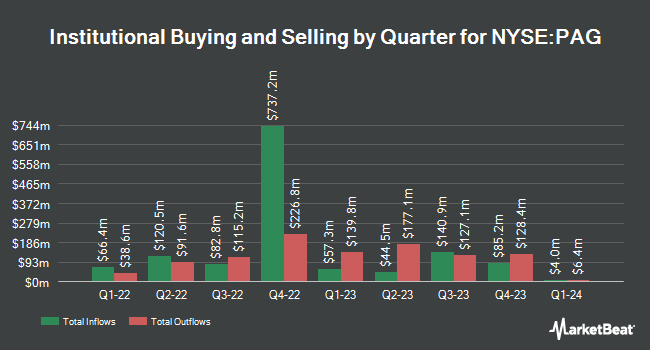

The Manufacturers Life Insurance Company raised its position in Penske Automotive Group, Inc. (NYSE:PAG - Free Report) by 62.8% in the third quarter, according to its most recent disclosure with the SEC. The firm owned 29,199 shares of the company's stock after acquiring an additional 11,267 shares during the period. The Manufacturers Life Insurance Company's holdings in Penske Automotive Group were worth $4,743,000 as of its most recent filing with the SEC.

A number of other institutional investors also recently modified their holdings of the company. Burgundy Asset Management Ltd. increased its holdings in Penske Automotive Group by 1.8% during the 2nd quarter. Burgundy Asset Management Ltd. now owns 777,574 shares of the company's stock worth $115,874,000 after purchasing an additional 13,968 shares in the last quarter. AQR Capital Management LLC grew its holdings in Penske Automotive Group by 31.1% during the second quarter. AQR Capital Management LLC now owns 417,932 shares of the company's stock worth $62,280,000 after buying an additional 99,164 shares in the last quarter. Millennium Management LLC raised its position in Penske Automotive Group by 9.1% in the 2nd quarter. Millennium Management LLC now owns 126,278 shares of the company's stock valued at $18,818,000 after buying an additional 10,522 shares during the last quarter. Citigroup Inc. boosted its holdings in Penske Automotive Group by 4.1% during the 3rd quarter. Citigroup Inc. now owns 63,548 shares of the company's stock worth $10,321,000 after acquiring an additional 2,475 shares during the last quarter. Finally, International Assets Investment Management LLC grew its stake in shares of Penske Automotive Group by 12,674.5% in the 3rd quarter. International Assets Investment Management LLC now owns 59,146 shares of the company's stock worth $9,606,000 after acquiring an additional 58,683 shares in the last quarter. 77.08% of the stock is owned by institutional investors and hedge funds.

Analysts Set New Price Targets

Several equities research analysts have commented on PAG shares. Stephens began coverage on shares of Penske Automotive Group in a research note on Thursday, September 12th. They issued an "equal weight" rating and a $161.00 price objective for the company. JPMorgan Chase & Co. upped their price objective on Penske Automotive Group from $140.00 to $160.00 and gave the company an "underweight" rating in a research note on Tuesday, September 10th. Finally, Morgan Stanley raised shares of Penske Automotive Group from an "underweight" rating to an "overweight" rating and boosted their price target for the stock from $115.00 to $180.00 in a report on Wednesday, September 25th.

View Our Latest Analysis on Penske Automotive Group

Penske Automotive Group Stock Performance

PAG traded up $0.14 during trading hours on Friday, hitting $163.88. The stock had a trading volume of 87,921 shares, compared to its average volume of 139,481. Penske Automotive Group, Inc. has a 1 year low of $142.32 and a 1 year high of $179.72. The company's fifty day simple moving average is $158.69 and its 200 day simple moving average is $157.20. The stock has a market cap of $10.94 billion, a PE ratio of 12.56 and a beta of 1.18. The company has a quick ratio of 0.20, a current ratio of 0.91 and a debt-to-equity ratio of 0.22.

Penske Automotive Group (NYSE:PAG - Get Free Report) last posted its earnings results on Tuesday, October 29th. The company reported $3.39 earnings per share for the quarter, missing the consensus estimate of $3.41 by ($0.02). The business had revenue of $7.59 billion during the quarter, compared to analysts' expectations of $7.67 billion. Penske Automotive Group had a return on equity of 18.38% and a net margin of 2.91%. Penske Automotive Group's revenue for the quarter was up 1.9% on a year-over-year basis. During the same quarter in the previous year, the business earned $3.90 EPS. Equities analysts anticipate that Penske Automotive Group, Inc. will post 13.5 earnings per share for the current year.

Penske Automotive Group Increases Dividend

The business also recently announced a quarterly dividend, which was paid on Tuesday, December 3rd. Shareholders of record on Friday, November 15th were given a dividend of $1.19 per share. The ex-dividend date of this dividend was Friday, November 15th. This represents a $4.76 annualized dividend and a dividend yield of 2.90%. This is an increase from Penske Automotive Group's previous quarterly dividend of $1.07. Penske Automotive Group's dividend payout ratio is currently 36.48%.

Penske Automotive Group Profile

(

Free Report)

Penske Automotive Group, Inc, a diversified transportation services company, operates automotive and commercial truck dealerships worldwide. The company operates through four segments: Retail Automotive, Retail Commercial Truck, Other, and Non-Automotive Investments. It operates dealerships under franchise agreements with various automotive manufacturers and distributors.

Recommended Stories

Before you consider Penske Automotive Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Penske Automotive Group wasn't on the list.

While Penske Automotive Group currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.