The Manufacturers Life Insurance Company raised its position in Parsons Co. (NYSE:PSN - Free Report) by 110.4% during the third quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 54,933 shares of the company's stock after purchasing an additional 28,820 shares during the quarter. The Manufacturers Life Insurance Company owned 0.05% of Parsons worth $5,695,000 as of its most recent SEC filing.

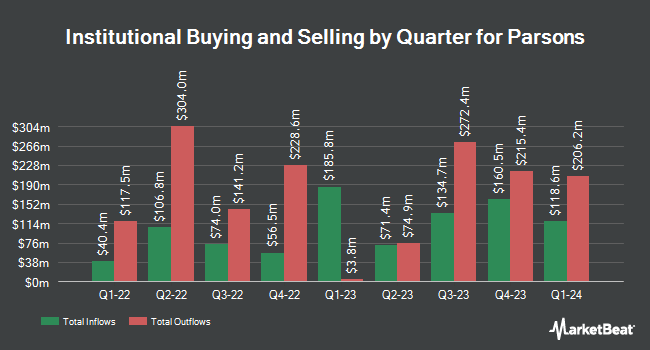

Several other institutional investors have also added to or reduced their stakes in the company. V Square Quantitative Management LLC purchased a new stake in shares of Parsons during the third quarter valued at $33,000. Tanglewood Legacy Advisors LLC purchased a new stake in Parsons in the 2nd quarter valued at about $44,000. Capital Performance Advisors LLP bought a new position in Parsons in the 3rd quarter worth about $45,000. DekaBank Deutsche Girozentrale bought a new stake in shares of Parsons during the third quarter valued at approximately $72,000. Finally, Blue Trust Inc. boosted its holdings in shares of Parsons by 23.6% in the second quarter. Blue Trust Inc. now owns 1,041 shares of the company's stock valued at $86,000 after purchasing an additional 199 shares during the period. Institutional investors own 98.02% of the company's stock.

Wall Street Analysts Forecast Growth

Several research firms have commented on PSN. KeyCorp raised their price objective on Parsons from $116.00 to $122.00 and gave the stock an "overweight" rating in a report on Thursday, October 31st. Raymond James lowered Parsons from a "strong-buy" rating to an "outperform" rating and set a $115.00 price target on the stock. in a research note on Wednesday, October 23rd. Robert W. Baird upped their price objective on shares of Parsons from $103.00 to $125.00 and gave the stock an "outperform" rating in a research note on Thursday, October 31st. Finally, Truist Financial cut their target price on shares of Parsons from $130.00 to $110.00 and set a "buy" rating on the stock in a research report on Friday, November 22nd. One equities research analyst has rated the stock with a hold rating and seven have issued a buy rating to the stock. According to data from MarketBeat, Parsons has an average rating of "Moderate Buy" and a consensus price target of $105.13.

Read Our Latest Stock Analysis on PSN

Parsons Stock Down 0.9 %

Shares of PSN stock traded down $0.85 during mid-day trading on Friday, hitting $98.03. 570,961 shares of the stock traded hands, compared to its average volume of 905,679. Parsons Co. has a 52-week low of $61.10 and a 52-week high of $114.68. The stock has a market cap of $10.41 billion, a P/E ratio of 149.82, a P/E/G ratio of 1.69 and a beta of 0.74. The company has a debt-to-equity ratio of 0.47, a current ratio of 1.55 and a quick ratio of 1.55. The stock's fifty day moving average is $104.21 and its two-hundred day moving average is $91.98.

Parsons (NYSE:PSN - Get Free Report) last posted its earnings results on Wednesday, October 30th. The company reported $0.80 EPS for the quarter, beating analysts' consensus estimates of $0.73 by $0.07. Parsons had a net margin of 1.21% and a return on equity of 12.74%. The company had revenue of $1.81 billion during the quarter, compared to analysts' expectations of $1.63 billion. Equities analysts predict that Parsons Co. will post 3.02 EPS for the current year.

Parsons Profile

(

Free Report)

Parsons Corporation provides integrated solutions and services in the defense, intelligence, and critical infrastructure markets in North America, the Middle East, and internationally. The company operates through Federal Solutions and Critical Infrastructure segments. The Federal Solutions segment provides critical technologies, such as cybersecurity; missile defense; intelligence; space launch and ground systems; space and weapon system resiliency; geospatial intelligence; signals intelligence; environmental remediation; border security, critical infrastructure protection; counter unmanned air systems; biometrics and bio surveillance solutions to U.S.

Read More

Before you consider Parsons, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Parsons wasn't on the list.

While Parsons currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.