The Manufacturers Life Insurance Company cut its holdings in Rio Tinto Group (NYSE:RIO - Free Report) by 10.9% in the 3rd quarter, according to its most recent 13F filing with the SEC. The fund owned 119,573 shares of the mining company's stock after selling 14,687 shares during the period. The Manufacturers Life Insurance Company's holdings in Rio Tinto Group were worth $8,510,000 at the end of the most recent reporting period.

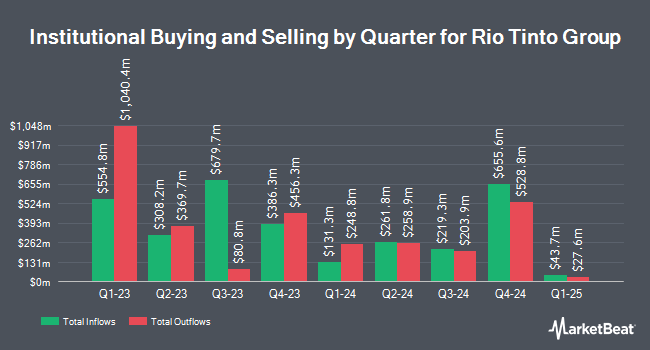

Several other institutional investors also recently bought and sold shares of RIO. GHP Investment Advisors Inc. purchased a new stake in Rio Tinto Group during the 2nd quarter worth $26,000. Winch Advisory Services LLC purchased a new stake in Rio Tinto Group during the 3rd quarter worth $26,000. FSC Wealth Advisors LLC purchased a new stake in Rio Tinto Group during the 3rd quarter worth $28,000. Sound Income Strategies LLC boosted its position in Rio Tinto Group by 70.9% during the 3rd quarter. Sound Income Strategies LLC now owns 417 shares of the mining company's stock worth $30,000 after purchasing an additional 173 shares during the period. Finally, Centerpoint Advisors LLC boosted its position in Rio Tinto Group by 110.0% during the 2nd quarter. Centerpoint Advisors LLC now owns 525 shares of the mining company's stock worth $35,000 after purchasing an additional 275 shares during the period. 19.33% of the stock is currently owned by institutional investors and hedge funds.

Rio Tinto Group Trading Down 0.2 %

Shares of RIO stock traded down $0.11 during trading hours on Wednesday, hitting $63.40. 2,520,078 shares of the company were exchanged, compared to its average volume of 2,737,554. The company has a debt-to-equity ratio of 0.23, a quick ratio of 1.16 and a current ratio of 1.70. Rio Tinto Group has a one year low of $59.35 and a one year high of $75.09. The business's 50-day simple moving average is $65.27 and its two-hundred day simple moving average is $65.38.

Wall Street Analyst Weigh In

RIO has been the subject of a number of research reports. Macquarie reaffirmed a "neutral" rating on shares of Rio Tinto Group in a research report on Wednesday, October 16th. StockNews.com downgraded Rio Tinto Group from a "strong-buy" rating to a "buy" rating in a research note on Tuesday, November 12th. Finally, Berenberg Bank upgraded Rio Tinto Group from a "hold" rating to a "buy" rating in a research note on Wednesday, October 2nd. Four investment analysts have rated the stock with a hold rating, five have assigned a buy rating and one has assigned a strong buy rating to the company's stock. According to MarketBeat.com, Rio Tinto Group presently has a consensus rating of "Moderate Buy".

Check Out Our Latest Analysis on RIO

Rio Tinto Group Profile

(

Free Report)

Rio Tinto Group engages in exploring, mining, and processing mineral resources worldwide. The company operates through Iron Ore, Aluminium, Copper, and Minerals Segments. The Iron Ore segment engages in the iron ore mining, and salt and gypsum production in Western Australia. The Aluminum segment is involved in bauxite mining; alumina refining; and aluminium smelting.

Read More

Before you consider Rio Tinto Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Rio Tinto Group wasn't on the list.

While Rio Tinto Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.