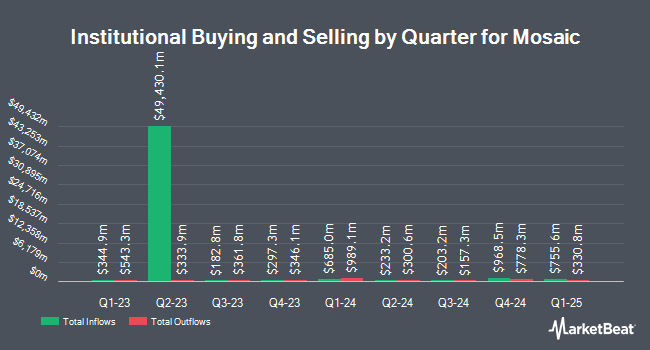

Geode Capital Management LLC lifted its stake in The Mosaic Company (NYSE:MOS - Free Report) by 3.2% in the fourth quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The firm owned 8,621,001 shares of the basic materials company's stock after purchasing an additional 269,650 shares during the period. Geode Capital Management LLC owned about 2.71% of Mosaic worth $218,751,000 at the end of the most recent quarter.

Several other institutional investors and hedge funds have also recently bought and sold shares of MOS. Brooklyn Investment Group boosted its stake in shares of Mosaic by 110.8% in the 4th quarter. Brooklyn Investment Group now owns 1,117 shares of the basic materials company's stock valued at $27,000 after buying an additional 587 shares during the period. R Squared Ltd acquired a new position in Mosaic during the 4th quarter worth approximately $33,000. Tobam purchased a new stake in shares of Mosaic in the 4th quarter valued at approximately $38,000. Heck Capital Advisors LLC acquired a new stake in shares of Mosaic in the 4th quarter valued at $41,000. Finally, Ethos Financial Group LLC acquired a new position in shares of Mosaic during the fourth quarter worth $55,000. 77.54% of the stock is owned by institutional investors and hedge funds.

Analysts Set New Price Targets

MOS has been the subject of several analyst reports. Royal Bank of Canada upped their price objective on Mosaic from $28.00 to $30.00 and gave the stock a "sector perform" rating in a research report on Friday, April 4th. Piper Sandler reissued a "neutral" rating and issued a $30.00 target price on shares of Mosaic in a research report on Thursday, March 27th. JPMorgan Chase & Co. upgraded Mosaic from a "neutral" rating to an "overweight" rating and boosted their price target for the company from $26.00 to $29.00 in a research report on Monday, March 3rd. The Goldman Sachs Group began coverage on Mosaic in a research report on Thursday, March 13th. They set a "buy" rating and a $31.00 price objective for the company. Finally, Scotiabank upped their price target on Mosaic from $31.00 to $34.00 and gave the stock a "sector outperform" rating in a research note on Wednesday, March 19th. Seven investment analysts have rated the stock with a hold rating and five have given a buy rating to the stock. Based on data from MarketBeat, Mosaic presently has an average rating of "Hold" and a consensus target price of $32.58.

Get Our Latest Research Report on MOS

Mosaic Stock Down 2.7 %

Shares of MOS traded down $0.68 during midday trading on Thursday, reaching $24.00. 1,629,789 shares of the company were exchanged, compared to its average volume of 5,842,670. The company has a current ratio of 1.19, a quick ratio of 0.49 and a debt-to-equity ratio of 0.27. The Mosaic Company has a 1-year low of $22.36 and a 1-year high of $32.66. The company has a market cap of $7.61 billion, a price-to-earnings ratio of 21.32, a P/E/G ratio of 1.42 and a beta of 1.04. The stock has a 50-day moving average price of $25.93 and a 200-day moving average price of $26.15.

Mosaic Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Thursday, June 19th. Shareholders of record on Thursday, June 5th will be given a $0.22 dividend. This represents a $0.88 annualized dividend and a yield of 3.67%. The ex-dividend date of this dividend is Thursday, June 5th. Mosaic's dividend payout ratio (DPR) is 160.00%.

About Mosaic

(

Free Report)

The Mosaic Company, through its subsidiaries, produces and markets concentrated phosphate and potash crop nutrients in North America and internationally. The company operates through three segments: Phosphates, Potash, and Mosaic Fertilizantes. It owns and operates mines, which produce concentrated phosphate crop nutrients, such as diammonium phosphate, monoammonium phosphate, and ammoniated phosphate products; and phosphate-based animal feed ingredients primarily under the Biofos and Nexfos brand names, as well as produces a double sulfate of potash magnesia product under K-Mag brand name.

Read More

Before you consider Mosaic, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mosaic wasn't on the list.

While Mosaic currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.