The Manufacturers Life Insurance Company grew its holdings in shares of Atour Lifestyle Holdings Limited (NASDAQ:ATAT - Free Report) by 49.9% in the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The fund owned 62,702 shares of the company's stock after purchasing an additional 20,869 shares during the period. The Manufacturers Life Insurance Company's holdings in Atour Lifestyle were worth $1,626,000 at the end of the most recent quarter.

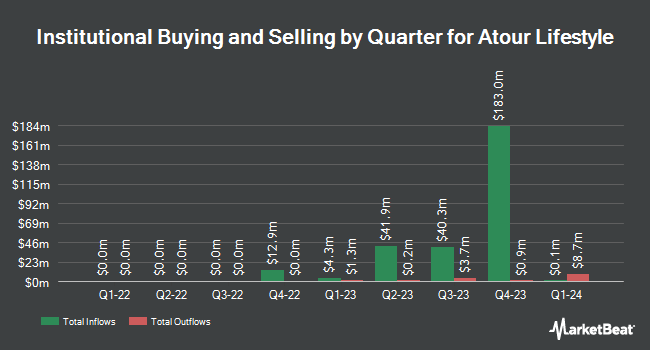

Other hedge funds and other institutional investors have also recently made changes to their positions in the company. First Beijing Investment Ltd raised its stake in Atour Lifestyle by 175.0% in the 3rd quarter. First Beijing Investment Ltd now owns 5,639,562 shares of the company's stock worth $146,290,000 after acquiring an additional 3,588,469 shares during the last quarter. M&G PLC raised its stake in Atour Lifestyle by 173.2% in the 3rd quarter. M&G PLC now owns 3,518,106 shares of the company's stock worth $91,471,000 after acquiring an additional 2,230,247 shares during the last quarter. M&G Plc purchased a new position in Atour Lifestyle in the 2nd quarter worth $23,181,000. Prudential PLC purchased a new position in Atour Lifestyle in the 2nd quarter worth $13,161,000. Finally, Renaissance Technologies LLC raised its stake in Atour Lifestyle by 126.7% in the 2nd quarter. Renaissance Technologies LLC now owns 783,400 shares of the company's stock worth $14,375,000 after acquiring an additional 437,900 shares during the last quarter. Hedge funds and other institutional investors own 17.79% of the company's stock.

Atour Lifestyle Trading Down 7.2 %

ATAT traded down $2.13 during midday trading on Tuesday, hitting $27.32. 2,239,842 shares of the company were exchanged, compared to its average volume of 980,820. The company's 50 day simple moving average is $26.60 and its 200 day simple moving average is $21.29. The firm has a market capitalization of $3.76 billion, a price-to-earnings ratio of 23.55, a price-to-earnings-growth ratio of 0.62 and a beta of 0.52. Atour Lifestyle Holdings Limited has a 1-year low of $15.22 and a 1-year high of $29.90.

Analyst Upgrades and Downgrades

Separately, The Goldman Sachs Group began coverage on Atour Lifestyle in a research report on Monday. They set a "buy" rating and a $34.40 price target on the stock.

View Our Latest Research Report on Atour Lifestyle

Atour Lifestyle Company Profile

(

Free Report)

Atour Lifestyle Holdings Limited, through its subsidiaries, develops lifestyle brands around hotel offerings in the People's Republic of China. The company provides hotel management services, including day-to-day management services of the hotels for the franchisees; and sells hotel supplies and other products.

Read More

Before you consider Atour Lifestyle, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Atour Lifestyle wasn't on the list.

While Atour Lifestyle currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.