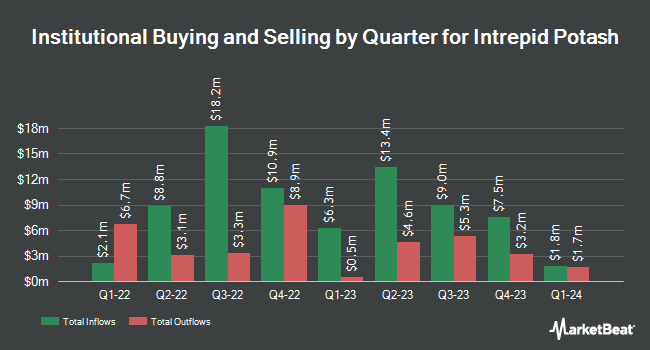

The Manufacturers Life Insurance Company acquired a new position in shares of Intrepid Potash, Inc. (NYSE:IPI - Free Report) during the third quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor acquired 25,098 shares of the basic materials company's stock, valued at approximately $602,000. The Manufacturers Life Insurance Company owned approximately 0.19% of Intrepid Potash as of its most recent filing with the Securities and Exchange Commission.

A number of other institutional investors have also added to or reduced their stakes in the stock. Dimensional Fund Advisors LP increased its stake in Intrepid Potash by 3.8% in the 2nd quarter. Dimensional Fund Advisors LP now owns 737,538 shares of the basic materials company's stock worth $17,281,000 after acquiring an additional 26,696 shares during the last quarter. First Eagle Investment Management LLC increased its stake in Intrepid Potash by 25.1% in the 2nd quarter. First Eagle Investment Management LLC now owns 602,770 shares of the basic materials company's stock worth $14,123,000 after acquiring an additional 121,100 shares during the last quarter. Goehring & Rozencwajg Associates LLC increased its stake in Intrepid Potash by 11.0% in the 2nd quarter. Goehring & Rozencwajg Associates LLC now owns 193,824 shares of the basic materials company's stock worth $4,541,000 after acquiring an additional 19,200 shares during the last quarter. American Century Companies Inc. increased its stake in Intrepid Potash by 8.8% in the 2nd quarter. American Century Companies Inc. now owns 184,337 shares of the basic materials company's stock worth $4,319,000 after acquiring an additional 14,968 shares during the last quarter. Finally, Pinnacle Associates Ltd. bought a new position in Intrepid Potash in the 3rd quarter worth about $3,100,000. Hedge funds and other institutional investors own 56.13% of the company's stock.

Intrepid Potash Stock Up 0.5 %

Shares of Intrepid Potash stock traded up $0.12 during trading on Friday, hitting $25.16. 93,071 shares of the stock traded hands, compared to its average volume of 93,110. The stock has a market cap of $331.18 million, a price-to-earnings ratio of -7.51 and a beta of 2.21. The firm's fifty day moving average is $25.94 and its 200-day moving average is $24.66. Intrepid Potash, Inc. has a 52 week low of $17.52 and a 52 week high of $29.75.

Intrepid Potash (NYSE:IPI - Get Free Report) last announced its quarterly earnings data on Monday, November 4th. The basic materials company reported ($0.14) EPS for the quarter, missing the consensus estimate of $0.11 by ($0.25). The firm had revenue of $57.55 million for the quarter, compared to the consensus estimate of $42.57 million. Intrepid Potash had a negative net margin of 16.86% and a negative return on equity of 1.32%. During the same quarter last year, the company posted ($0.53) earnings per share. On average, analysts forecast that Intrepid Potash, Inc. will post -0.17 earnings per share for the current fiscal year.

Wall Street Analyst Weigh In

A number of equities analysts have weighed in on IPI shares. UBS Group upped their target price on Intrepid Potash from $18.00 to $19.00 and gave the stock a "sell" rating in a research note on Tuesday, November 5th. StockNews.com upgraded Intrepid Potash from a "sell" rating to a "hold" rating in a research note on Wednesday, November 6th.

Check Out Our Latest Stock Report on IPI

About Intrepid Potash

(

Free Report)

Intrepid Potash, Inc, together with its subsidiaries, engages in the extraction and production of the potash in the United States and internationally. It operates through three segments: Potash, Trio, and Oilfield Solutions. The company offers muriate of potash for various markets, such as agricultural market as a fertilizer input; the industrial market as a component in drilling and fracturing fluids for oil and gas wells, as well as an input to other industrial processes; and the animal feed market as a nutrient supplement.

Featured Articles

Before you consider Intrepid Potash, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Intrepid Potash wasn't on the list.

While Intrepid Potash currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.