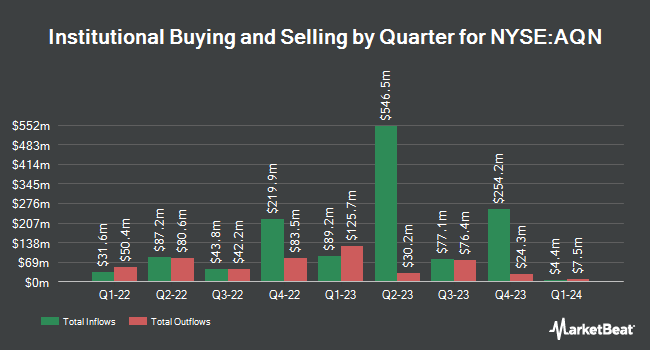

The Manufacturers Life Insurance Company grew its holdings in shares of Algonquin Power & Utilities Corp. (NYSE:AQN - Free Report) by 6.1% during the third quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The firm owned 7,720,474 shares of the utilities provider's stock after purchasing an additional 447,246 shares during the quarter. The Manufacturers Life Insurance Company owned approximately 1.01% of Algonquin Power & Utilities worth $42,105,000 at the end of the most recent quarter.

Several other hedge funds have also made changes to their positions in the business. Central Pacific Bank Trust Division acquired a new stake in Algonquin Power & Utilities in the 3rd quarter worth about $54,000. Claro Advisors LLC acquired a new stake in shares of Algonquin Power & Utilities in the second quarter worth approximately $61,000. SeaCrest Wealth Management LLC purchased a new stake in Algonquin Power & Utilities in the second quarter valued at approximately $66,000. Verdence Capital Advisors LLC acquired a new position in Algonquin Power & Utilities during the third quarter worth approximately $61,000. Finally, SVB Wealth LLC purchased a new position in Algonquin Power & Utilities during the first quarter worth approximately $82,000. Institutional investors and hedge funds own 62.28% of the company's stock.

Algonquin Power & Utilities Stock Up 1.4 %

NYSE AQN traded up $0.07 during trading hours on Friday, reaching $4.95. 2,683,287 shares of the company traded hands, compared to its average volume of 5,580,548. The company has a current ratio of 0.92, a quick ratio of 0.73 and a debt-to-equity ratio of 1.17. Algonquin Power & Utilities Corp. has a 12 month low of $4.67 and a 12 month high of $6.79. The company has a 50 day moving average of $5.03 and a two-hundred day moving average of $5.59.

Algonquin Power & Utilities (NYSE:AQN - Get Free Report) last issued its quarterly earnings results on Thursday, November 7th. The utilities provider reported $0.08 EPS for the quarter, missing the consensus estimate of $0.09 by ($0.01). The company had revenue of $573.20 million for the quarter, compared to the consensus estimate of $620.46 million. Algonquin Power & Utilities had a positive return on equity of 5.22% and a negative net margin of 39.12%. The business's revenue for the quarter was up 1.5% on a year-over-year basis. During the same period in the previous year, the business posted $0.11 EPS. As a group, analysts expect that Algonquin Power & Utilities Corp. will post 0.39 EPS for the current year.

Algonquin Power & Utilities Announces Dividend

The company also recently declared a quarterly dividend, which will be paid on Wednesday, January 15th. Stockholders of record on Tuesday, December 31st will be issued a $0.065 dividend. The ex-dividend date is Tuesday, December 31st. This represents a $0.26 dividend on an annualized basis and a dividend yield of 5.25%. Algonquin Power & Utilities's dividend payout ratio (DPR) is -20.15%.

Analysts Set New Price Targets

A number of analysts have recently commented on AQN shares. National Bank Financial upgraded Algonquin Power & Utilities from a "hold" rating to a "strong-buy" rating in a report on Monday, August 12th. Scotiabank cut their price objective on Algonquin Power & Utilities from $5.75 to $5.25 and set a "sector perform" rating on the stock in a report on Friday, November 8th. Janney Montgomery Scott started coverage on Algonquin Power & Utilities in a report on Thursday, September 5th. They set a "neutral" rating and a $6.00 target price for the company. Desjardins cut their price target on shares of Algonquin Power & Utilities from $5.50 to $5.25 and set a "hold" rating on the stock in a report on Monday, August 12th. Finally, Raymond James downgraded shares of Algonquin Power & Utilities from an "outperform" rating to a "market perform" rating and decreased their price objective for the stock from $7.75 to $7.00 in a research note on Monday, August 12th. One investment analyst has rated the stock with a sell rating, nine have issued a hold rating, one has assigned a buy rating and one has given a strong buy rating to the company. According to MarketBeat, the company presently has an average rating of "Hold" and an average target price of $6.18.

Get Our Latest Analysis on Algonquin Power & Utilities

Algonquin Power & Utilities Profile

(

Free Report)

Algonquin Power & Utilities Corp. operates in the power and utility industries in the United States, Canada, and other regions. The company operates in two segments, Regulated Services Group and Renewable Energy Group. The company primarily owns and operates a regulated electric, water distribution and wastewater collection, and natural gas utility systems and transmission operations.

See Also

Before you consider Algonquin Power & Utilities, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Algonquin Power & Utilities wasn't on the list.

While Algonquin Power & Utilities currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.