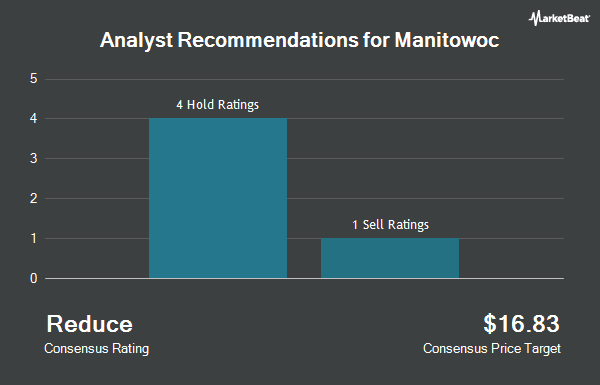

Shares of The Manitowoc Company, Inc. (NYSE:MTW - Get Free Report) have been given a consensus recommendation of "Reduce" by the six ratings firms that are presently covering the firm, Marketbeat.com reports. Two investment analysts have rated the stock with a sell rating and four have assigned a hold rating to the company. The average 12 month price target among analysts that have issued ratings on the stock in the last year is $12.47.

Several research firms have commented on MTW. Robert W. Baird reduced their price objective on Manitowoc from $13.00 to $12.00 and set a "neutral" rating for the company in a research note on Friday, November 1st. JPMorgan Chase & Co. increased their price target on Manitowoc from $10.00 to $12.00 and gave the stock a "neutral" rating in a report on Monday, October 14th. StockNews.com raised shares of Manitowoc from a "sell" rating to a "hold" rating in a research note on Friday, November 1st. Barclays reduced their target price on shares of Manitowoc from $12.00 to $9.00 and set an "underweight" rating for the company in a research note on Friday, August 9th. Finally, The Goldman Sachs Group dropped their price target on shares of Manitowoc from $13.00 to $11.30 and set a "sell" rating on the stock in a research note on Friday, August 9th.

Get Our Latest Stock Report on Manitowoc

Institutional Inflows and Outflows

A number of large investors have recently made changes to their positions in MTW. Front Street Capital Management Inc. boosted its position in shares of Manitowoc by 8.4% in the second quarter. Front Street Capital Management Inc. now owns 2,806,642 shares of the industrial products company's stock worth $32,361,000 after acquiring an additional 217,389 shares during the last quarter. Victory Capital Management Inc. boosted its holdings in shares of Manitowoc by 1.3% in the 3rd quarter. Victory Capital Management Inc. now owns 774,115 shares of the industrial products company's stock valued at $7,447,000 after purchasing an additional 9,758 shares during the last quarter. AQR Capital Management LLC increased its holdings in shares of Manitowoc by 31.1% during the 2nd quarter. AQR Capital Management LLC now owns 590,647 shares of the industrial products company's stock worth $6,810,000 after buying an additional 140,042 shares during the last quarter. Acadian Asset Management LLC raised its position in shares of Manitowoc by 4.3% in the 1st quarter. Acadian Asset Management LLC now owns 436,606 shares of the industrial products company's stock worth $6,172,000 after buying an additional 18,181 shares during the period. Finally, TCW Group Inc. boosted its holdings in Manitowoc by 65.4% in the second quarter. TCW Group Inc. now owns 406,186 shares of the industrial products company's stock valued at $4,683,000 after acquiring an additional 160,601 shares during the last quarter. Hedge funds and other institutional investors own 78.66% of the company's stock.

Manitowoc Stock Up 3.1 %

NYSE:MTW traded up $0.33 during trading hours on Friday, hitting $11.04. The company's stock had a trading volume of 501,784 shares, compared to its average volume of 275,976. Manitowoc has a 52-week low of $8.50 and a 52-week high of $17.65. The company has a current ratio of 1.97, a quick ratio of 0.60 and a debt-to-equity ratio of 0.70. The stock has a market capitalization of $387.80 million, a P/E ratio of -40.07 and a beta of 1.84. The stock has a fifty day moving average of $9.64 and a 200-day moving average of $10.83.

Manitowoc (NYSE:MTW - Get Free Report) last released its quarterly earnings data on Wednesday, October 30th. The industrial products company reported ($0.08) earnings per share for the quarter, missing analysts' consensus estimates of $0.06 by ($0.14). The company had revenue of $524.80 million for the quarter, compared to analyst estimates of $516.49 million. Manitowoc had a positive return on equity of 2.40% and a negative net margin of 0.40%. The firm's revenue for the quarter was up .7% compared to the same quarter last year. During the same period in the previous year, the business posted $0.22 EPS. On average, equities analysts forecast that Manitowoc will post 0.46 earnings per share for the current year.

About Manitowoc

(

Get Free ReportThe Manitowoc Company, Inc provides engineered lifting solutions in the Americas, Europe, Africa, the Middle East, the Asia Pacific, and internationally. It designs, manufactures, and distributes crawler-mounted lattice-boom cranes under the Manitowoc brand; a line of top-slewing and self-erecting tower cranes under the Potain brand; mobile hydraulic cranes under the Grove, Shuttlelift, and National Crane brands; and hydraulic boom trucks under the National Crane brand.

Recommended Stories

Before you consider Manitowoc, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Manitowoc wasn't on the list.

While Manitowoc currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.