The Manufacturers Life Insurance Company trimmed its position in Alnylam Pharmaceuticals, Inc. (NASDAQ:ALNY - Free Report) by 41.8% during the 3rd quarter, according to its most recent disclosure with the Securities and Exchange Commission. The fund owned 191,382 shares of the biopharmaceutical company's stock after selling 137,655 shares during the quarter. The Manufacturers Life Insurance Company owned about 0.15% of Alnylam Pharmaceuticals worth $52,636,000 at the end of the most recent reporting period.

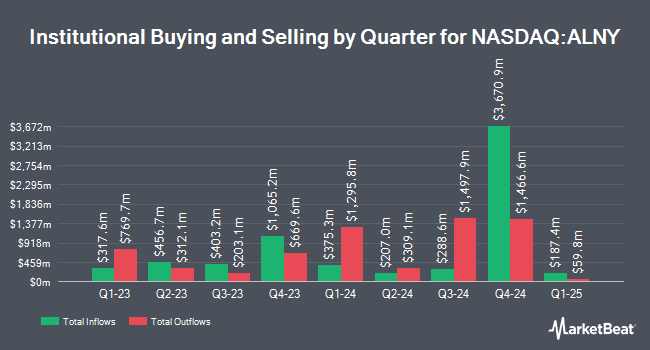

A number of other hedge funds also recently made changes to their positions in ALNY. Kennedy Capital Management LLC bought a new stake in Alnylam Pharmaceuticals in the first quarter worth $231,000. Tidal Investments LLC increased its holdings in shares of Alnylam Pharmaceuticals by 292.3% in the 1st quarter. Tidal Investments LLC now owns 10,281 shares of the biopharmaceutical company's stock worth $1,536,000 after buying an additional 7,660 shares during the last quarter. iA Global Asset Management Inc. raised its position in shares of Alnylam Pharmaceuticals by 28.2% during the 1st quarter. iA Global Asset Management Inc. now owns 7,765 shares of the biopharmaceutical company's stock valued at $1,160,000 after buying an additional 1,710 shares in the last quarter. Swedbank AB bought a new position in shares of Alnylam Pharmaceuticals in the 1st quarter valued at about $3,084,000. Finally, Burney Co. lifted its holdings in shares of Alnylam Pharmaceuticals by 371.9% in the 1st quarter. Burney Co. now owns 27,059 shares of the biopharmaceutical company's stock valued at $4,044,000 after acquiring an additional 21,325 shares during the last quarter. 92.97% of the stock is currently owned by hedge funds and other institutional investors.

Insiders Place Their Bets

In other news, EVP Tolga Tanguler sold 1,469 shares of the firm's stock in a transaction on Tuesday, November 26th. The stock was sold at an average price of $250.98, for a total value of $368,689.62. Following the completion of the sale, the executive vice president now owns 13,191 shares of the company's stock, valued at $3,310,677.18. This trade represents a 10.02 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this hyperlink. Also, CMO Pushkal Garg sold 1,682 shares of the company's stock in a transaction dated Tuesday, November 26th. The shares were sold at an average price of $250.98, for a total value of $422,148.36. Following the transaction, the chief marketing officer now directly owns 17,457 shares in the company, valued at $4,381,357.86. This represents a 8.79 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last ninety days, insiders sold 8,370 shares of company stock worth $2,100,703. 1.50% of the stock is owned by corporate insiders.

Analysts Set New Price Targets

ALNY has been the topic of a number of recent research reports. Cantor Fitzgerald restated a "neutral" rating and set a $220.00 price objective on shares of Alnylam Pharmaceuticals in a research report on Friday, October 11th. Bank of America increased their price target on Alnylam Pharmaceuticals from $307.00 to $314.00 and gave the company a "buy" rating in a report on Monday, October 14th. Piper Sandler reiterated an "overweight" rating and set a $296.00 price objective on shares of Alnylam Pharmaceuticals in a research report on Monday, November 18th. William Blair reissued an "outperform" rating on shares of Alnylam Pharmaceuticals in a research note on Tuesday, November 19th. Finally, HC Wainwright reaffirmed a "buy" rating and set a $400.00 price target on shares of Alnylam Pharmaceuticals in a research note on Monday, November 18th. One analyst has rated the stock with a sell rating, six have given a hold rating and eighteen have issued a buy rating to the stock. Based on data from MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and a consensus price target of $298.09.

Check Out Our Latest Stock Report on Alnylam Pharmaceuticals

Alnylam Pharmaceuticals Stock Down 0.3 %

ALNY stock traded down $0.67 during trading on Friday, hitting $253.07. 325,534 shares of the company's stock traded hands, compared to its average volume of 875,545. The firm has a market capitalization of $32.64 billion, a P/E ratio of -96.85 and a beta of 0.39. Alnylam Pharmaceuticals, Inc. has a 1 year low of $141.98 and a 1 year high of $304.39. The company has a quick ratio of 2.69, a current ratio of 2.75 and a debt-to-equity ratio of 31.64. The business has a fifty day simple moving average of $271.48 and a two-hundred day simple moving average of $240.29.

Alnylam Pharmaceuticals (NASDAQ:ALNY - Get Free Report) last announced its quarterly earnings results on Thursday, October 31st. The biopharmaceutical company reported ($0.87) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($0.51) by ($0.36). The firm had revenue of $500.90 million during the quarter, compared to analyst estimates of $532.91 million. The company's revenue for the quarter was down 33.3% on a year-over-year basis. During the same quarter in the previous year, the company earned $1.15 EPS. Sell-side analysts anticipate that Alnylam Pharmaceuticals, Inc. will post -2.21 EPS for the current year.

Alnylam Pharmaceuticals Profile

(

Free Report)

Alnylam Pharmaceuticals, Inc, a biopharmaceutical company, focuses on discovering, developing, and commercializing novel therapeutics based on ribonucleic acid interference. Its marketed products include ONPATTRO (patisiran) for the treatment of the polyneuropathy of hereditary transthyretin-mediated amyloidosis in adults; AMVUTTRA for the treatment of hATTR amyloidosis with polyneuropathy in adults; GIVLAARI for the treatment of adults with acute hepatic porphyria; and OXLUMO for the treatment of primary hyperoxaluria type 1.

Read More

Before you consider Alnylam Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alnylam Pharmaceuticals wasn't on the list.

While Alnylam Pharmaceuticals currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.