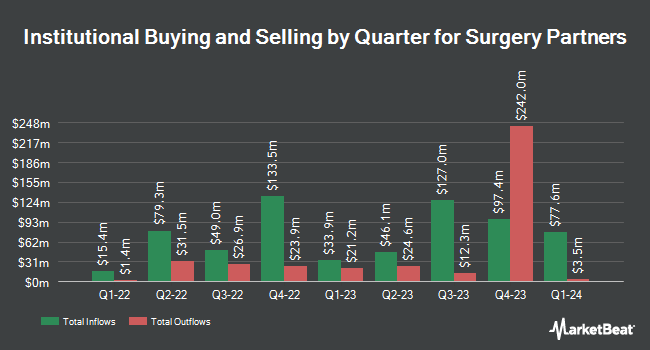

The Manufacturers Life Insurance Company reduced its stake in Surgery Partners, Inc. (NASDAQ:SGRY - Free Report) by 45.6% in the third quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 44,601 shares of the company's stock after selling 37,391 shares during the period. The Manufacturers Life Insurance Company's holdings in Surgery Partners were worth $1,438,000 as of its most recent SEC filing.

Several other large investors have also recently added to or reduced their stakes in SGRY. SG Americas Securities LLC boosted its stake in shares of Surgery Partners by 190.0% during the 2nd quarter. SG Americas Securities LLC now owns 17,276 shares of the company's stock worth $411,000 after acquiring an additional 11,318 shares in the last quarter. Raymond James & Associates increased its stake in Surgery Partners by 6.8% in the 2nd quarter. Raymond James & Associates now owns 68,872 shares of the company's stock valued at $1,638,000 after buying an additional 4,370 shares during the last quarter. MeadowBrook Investment Advisors LLC grew its stake in Surgery Partners by 15.9% in the 2nd quarter. MeadowBrook Investment Advisors LLC now owns 12,320 shares of the company's stock valued at $293,000 after buying an additional 1,690 shares during the last quarter. Tranquility Partners LLC lifted its holdings in shares of Surgery Partners by 7.3% during the second quarter. Tranquility Partners LLC now owns 61,892 shares of the company's stock worth $1,472,000 after buying an additional 4,192 shares in the last quarter. Finally, Bank of New York Mellon Corp boosted its position in shares of Surgery Partners by 12.4% in the second quarter. Bank of New York Mellon Corp now owns 347,485 shares of the company's stock valued at $8,267,000 after acquiring an additional 38,285 shares during the period.

Analyst Ratings Changes

SGRY has been the topic of a number of research reports. Benchmark reaffirmed a "buy" rating and set a $50.00 target price on shares of Surgery Partners in a research report on Monday, August 26th. Macquarie reiterated an "outperform" rating and set a $34.00 price target on shares of Surgery Partners in a research note on Tuesday, November 19th. JPMorgan Chase & Co. dropped their price objective on Surgery Partners from $38.00 to $28.00 and set a "neutral" rating for the company in a research note on Tuesday, December 3rd. Royal Bank of Canada decreased their price target on shares of Surgery Partners from $49.00 to $35.00 and set an "outperform" rating on the stock in a research note on Wednesday, November 20th. Finally, KeyCorp began coverage on Surgery Partners in a research note on Friday, October 11th. They issued a "sector weight" rating on the stock. One research analyst has rated the stock with a sell rating, three have assigned a hold rating and six have given a buy rating to the company's stock. According to MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and a consensus price target of $37.38.

View Our Latest Stock Report on SGRY

Surgery Partners Stock Performance

Shares of NASDAQ SGRY traded down $0.55 during trading on Wednesday, reaching $21.00. The stock had a trading volume of 984,341 shares, compared to its average volume of 981,951. Surgery Partners, Inc. has a one year low of $20.90 and a one year high of $36.92. The stock has a market cap of $2.67 billion, a PE ratio of -43.75, a P/E/G ratio of 18.22 and a beta of 2.58. The company has a debt-to-equity ratio of 0.99, a quick ratio of 1.66 and a current ratio of 1.80. The firm's 50 day moving average price is $27.58 and its two-hundred day moving average price is $28.09.

Surgery Partners (NASDAQ:SGRY - Get Free Report) last released its quarterly earnings results on Tuesday, November 12th. The company reported $0.19 earnings per share for the quarter, missing analysts' consensus estimates of $0.25 by ($0.06). Surgery Partners had a negative net margin of 2.03% and a positive return on equity of 2.85%. The business had revenue of $770.40 million for the quarter, compared to analyst estimates of $768.99 million. During the same period in the prior year, the business earned $0.15 earnings per share. The company's revenue for the quarter was up 14.3% on a year-over-year basis. On average, research analysts forecast that Surgery Partners, Inc. will post 0.73 earnings per share for the current fiscal year.

Surgery Partners Company Profile

(

Free Report)

Surgery Partners, Inc, together with its subsidiaries, owns and operates a network of surgical facilities and ancillary services in the United States. The company provides ambulatory surgery centers and surgical hospitals that offer non-emergency surgical procedures in various specialties, including orthopedics and pain management, ophthalmology, gastroenterology, and general surgery.

Featured Stories

Before you consider Surgery Partners, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Surgery Partners wasn't on the list.

While Surgery Partners currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.