The Manufacturers Life Insurance Company lifted its stake in shares of Globant S.A. (NYSE:GLOB - Free Report) by 18.9% during the third quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 316,506 shares of the information technology services provider's stock after acquiring an additional 50,322 shares during the quarter. The Manufacturers Life Insurance Company owned about 0.73% of Globant worth $62,712,000 at the end of the most recent reporting period.

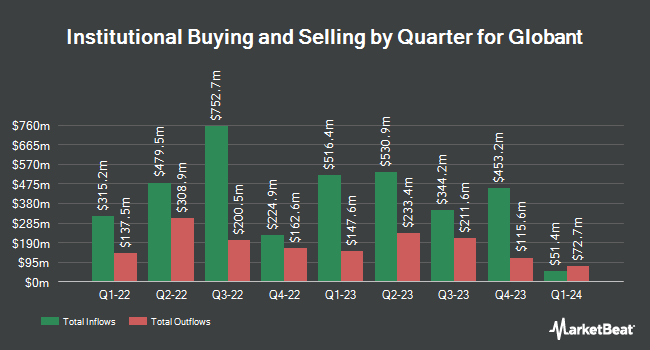

Other hedge funds and other institutional investors have also recently added to or reduced their stakes in the company. Quarry LP raised its position in Globant by 529.6% during the second quarter. Quarry LP now owns 170 shares of the information technology services provider's stock valued at $30,000 after buying an additional 143 shares during the period. Ridgewood Investments LLC purchased a new stake in shares of Globant in the second quarter worth approximately $31,000. BOKF NA boosted its holdings in shares of Globant by 15,800.0% during the first quarter. BOKF NA now owns 159 shares of the information technology services provider's stock worth $32,000 after purchasing an additional 158 shares during the period. ORG Partners LLC grew its position in Globant by 65.5% during the third quarter. ORG Partners LLC now owns 192 shares of the information technology services provider's stock valued at $38,000 after purchasing an additional 76 shares in the last quarter. Finally, American National Bank & Trust increased its stake in Globant by 430.2% in the 3rd quarter. American National Bank & Trust now owns 228 shares of the information technology services provider's stock valued at $45,000 after buying an additional 185 shares during the period. Institutional investors own 91.60% of the company's stock.

Analyst Upgrades and Downgrades

Several equities analysts have recently commented on GLOB shares. StockNews.com upgraded shares of Globant from a "sell" rating to a "hold" rating in a report on Sunday. UBS Group reaffirmed a "neutral" rating and set a $235.00 price objective (up previously from $225.00) on shares of Globant in a research report on Tuesday, August 20th. TD Cowen lifted their price objective on shares of Globant from $230.00 to $240.00 and gave the company a "buy" rating in a research note on Friday, November 15th. Canaccord Genuity Group restated a "hold" rating and set a $205.00 target price on shares of Globant in a report on Monday, November 18th. Finally, Citigroup raised their price objective on Globant from $240.00 to $251.00 and gave the company a "buy" rating in a research note on Monday, October 28th. One research analyst has rated the stock with a sell rating, seven have assigned a hold rating and twelve have issued a buy rating to the stock. Based on data from MarketBeat, the stock presently has an average rating of "Moderate Buy" and an average target price of $229.06.

View Our Latest Stock Analysis on GLOB

Globant Price Performance

Shares of NYSE GLOB traded down $1.38 during mid-day trading on Thursday, hitting $229.55. The company had a trading volume of 239,131 shares, compared to its average volume of 484,194. The business's 50-day simple moving average is $213.69 and its 200-day simple moving average is $193.49. Globant S.A. has a 12 month low of $151.68 and a 12 month high of $251.50. The firm has a market cap of $9.89 billion, a P/E ratio of 59.93, a PEG ratio of 2.85 and a beta of 1.39.

Globant Company Profile

(

Free Report)

Globant SA, together with its subsidiaries, provides technology services worldwide. It provides digital solutions comprising blockchain, cloud technologies, cybersecurity, data and artificial intelligence, digital experience and performance, code, Internet of Things, metaverse, and engineering and testing; and enterprise technology solutions and services, such as Agile organization, Cultural Hacking, process optimization services, as well as AWS, Google Cloud, Microsoft, Oracle, SalesForce, SAP, and ServiceNow technology solutions.

Further Reading

Before you consider Globant, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Globant wasn't on the list.

While Globant currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.