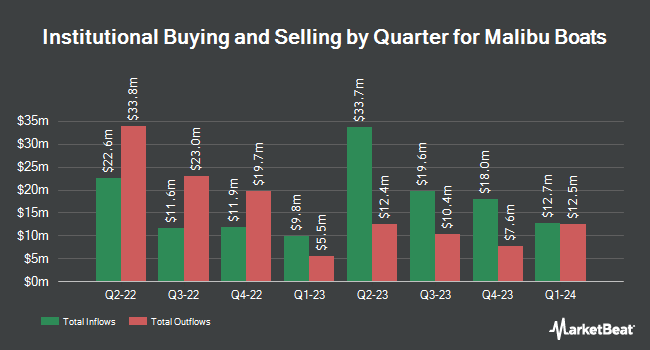

The Manufacturers Life Insurance Company lessened its stake in Malibu Boats, Inc. (NASDAQ:MBUU - Free Report) by 24.8% during the 3rd quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The fund owned 634,290 shares of the company's stock after selling 209,315 shares during the period. The Manufacturers Life Insurance Company owned 3.22% of Malibu Boats worth $24,617,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

Other hedge funds have also recently made changes to their positions in the company. Pzena Investment Management LLC lifted its holdings in Malibu Boats by 5.2% during the 3rd quarter. Pzena Investment Management LLC now owns 1,555,331 shares of the company's stock worth $60,362,000 after buying an additional 77,015 shares during the last quarter. Dimensional Fund Advisors LP grew its stake in Malibu Boats by 10.9% during the second quarter. Dimensional Fund Advisors LP now owns 1,131,877 shares of the company's stock worth $39,661,000 after buying an additional 111,699 shares during the period. Lodge Hill Capital LLC bought a new stake in shares of Malibu Boats in the 2nd quarter worth about $4,866,000. Allspring Global Investments Holdings LLC grew its position in shares of Malibu Boats by 37.2% during the third quarter. Allspring Global Investments Holdings LLC now owns 114,525 shares of the company's stock worth $4,445,000 after acquiring an additional 31,026 shares during the last quarter. Finally, Assenagon Asset Management S.A. acquired a new stake in shares of Malibu Boats in the second quarter valued at $3,667,000. 91.35% of the stock is owned by institutional investors and hedge funds.

Malibu Boats Price Performance

Malibu Boats stock traded down $0.29 during midday trading on Friday, reaching $43.35. 95,885 shares of the stock traded hands, compared to its average volume of 202,361. The stock's fifty day moving average is $41.47 and its 200-day moving average is $37.85. Malibu Boats, Inc. has a 12 month low of $30.20 and a 12 month high of $56.03. The company has a quick ratio of 0.52, a current ratio of 1.55 and a debt-to-equity ratio of 0.05. The stock has a market cap of $854.86 million, a P/E ratio of -10.89 and a beta of 1.36.

Malibu Boats (NASDAQ:MBUU - Get Free Report) last announced its quarterly earnings results on Thursday, October 31st. The company reported $0.08 EPS for the quarter, topping analysts' consensus estimates of ($0.08) by $0.16. Malibu Boats had a positive return on equity of 2.39% and a negative net margin of 10.90%. The business had revenue of $171.60 million for the quarter, compared to analysts' expectations of $165.33 million. During the same period in the previous year, the firm earned $1.07 EPS. The business's quarterly revenue was down 32.9% on a year-over-year basis. As a group, equities research analysts anticipate that Malibu Boats, Inc. will post 2.01 EPS for the current year.

Wall Street Analyst Weigh In

A number of equities research analysts recently commented on MBUU shares. Benchmark restated a "buy" rating and set a $44.00 price target on shares of Malibu Boats in a research report on Friday, November 1st. KeyCorp lifted their price objective on Malibu Boats from $38.00 to $50.00 and gave the stock an "overweight" rating in a research note on Friday, November 1st. StockNews.com upgraded shares of Malibu Boats to a "sell" rating in a research note on Saturday, November 2nd. Truist Financial lifted their price target on shares of Malibu Boats from $32.00 to $42.00 and gave the stock a "hold" rating in a research note on Friday, November 1st. Finally, Robert W. Baird upped their target price on shares of Malibu Boats from $40.00 to $50.00 and gave the stock an "outperform" rating in a research note on Friday, November 1st. One investment analyst has rated the stock with a sell rating, four have issued a hold rating and three have assigned a buy rating to the stock. Based on data from MarketBeat, Malibu Boats has a consensus rating of "Hold" and an average target price of $44.57.

Check Out Our Latest Research Report on Malibu Boats

Malibu Boats Company Profile

(

Free Report)

Malibu Boats, Inc designs, engineers, manufactures, markets, and sells a range of recreational powerboats. It operates through three segments: Malibu, Saltwater Fishing, and Cobalt. The company provides performance sport boats, and sterndrive and outboard boats under the Malibu, Axis, Pursuit, Maverick, Cobia, Pathfinder, Hewes, and Cobalt brands.

Recommended Stories

Before you consider Malibu Boats, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Malibu Boats wasn't on the list.

While Malibu Boats currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.