The Manufacturers Life Insurance Company boosted its holdings in shares of Fortuna Silver Mines Inc. (NYSE:FSM - Free Report) TSE: FVI by 323.4% in the 3rd quarter, according to its most recent Form 13F filing with the SEC. The firm owned 1,075,479 shares of the basic materials company's stock after buying an additional 821,495 shares during the period. The Manufacturers Life Insurance Company owned approximately 0.34% of Fortuna Silver Mines worth $5,005,000 as of its most recent SEC filing.

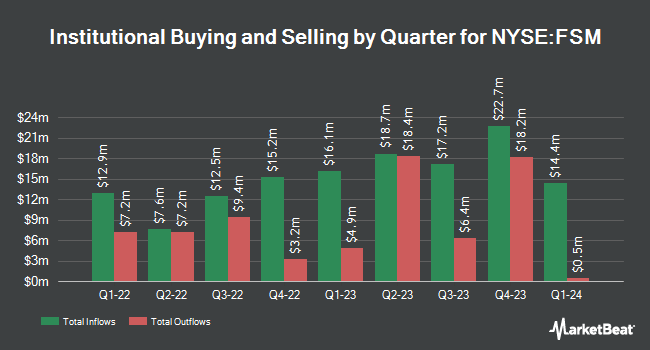

Several other hedge funds and other institutional investors have also added to or reduced their stakes in FSM. Cubist Systematic Strategies LLC increased its holdings in shares of Fortuna Silver Mines by 273.0% in the 2nd quarter. Cubist Systematic Strategies LLC now owns 1,263,905 shares of the basic materials company's stock worth $6,180,000 after buying an additional 925,084 shares during the last quarter. Van ECK Associates Corp grew its position in Fortuna Silver Mines by 2.6% in the third quarter. Van ECK Associates Corp now owns 30,563,833 shares of the basic materials company's stock worth $141,511,000 after acquiring an additional 788,703 shares in the last quarter. K2 Principal Fund L.P. bought a new position in Fortuna Silver Mines in the second quarter valued at $550,000. D. E. Shaw & Co. Inc. increased its stake in Fortuna Silver Mines by 165.9% in the second quarter. D. E. Shaw & Co. Inc. now owns 5,557,376 shares of the basic materials company's stock valued at $27,176,000 after acquiring an additional 3,467,562 shares during the last quarter. Finally, Sicart Associates LLC purchased a new stake in Fortuna Silver Mines during the third quarter valued at about $3,171,000. 33.80% of the stock is currently owned by hedge funds and other institutional investors.

Analysts Set New Price Targets

Separately, Scotiabank upped their price objective on Fortuna Silver Mines from $6.00 to $6.50 and gave the stock a "sector perform" rating in a report on Monday, August 19th.

Check Out Our Latest Report on FSM

Fortuna Silver Mines Trading Down 3.7 %

Shares of FSM stock traded down $0.18 on Friday, hitting $4.72. 9,831,506 shares of the company's stock traded hands, compared to its average volume of 7,403,450. The stock has a market capitalization of $1.48 billion, a price-to-earnings ratio of 59.00 and a beta of 1.55. The company's fifty day simple moving average is $4.84 and its 200 day simple moving average is $4.91. Fortuna Silver Mines Inc. has a one year low of $2.63 and a one year high of $6.36. The company has a debt-to-equity ratio of 0.12, a quick ratio of 1.37 and a current ratio of 1.94.

About Fortuna Silver Mines

(

Free Report)

Fortuna Mining Corp. engages in the precious and base metal mining in Argentina, Burkina Faso, Mexico, Peru, and Côte d'Ivoire. It operates through Mansfield, Sanu, Sango, Cuzcatlan, Bateas, and Corporate segments. The company primarily explores for silver, lead, zinc, and gold. Its flagship project is the Séguéla gold mine, which consists of approximately 62,000 hectares and is located in the Worodougou Region of the Woroba District, Côte d'Ivoire.

Further Reading

Before you consider Fortuna Silver Mines, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fortuna Silver Mines wasn't on the list.

While Fortuna Silver Mines currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.