The Manufacturers Life Insurance Company lessened its holdings in Ziff Davis, Inc. (NASDAQ:ZD - Free Report) by 54.2% during the third quarter, according to the company in its most recent 13F filing with the SEC. The institutional investor owned 25,023 shares of the technology company's stock after selling 29,589 shares during the quarter. The Manufacturers Life Insurance Company owned 0.06% of Ziff Davis worth $1,218,000 as of its most recent SEC filing.

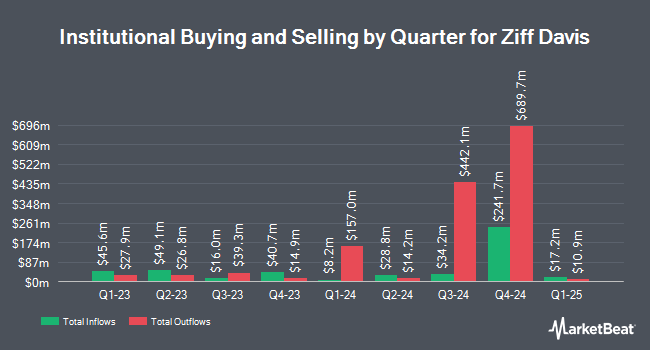

A number of other large investors have also recently modified their holdings of the business. Dimensional Fund Advisors LP boosted its holdings in shares of Ziff Davis by 14.3% in the 2nd quarter. Dimensional Fund Advisors LP now owns 2,057,314 shares of the technology company's stock valued at $113,255,000 after purchasing an additional 257,056 shares in the last quarter. Charles Schwab Investment Management Inc. boosted its holdings in shares of Ziff Davis by 9.5% during the 3rd quarter. Charles Schwab Investment Management Inc. now owns 695,542 shares of the technology company's stock valued at $33,845,000 after acquiring an additional 60,472 shares in the last quarter. Rice Hall James & Associates LLC boosted its holdings in shares of Ziff Davis by 11.0% during the 3rd quarter. Rice Hall James & Associates LLC now owns 501,313 shares of the technology company's stock valued at $24,394,000 after acquiring an additional 49,510 shares in the last quarter. Retirement Systems of Alabama boosted its holdings in shares of Ziff Davis by 21.4% during the 2nd quarter. Retirement Systems of Alabama now owns 360,030 shares of the technology company's stock valued at $19,820,000 after acquiring an additional 63,458 shares in the last quarter. Finally, AQR Capital Management LLC boosted its holdings in shares of Ziff Davis by 453.7% during the 2nd quarter. AQR Capital Management LLC now owns 278,564 shares of the technology company's stock valued at $15,204,000 after acquiring an additional 228,257 shares in the last quarter. Institutional investors and hedge funds own 99.76% of the company's stock.

Ziff Davis Trading Up 0.7 %

Shares of ZD stock traded up $0.39 during mid-day trading on Thursday, hitting $59.58. The company's stock had a trading volume of 162,829 shares, compared to its average volume of 432,527. The company's fifty day simple moving average is $51.76 and its 200-day simple moving average is $50.51. Ziff Davis, Inc. has a 52 week low of $37.76 and a 52 week high of $70.90. The company has a debt-to-equity ratio of 0.49, a quick ratio of 1.42 and a current ratio of 1.42. The company has a market cap of $2.55 billion, a PE ratio of 50.16 and a beta of 1.35.

Analysts Set New Price Targets

Several research firms recently weighed in on ZD. Royal Bank of Canada reissued an "outperform" rating and set a $95.00 price objective on shares of Ziff Davis in a report on Friday, September 6th. Barclays raised their price objective on Ziff Davis from $44.00 to $61.00 and gave the company an "equal weight" rating in a report on Monday, November 11th. Finally, UBS Group cut their price objective on Ziff Davis from $76.00 to $65.00 and set a "neutral" rating on the stock in a report on Tuesday, December 3rd. Three research analysts have rated the stock with a hold rating and four have issued a buy rating to the company's stock. According to data from MarketBeat, Ziff Davis currently has a consensus rating of "Moderate Buy" and an average price target of $69.71.

Get Our Latest Stock Analysis on ZD

Ziff Davis Profile

(

Free Report)

Ziff Davis, Inc, together with its subsidiaries, operates as a digital media and internet company in the United States and internationally. The company offers PCMag, an online resource for laboratory-based product reviews, technology news, buying guides, and research papers; Mashable for publishing technology and culture content; Spiceworks Ziff Davis provides digital content of IT products and services; retailMeNot, a savings destination platform; Offers.com, a coupon and deals website; and event-based properties, including BlackFriday.com, TheBlackFriday.com, BestBlackFriday.com, and DealsofAmerica.com.

See Also

Before you consider Ziff Davis, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ziff Davis wasn't on the list.

While Ziff Davis currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.