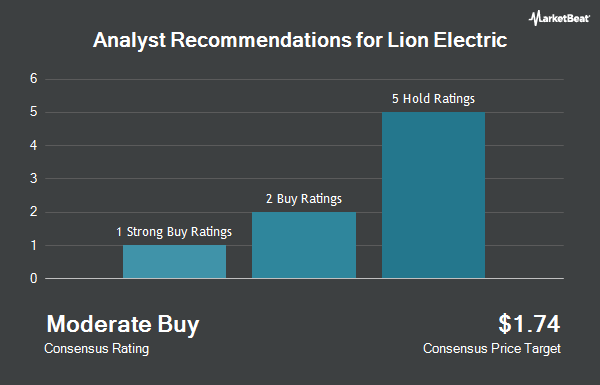

Shares of The Lion Electric Company (NYSE:LEV - Get Free Report) have earned a consensus rating of "Hold" from the nine brokerages that are covering the stock, MarketBeat reports. Seven research analysts have rated the stock with a hold rating, one has assigned a buy rating and one has assigned a strong buy rating to the company. The average twelve-month target price among analysts that have covered the stock in the last year is $1.46.

Separately, BMO Capital Markets lowered their price objective on Lion Electric from $0.80 to $0.60 and set a "market perform" rating for the company in a research report on Friday, November 8th.

Get Our Latest Report on LEV

Institutional Investors Weigh In On Lion Electric

A hedge fund recently bought a new stake in Lion Electric stock. Cubist Systematic Strategies LLC purchased a new stake in The Lion Electric Company (NYSE:LEV - Free Report) in the second quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The fund purchased 68,484 shares of the company's stock, valued at approximately $62,000. Hedge funds and other institutional investors own 52.73% of the company's stock.

Lion Electric Stock Down 26.6 %

LEV stock traded down $0.09 during midday trading on Monday, hitting $0.24. The company's stock had a trading volume of 4,480,555 shares, compared to its average volume of 1,818,844. The firm has a 50-day simple moving average of $0.45 and a 200-day simple moving average of $0.69. The firm has a market capitalization of $55.33 million, a P/E ratio of -0.41 and a beta of 1.84. The company has a quick ratio of 0.30, a current ratio of 1.12 and a debt-to-equity ratio of 0.52. Lion Electric has a 52-week low of $0.18 and a 52-week high of $1.99.

Lion Electric (NYSE:LEV - Get Free Report) last released its earnings results on Wednesday, November 6th. The company reported ($0.15) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($0.13) by ($0.02). Lion Electric had a negative net margin of 74.35% and a negative return on equity of 32.42%. The company had revenue of $30.63 million during the quarter, compared to analysts' expectations of $34.33 million. During the same quarter last year, the business posted ($0.10) earnings per share. As a group, equities analysts forecast that Lion Electric will post -0.53 EPS for the current year.

About Lion Electric

(

Get Free ReportThe Lion Electric Company designs, develops, manufactures, and distributes purpose-built all-electric medium and heavy-duty urban vehicles in North America. The company's products include battery systems, chassis, bus bodies, and truck cabins. It distributes truck and bus parts, as well as accessories.

Featured Stories

Before you consider Lion Electric, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lion Electric wasn't on the list.

While Lion Electric currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.