The Manufacturers Life Insurance Company cut its holdings in BorgWarner Inc. (NYSE:BWA - Free Report) by 7.7% in the third quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 184,935 shares of the auto parts company's stock after selling 15,511 shares during the period. The Manufacturers Life Insurance Company owned approximately 0.08% of BorgWarner worth $6,711,000 at the end of the most recent reporting period.

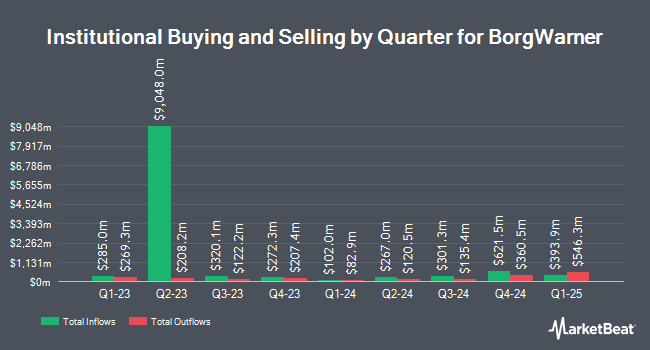

Other large investors have also recently bought and sold shares of the company. B. Riley Wealth Advisors Inc. bought a new stake in BorgWarner during the first quarter valued at about $208,000. Comerica Bank boosted its holdings in BorgWarner by 25.0% during the first quarter. Comerica Bank now owns 87,911 shares of the auto parts company's stock valued at $3,054,000 after acquiring an additional 17,596 shares during the period. GAMMA Investing LLC boosted its holdings in BorgWarner by 76.6% during the second quarter. GAMMA Investing LLC now owns 2,806 shares of the auto parts company's stock valued at $90,000 after acquiring an additional 1,217 shares during the period. CWM LLC boosted its holdings in BorgWarner by 51.3% during the second quarter. CWM LLC now owns 12,110 shares of the auto parts company's stock valued at $390,000 after acquiring an additional 4,104 shares during the period. Finally, CX Institutional boosted its holdings in BorgWarner by 18.1% during the second quarter. CX Institutional now owns 9,551 shares of the auto parts company's stock valued at $308,000 after acquiring an additional 1,465 shares during the period. 95.67% of the stock is currently owned by institutional investors.

Insiders Place Their Bets

In other news, CEO Frederic Lissalde sold 154,000 shares of the stock in a transaction that occurred on Monday, November 11th. The shares were sold at an average price of $34.61, for a total transaction of $5,329,940.00. Following the sale, the chief executive officer now directly owns 259,957 shares of the company's stock, valued at $8,997,111.77. This represents a 37.20 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. Also, VP Isabelle Mckenzie sold 5,700 shares of the stock in a transaction that occurred on Monday, November 11th. The shares were sold at an average price of $34.62, for a total transaction of $197,334.00. Following the sale, the vice president now directly owns 37,640 shares in the company, valued at $1,303,096.80. This trade represents a 13.15 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last ninety days, insiders have sold 222,010 shares of company stock valued at $7,678,076. 0.45% of the stock is currently owned by insiders.

Analyst Ratings Changes

A number of equities research analysts have issued reports on the stock. Evercore ISI upgraded shares of BorgWarner from an "in-line" rating to an "outperform" rating and upped their price target for the company from $39.00 to $43.00 in a report on Monday, October 14th. Deutsche Bank Aktiengesellschaft upped their price objective on shares of BorgWarner from $38.00 to $39.00 and gave the company a "hold" rating in a research report on Monday, November 4th. JPMorgan Chase & Co. cut their price objective on shares of BorgWarner from $51.00 to $50.00 and set an "overweight" rating for the company in a research report on Monday, October 21st. Wolfe Research assumed coverage on shares of BorgWarner in a research report on Thursday, September 5th. They set a "peer perform" rating for the company. Finally, The Goldman Sachs Group cut their price objective on shares of BorgWarner from $38.00 to $36.00 and set a "neutral" rating for the company in a research report on Tuesday, October 1st. Six research analysts have rated the stock with a hold rating and ten have given a buy rating to the company's stock. According to MarketBeat.com, the stock has an average rating of "Moderate Buy" and an average target price of $41.21.

Get Our Latest Stock Analysis on BorgWarner

BorgWarner Price Performance

NYSE:BWA traded down $0.81 during mid-day trading on Thursday, hitting $33.99. The company's stock had a trading volume of 2,241,021 shares, compared to its average volume of 2,647,379. The company has a current ratio of 1.84, a quick ratio of 1.48 and a debt-to-equity ratio of 0.66. The company has a market capitalization of $7.43 billion, a price-to-earnings ratio of 8.83, a P/E/G ratio of 0.75 and a beta of 1.19. BorgWarner Inc. has a fifty-two week low of $29.51 and a fifty-two week high of $38.22. The stock has a fifty day moving average of $34.55 and a 200-day moving average of $33.73.

BorgWarner (NYSE:BWA - Get Free Report) last issued its quarterly earnings data on Thursday, October 31st. The auto parts company reported $1.09 earnings per share for the quarter, topping the consensus estimate of $0.92 by $0.17. The firm had revenue of $3.45 billion for the quarter, compared to analysts' expectations of $3.50 billion. BorgWarner had a net margin of 6.33% and a return on equity of 15.51%. The company's quarterly revenue was down 4.8% compared to the same quarter last year. During the same period in the prior year, the firm earned $0.98 earnings per share. As a group, equities analysts forecast that BorgWarner Inc. will post 4.22 EPS for the current fiscal year.

BorgWarner Dividend Announcement

The company also recently disclosed a quarterly dividend, which will be paid on Monday, December 16th. Shareholders of record on Monday, December 2nd will be paid a dividend of $0.11 per share. The ex-dividend date is Monday, December 2nd. This represents a $0.44 annualized dividend and a yield of 1.29%. BorgWarner's dividend payout ratio is 11.17%.

About BorgWarner

(

Free Report)

BorgWarner Inc, together with its subsidiaries, provides solutions for combustion, hybrid, and electric vehicles worldwide. It offers turbochargers, eBoosters, eTurbos, timing systems, emissions systems, thermal systems, gasoline ignition technology, smart remote actuators, powertrain sensors, cabin heaters, battery modules and systems, battery heaters, and battery charging.

Featured Articles

Before you consider BorgWarner, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BorgWarner wasn't on the list.

While BorgWarner currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.