The Manufacturers Life Insurance Company increased its holdings in Live Nation Entertainment, Inc. (NYSE:LYV - Free Report) by 8.0% during the third quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The firm owned 96,824 shares of the company's stock after purchasing an additional 7,143 shares during the quarter. The Manufacturers Life Insurance Company's holdings in Live Nation Entertainment were worth $10,601,000 as of its most recent filing with the Securities & Exchange Commission.

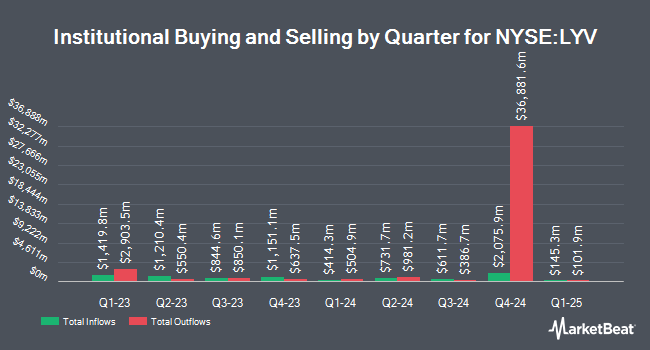

Several other hedge funds have also added to or reduced their stakes in LYV. Select Equity Group L.P. grew its holdings in Live Nation Entertainment by 12.3% in the 2nd quarter. Select Equity Group L.P. now owns 12,940,613 shares of the company's stock worth $1,213,053,000 after acquiring an additional 1,415,173 shares during the last quarter. Canada Pension Plan Investment Board increased its position in shares of Live Nation Entertainment by 1.8% during the second quarter. Canada Pension Plan Investment Board now owns 8,722,620 shares of the company's stock valued at $817,658,000 after buying an additional 155,920 shares during the period. Principal Financial Group Inc. grew its stake in Live Nation Entertainment by 1.2% in the third quarter. Principal Financial Group Inc. now owns 7,196,551 shares of the company's stock worth $787,950,000 after purchasing an additional 87,032 shares during the period. D1 Capital Partners L.P. lifted its position in Live Nation Entertainment by 44.6% during the 2nd quarter. D1 Capital Partners L.P. now owns 3,543,532 shares of the company's stock valued at $332,171,000 after acquiring an additional 1,093,000 shares during the period. Finally, Vulcan Value Partners LLC increased its position in Live Nation Entertainment by 46.5% during the 2nd quarter. Vulcan Value Partners LLC now owns 2,694,463 shares of the company's stock valued at $252,663,000 after buying an additional 855,197 shares in the last quarter. 74.52% of the stock is owned by institutional investors.

Live Nation Entertainment Trading Down 1.2 %

Shares of NYSE LYV traded down $1.63 during trading hours on Tuesday, hitting $136.13. 1,010,827 shares of the company traded hands, compared to its average volume of 2,169,863. The company's 50 day moving average price is $121.04 and its 200 day moving average price is $104.08. The stock has a market capitalization of $31.63 billion, a price-to-earnings ratio of 144.48, a price-to-earnings-growth ratio of 3.75 and a beta of 1.37. The company has a current ratio of 1.01, a quick ratio of 1.01 and a debt-to-equity ratio of 6.10. Live Nation Entertainment, Inc. has a 12 month low of $81.38 and a 12 month high of $141.18.

Live Nation Entertainment (NYSE:LYV - Get Free Report) last posted its quarterly earnings results on Monday, November 11th. The company reported $1.66 earnings per share for the quarter, beating the consensus estimate of $1.58 by $0.08. The firm had revenue of $7.65 billion during the quarter, compared to the consensus estimate of $7.75 billion. Live Nation Entertainment had a net margin of 2.11% and a return on equity of 77.62%. The company's revenue was down 6.2% on a year-over-year basis. During the same quarter in the previous year, the firm posted $1.78 earnings per share. On average, equities research analysts anticipate that Live Nation Entertainment, Inc. will post 1.04 earnings per share for the current fiscal year.

Wall Street Analyst Weigh In

A number of analysts have weighed in on the stock. Citigroup raised their price objective on shares of Live Nation Entertainment from $130.00 to $163.00 and gave the company a "buy" rating in a research note on Wednesday, November 20th. Bank of America increased their price objective on Live Nation Entertainment from $125.00 to $149.00 and gave the company a "buy" rating in a research report on Thursday, November 14th. Guggenheim upped their price objective on Live Nation Entertainment from $130.00 to $146.00 and gave the company a "buy" rating in a research report on Tuesday, November 12th. TD Cowen raised their price objective on shares of Live Nation Entertainment from $108.00 to $145.00 and gave the stock a "buy" rating in a report on Tuesday, November 12th. Finally, Rosenblatt Securities reaffirmed a "buy" rating and issued a $123.00 target price on shares of Live Nation Entertainment in a report on Thursday, August 15th. Two analysts have rated the stock with a hold rating and sixteen have given a buy rating to the stock. According to MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and an average price target of $141.53.

Check Out Our Latest Analysis on LYV

Insider Activity at Live Nation Entertainment

In other Live Nation Entertainment news, Director Jeffrey T. Hinson sold 5,640 shares of the firm's stock in a transaction dated Monday, September 9th. The stock was sold at an average price of $95.18, for a total value of $536,815.20. Following the completion of the sale, the director now owns 53,949 shares of the company's stock, valued at approximately $5,134,865.82. This trade represents a 9.46 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, EVP Michael Rowles sold 35,000 shares of the stock in a transaction that occurred on Wednesday, September 11th. The shares were sold at an average price of $97.64, for a total transaction of $3,417,400.00. Following the completion of the transaction, the executive vice president now directly owns 167,447 shares of the company's stock, valued at $16,349,525.08. The trade was a 17.29 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 168,799 shares of company stock valued at $16,449,718 over the last quarter. 2.72% of the stock is owned by corporate insiders.

About Live Nation Entertainment

(

Free Report)

Live Nation Entertainment, Inc operates as a live entertainment company worldwide. It operates through Concerts, Ticketing, and Sponsorship & Advertising segments. The Concerts segment promotes live music events in its owned or operated venues, and in rented third-party venues. This segment operates and manages music venues; produces music festivals; creates and streams associated content; and offers management and other services to artists.

Read More

Before you consider Live Nation Entertainment, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Live Nation Entertainment wasn't on the list.

While Live Nation Entertainment currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.