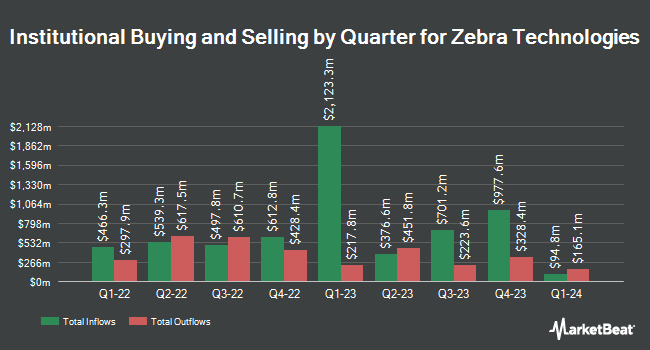

The Manufacturers Life Insurance Company increased its stake in Zebra Technologies Co. (NASDAQ:ZBRA - Free Report) by 158.4% in the 3rd quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 100,875 shares of the industrial products company's stock after acquiring an additional 61,842 shares during the quarter. The Manufacturers Life Insurance Company owned 0.20% of Zebra Technologies worth $37,356,000 at the end of the most recent reporting period.

A number of other institutional investors also recently modified their holdings of the stock. Bank of Montreal Can lifted its holdings in shares of Zebra Technologies by 48.9% in the 3rd quarter. Bank of Montreal Can now owns 76,050 shares of the industrial products company's stock worth $28,032,000 after purchasing an additional 24,969 shares in the last quarter. Trust Asset Management LLC bought a new position in shares of Zebra Technologies in the third quarter valued at $223,000. Brown Brothers Harriman & Co. grew its holdings in shares of Zebra Technologies by 40.9% during the third quarter. Brown Brothers Harriman & Co. now owns 116,221 shares of the industrial products company's stock valued at $43,039,000 after buying an additional 33,753 shares during the last quarter. Harvest Fund Management Co. Ltd increased its position in shares of Zebra Technologies by 150.6% during the third quarter. Harvest Fund Management Co. Ltd now owns 654 shares of the industrial products company's stock worth $242,000 after acquiring an additional 393 shares in the last quarter. Finally, Daiwa Securities Group Inc. raised its holdings in shares of Zebra Technologies by 37.5% in the 3rd quarter. Daiwa Securities Group Inc. now owns 8,917 shares of the industrial products company's stock worth $3,302,000 after acquiring an additional 2,433 shares during the last quarter. Institutional investors and hedge funds own 91.03% of the company's stock.

Wall Street Analyst Weigh In

A number of research firms have issued reports on ZBRA. Morgan Stanley lifted their price objective on shares of Zebra Technologies from $290.00 to $305.00 and gave the stock an "underweight" rating in a report on Wednesday, October 30th. TD Cowen upped their price objective on shares of Zebra Technologies from $380.00 to $425.00 and gave the stock a "buy" rating in a research report on Wednesday, October 30th. UBS Group increased their price objective on shares of Zebra Technologies from $390.00 to $445.00 and gave the company a "buy" rating in a research note on Wednesday, October 30th. Truist Financial restated a "hold" rating and issued a $383.00 target price (up previously from $379.00) on shares of Zebra Technologies in a research note on Wednesday, October 30th. Finally, Robert W. Baird increased their price target on Zebra Technologies from $380.00 to $415.00 and gave the company an "outperform" rating in a research report on Wednesday, October 30th. One investment analyst has rated the stock with a sell rating, three have issued a hold rating, eight have issued a buy rating and one has given a strong buy rating to the company. According to data from MarketBeat.com, Zebra Technologies has a consensus rating of "Moderate Buy" and a consensus target price of $385.18.

View Our Latest Analysis on Zebra Technologies

Zebra Technologies Price Performance

NASDAQ:ZBRA traded up $1.25 during trading hours on Friday, hitting $407.00. 175,680 shares of the company's stock traded hands, compared to its average volume of 359,615. Zebra Technologies Co. has a 52 week low of $232.29 and a 52 week high of $409.03. The company has a quick ratio of 0.96, a current ratio of 1.37 and a debt-to-equity ratio of 0.61. The firm has a market cap of $20.99 billion, a P/E ratio of 55.37 and a beta of 1.64. The business's fifty day simple moving average is $380.51 and its two-hundred day simple moving average is $344.26.

Zebra Technologies (NASDAQ:ZBRA - Get Free Report) last released its quarterly earnings results on Tuesday, October 29th. The industrial products company reported $3.49 earnings per share for the quarter, beating analysts' consensus estimates of $2.92 by $0.57. The business had revenue of $1.26 billion for the quarter, compared to the consensus estimate of $1.22 billion. Zebra Technologies had a return on equity of 15.56% and a net margin of 8.20%. The company's revenue for the quarter was up 31.3% on a year-over-year basis. During the same quarter last year, the business posted $0.57 earnings per share. On average, research analysts anticipate that Zebra Technologies Co. will post 12.4 earnings per share for the current fiscal year.

Insider Activity at Zebra Technologies

In other Zebra Technologies news, CFO Nathan Andrew Winters sold 1,837 shares of the firm's stock in a transaction dated Thursday, October 31st. The shares were sold at an average price of $381.73, for a total value of $701,238.01. Following the completion of the sale, the chief financial officer now directly owns 11,421 shares in the company, valued at $4,359,738.33. This trade represents a 13.86 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available at this link. 1.06% of the stock is currently owned by company insiders.

Zebra Technologies Profile

(

Free Report)

Zebra Technologies Corporation, together with its subsidiaries, provides enterprise asset intelligence solutions in the automatic identification and data capture solutions industry worldwide. It operates in two segments, Asset Intelligence & Tracking, and Enterprise Visibility & Mobility. The company designs, manufactures, and sells printers that produce labels, wristbands, tickets, receipts, and plastic cards; dye-sublimination thermal card printers that produce images, which are used for personal identification, access control, and financial transactions; radio frequency identification device (RFID) printers that encode data into passive RFID transponders; accessories and options for printers, including carrying cases, vehicle mounts, and battery chargers; stock and customized thermal labels, receipts, ribbons, plastic cards, and RFID tags for printers; and temperature-monitoring labels primarily used in vaccine distribution.

Featured Articles

Before you consider Zebra Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Zebra Technologies wasn't on the list.

While Zebra Technologies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.