The Manufacturers Life Insurance Company lifted its holdings in shares of Wyndham Hotels & Resorts, Inc. (NYSE:WH - Free Report) by 15.0% during the 3rd quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 64,329 shares of the company's stock after purchasing an additional 8,389 shares during the period. The Manufacturers Life Insurance Company owned 0.08% of Wyndham Hotels & Resorts worth $5,027,000 at the end of the most recent reporting period.

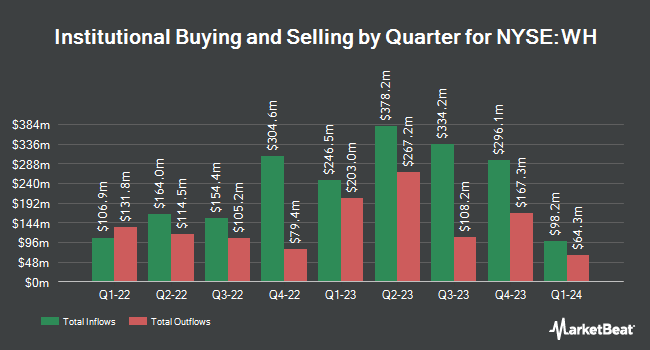

Several other large investors have also added to or reduced their stakes in WH. Thrivent Financial for Lutherans increased its stake in Wyndham Hotels & Resorts by 377.5% in the second quarter. Thrivent Financial for Lutherans now owns 1,240,702 shares of the company's stock valued at $91,812,000 after purchasing an additional 980,848 shares in the last quarter. Burgundy Asset Management Ltd. increased its position in Wyndham Hotels & Resorts by 70.9% in the 2nd quarter. Burgundy Asset Management Ltd. now owns 2,210,658 shares of the company's stock valued at $163,589,000 after buying an additional 916,742 shares in the last quarter. TimesSquare Capital Management LLC increased its position in Wyndham Hotels & Resorts by 284,590.0% in the 3rd quarter. TimesSquare Capital Management LLC now owns 284,690 shares of the company's stock valued at $22,246,000 after buying an additional 284,590 shares in the last quarter. Copeland Capital Management LLC raised its stake in Wyndham Hotels & Resorts by 133.1% during the 3rd quarter. Copeland Capital Management LLC now owns 409,324 shares of the company's stock worth $31,985,000 after buying an additional 233,754 shares during the period. Finally, Dimensional Fund Advisors LP boosted its holdings in Wyndham Hotels & Resorts by 18.9% in the second quarter. Dimensional Fund Advisors LP now owns 1,237,944 shares of the company's stock worth $91,609,000 after acquiring an additional 196,982 shares in the last quarter. Institutional investors and hedge funds own 93.46% of the company's stock.

Analysts Set New Price Targets

Several equities research analysts have recently commented on WH shares. Barclays boosted their price objective on Wyndham Hotels & Resorts from $90.00 to $100.00 and gave the company an "overweight" rating in a report on Friday, October 25th. Wells Fargo & Company began coverage on shares of Wyndham Hotels & Resorts in a research note on Thursday. They set an "equal weight" rating and a $103.00 price target for the company. The Goldman Sachs Group assumed coverage on shares of Wyndham Hotels & Resorts in a research note on Wednesday, September 18th. They issued a "buy" rating and a $96.00 price objective on the stock. Oppenheimer lifted their price objective on shares of Wyndham Hotels & Resorts from $90.00 to $115.00 and gave the company an "outperform" rating in a report on Tuesday, November 12th. Finally, Robert W. Baird upped their target price on shares of Wyndham Hotels & Resorts from $92.00 to $97.00 and gave the stock an "outperform" rating in a report on Friday, October 25th. Three research analysts have rated the stock with a hold rating and six have given a buy rating to the stock. Based on data from MarketBeat, the stock has an average rating of "Moderate Buy" and an average target price of $100.38.

Get Our Latest Research Report on Wyndham Hotels & Resorts

Insider Activity at Wyndham Hotels & Resorts

In other Wyndham Hotels & Resorts news, insider Scott R. Strickland sold 2,850 shares of the business's stock in a transaction on Tuesday, November 5th. The stock was sold at an average price of $88.14, for a total value of $251,199.00. Following the sale, the insider now directly owns 26,062 shares in the company, valued at $2,297,104.68. The trade was a 9.86 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available through the SEC website. Also, CFO Michele Allen sold 15,000 shares of Wyndham Hotels & Resorts stock in a transaction dated Friday, October 25th. The stock was sold at an average price of $89.99, for a total value of $1,349,850.00. Following the completion of the sale, the chief financial officer now directly owns 10,056 shares of the company's stock, valued at approximately $904,939.44. This trade represents a 59.87 % decrease in their position. The disclosure for this sale can be found here. Over the last 90 days, insiders sold 97,850 shares of company stock worth $8,881,849. 2.79% of the stock is owned by company insiders.

Wyndham Hotels & Resorts Stock Up 0.0 %

Wyndham Hotels & Resorts stock traded up $0.01 during midday trading on Friday, hitting $101.89. 631,528 shares of the stock were exchanged, compared to its average volume of 651,911. Wyndham Hotels & Resorts, Inc. has a 52-week low of $67.67 and a 52-week high of $103.17. The company has a quick ratio of 0.97, a current ratio of 0.97 and a debt-to-equity ratio of 4.19. The business's 50-day moving average price is $89.76 and its 200-day moving average price is $79.88. The stock has a market capitalization of $7.93 billion, a price-to-earnings ratio of 32.35, a price-to-earnings-growth ratio of 2.56 and a beta of 1.32.

Wyndham Hotels & Resorts (NYSE:WH - Get Free Report) last announced its earnings results on Wednesday, October 23rd. The company reported $1.39 earnings per share for the quarter, topping analysts' consensus estimates of $1.38 by $0.01. The firm had revenue of $396.00 million for the quarter, compared to the consensus estimate of $408.32 million. Wyndham Hotels & Resorts had a return on equity of 51.79% and a net margin of 18.29%. The company's revenue was down 1.5% compared to the same quarter last year. During the same quarter in the previous year, the business earned $1.31 EPS. On average, research analysts expect that Wyndham Hotels & Resorts, Inc. will post 4.3 EPS for the current fiscal year.

Wyndham Hotels & Resorts Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Friday, December 27th. Investors of record on Friday, December 13th will be given a dividend of $0.38 per share. The ex-dividend date is Friday, December 13th. This represents a $1.52 annualized dividend and a yield of 1.49%. Wyndham Hotels & Resorts's payout ratio is currently 48.25%.

Wyndham Hotels & Resorts Company Profile

(

Free Report)

Wyndham Hotels & Resorts, Inc operates as a hotel franchisor in the United States and internationally. It operates through Hotel Franchising and Hotel Management segments. The Hotel Franchising segment licenses its lodging brands and provides related services to third-party hotel owners and others.

Further Reading

Before you consider Wyndham Hotels & Resorts, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Wyndham Hotels & Resorts wasn't on the list.

While Wyndham Hotels & Resorts currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.