Barclays PLC lessened its position in The Macerich Company (NYSE:MAC - Free Report) by 21.2% in the 3rd quarter, according to its most recent filing with the SEC. The firm owned 422,413 shares of the real estate investment trust's stock after selling 113,688 shares during the period. Barclays PLC owned approximately 0.19% of Macerich worth $7,705,000 at the end of the most recent reporting period.

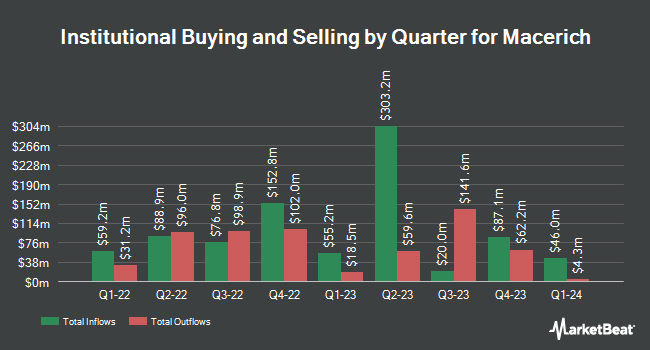

Several other hedge funds and other institutional investors have also made changes to their positions in the company. FMR LLC raised its holdings in Macerich by 12,475.9% during the third quarter. FMR LLC now owns 11,772,891 shares of the real estate investment trust's stock worth $214,738,000 after purchasing an additional 11,679,276 shares in the last quarter. Bamco Inc. NY raised its stake in shares of Macerich by 742.3% during the 3rd quarter. Bamco Inc. NY now owns 1,695,420 shares of the real estate investment trust's stock worth $30,924,000 after buying an additional 1,494,145 shares in the last quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC raised its stake in shares of Macerich by 399.8% during the 3rd quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 1,546,373 shares of the real estate investment trust's stock worth $28,206,000 after buying an additional 1,236,983 shares in the last quarter. Smead Capital Management Inc. lifted its holdings in shares of Macerich by 3.5% in the 3rd quarter. Smead Capital Management Inc. now owns 20,433,449 shares of the real estate investment trust's stock valued at $372,706,000 after buying an additional 688,790 shares during the period. Finally, Sei Investments Co. purchased a new stake in shares of Macerich in the second quarter valued at approximately $10,625,000. Hedge funds and other institutional investors own 87.38% of the company's stock.

Wall Street Analysts Forecast Growth

Several brokerages have commented on MAC. Compass Point boosted their target price on shares of Macerich from $20.00 to $23.00 and gave the stock a "buy" rating in a research report on Thursday, November 7th. StockNews.com lowered shares of Macerich from a "hold" rating to a "sell" rating in a research report on Thursday, November 7th. Bank of America lifted their price target on shares of Macerich from $17.00 to $19.00 and gave the company a "neutral" rating in a research report on Friday, October 11th. Mizuho upgraded Macerich from an "underperform" rating to a "neutral" rating and upped their price target for the stock from $14.00 to $22.00 in a report on Wednesday, December 4th. Finally, The Goldman Sachs Group lifted their price objective on Macerich from $13.00 to $14.60 and gave the stock a "sell" rating in a report on Thursday, September 19th. Three investment analysts have rated the stock with a sell rating, seven have given a hold rating and one has assigned a buy rating to the stock. Based on data from MarketBeat, the company currently has an average rating of "Hold" and a consensus price target of $18.86.

View Our Latest Stock Report on Macerich

Macerich Trading Down 0.5 %

MAC traded down $0.11 during trading on Thursday, hitting $19.92. 2,581,034 shares of the company's stock were exchanged, compared to its average volume of 1,880,043. The stock has a 50 day moving average price of $19.76 and a 200 day moving average price of $17.14. The Macerich Company has a 1 year low of $12.99 and a 1 year high of $22.27. The company has a current ratio of 0.92, a quick ratio of 0.92 and a debt-to-equity ratio of 1.68. The firm has a market cap of $4.95 billion, a P/E ratio of 51.08, a price-to-earnings-growth ratio of 0.74 and a beta of 2.51.

Macerich (NYSE:MAC - Get Free Report) last released its quarterly earnings data on Wednesday, November 6th. The real estate investment trust reported ($0.50) EPS for the quarter, missing the consensus estimate of $0.40 by ($0.90). The company had revenue of $220.20 million during the quarter, compared to analysts' expectations of $208.54 million. Macerich had a net margin of 8.98% and a return on equity of 3.15%. The company's revenue for the quarter was up .9% compared to the same quarter last year. During the same period last year, the business earned $0.44 earnings per share. As a group, analysts expect that The Macerich Company will post 1.56 EPS for the current fiscal year.

Macerich Announces Dividend

The business also recently declared a quarterly dividend, which was paid on Monday, December 2nd. Investors of record on Tuesday, November 12th were given a dividend of $0.17 per share. This represents a $0.68 annualized dividend and a yield of 3.41%. The ex-dividend date was Tuesday, November 12th. Macerich's dividend payout ratio (DPR) is presently 174.36%.

Macerich Profile

(

Free Report)

Macerich is a fully integrated, self-managed and self-administered real estate investment trust (REIT). As a leading owner, operator and developer of high-quality retail real estate in densely populated and attractive U.S. markets, Macerich's portfolio is concentrated in California, the Pacific Northwest, Phoenix/Scottsdale, and the Metro New York to Washington, DC corridor.

Featured Stories

Before you consider Macerich, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Macerich wasn't on the list.

While Macerich currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.