The Manufacturers Life Insurance Company trimmed its stake in Yelp Inc. (NYSE:YELP - Free Report) by 93.9% during the third quarter, according to its most recent 13F filing with the SEC. The institutional investor owned 35,946 shares of the local business review company's stock after selling 550,874 shares during the period. The Manufacturers Life Insurance Company owned 0.05% of Yelp worth $1,261,000 at the end of the most recent reporting period.

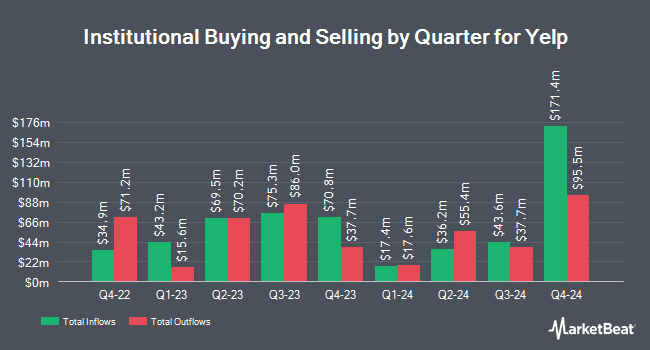

A number of other institutional investors have also made changes to their positions in the stock. Daiwa Securities Group Inc. increased its position in Yelp by 62.2% in the 3rd quarter. Daiwa Securities Group Inc. now owns 7,300 shares of the local business review company's stock worth $256,000 after buying an additional 2,800 shares during the period. Algert Global LLC increased its position in Yelp by 7.5% in the 3rd quarter. Algert Global LLC now owns 204,077 shares of the local business review company's stock worth $7,159,000 after buying an additional 14,213 shares during the period. Cerity Partners LLC increased its position in Yelp by 6.2% in the 3rd quarter. Cerity Partners LLC now owns 239,640 shares of the local business review company's stock worth $8,407,000 after buying an additional 13,993 shares during the period. Charles Schwab Investment Management Inc. increased its position in Yelp by 5.1% in the 3rd quarter. Charles Schwab Investment Management Inc. now owns 1,174,607 shares of the local business review company's stock worth $41,205,000 after buying an additional 56,618 shares during the period. Finally, Pacer Advisors Inc. increased its position in Yelp by 1.8% in the 3rd quarter. Pacer Advisors Inc. now owns 2,743,899 shares of the local business review company's stock worth $96,256,000 after buying an additional 48,363 shares during the period. 90.11% of the stock is owned by institutional investors.

Analyst Ratings Changes

Several analysts have recently weighed in on YELP shares. The Goldman Sachs Group lowered Yelp from a "buy" rating to a "neutral" rating and decreased their price objective for the stock from $46.00 to $38.00 in a report on Monday, October 14th. StockNews.com raised Yelp from a "buy" rating to a "strong-buy" rating in a report on Monday, November 11th. Robert W. Baird decreased their price objective on Yelp from $39.00 to $37.00 and set a "neutral" rating on the stock in a report on Friday, November 8th. Bank of America started coverage on Yelp in a report on Monday, September 16th. They set an "underperform" rating and a $30.00 price objective on the stock. Finally, Evercore ISI raised Yelp to a "hold" rating in a report on Monday, November 11th. Two analysts have rated the stock with a sell rating, six have assigned a hold rating, one has given a buy rating and one has given a strong buy rating to the stock. Based on data from MarketBeat, the stock currently has an average rating of "Hold" and an average price target of $37.00.

Read Our Latest Stock Report on Yelp

Insider Buying and Selling at Yelp

In other Yelp news, CFO David A. Schwarzbach sold 10,000 shares of Yelp stock in a transaction on Friday, November 29th. The stock was sold at an average price of $38.29, for a total value of $382,900.00. Following the completion of the transaction, the chief financial officer now owns 211,988 shares in the company, valued at approximately $8,117,020.52. The trade was a 4.50 % decrease in their position. The sale was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Also, COO Joseph R. Nachman sold 7,000 shares of Yelp stock in a transaction on Friday, October 4th. The shares were sold at an average price of $34.02, for a total value of $238,140.00. Following the completion of the transaction, the chief operating officer now owns 255,558 shares of the company's stock, valued at approximately $8,694,083.16. The trade was a 2.67 % decrease in their position. The disclosure for this sale can be found here. In the last quarter, insiders sold 41,865 shares of company stock worth $1,537,218. 7.40% of the stock is currently owned by insiders.

Yelp Trading Down 0.8 %

YELP stock traded down $0.33 during trading on Thursday, hitting $40.28. The company had a trading volume of 205,441 shares, compared to its average volume of 724,166. The company has a fifty day moving average price of $35.94 and a two-hundred day moving average price of $35.55. The company has a market cap of $2.65 billion, a P/E ratio of 24.32, a P/E/G ratio of 0.72 and a beta of 1.35. Yelp Inc. has a fifty-two week low of $32.56 and a fifty-two week high of $48.99.

Yelp Company Profile

(

Free Report)

Yelp Inc operates a platform that connects consumers with local businesses in the United States and internationally. The company's platform covers various categories, including restaurants, shopping, beauty and fitness, health, and other categories, as well as home, local, auto, professional, pets, events, real estate, and financial services.

See Also

Before you consider Yelp, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Yelp wasn't on the list.

While Yelp currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.