Wells Fargo & Company initiated coverage on shares of The Pennant Group (NASDAQ:PNTG - Free Report) in a report issued on Thursday morning, Marketbeat.com reports. The brokerage issued an equal weight rating and a $33.00 target price on the stock.

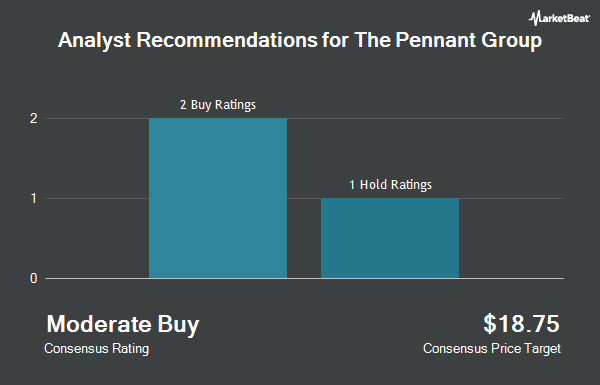

Several other brokerages have also commented on PNTG. Oppenheimer lifted their price objective on The Pennant Group from $34.00 to $37.00 and gave the stock an "outperform" rating in a report on Friday, November 8th. Stephens reaffirmed an "overweight" rating and set a $40.00 price target on shares of The Pennant Group in a research report on Wednesday, October 9th. Truist Financial raised their price objective on shares of The Pennant Group from $34.00 to $38.00 and gave the stock a "hold" rating in a report on Monday, October 7th. Finally, Royal Bank of Canada upped their target price on shares of The Pennant Group from $26.00 to $38.00 and gave the company an "outperform" rating in a report on Wednesday, October 23rd. Two research analysts have rated the stock with a hold rating and three have issued a buy rating to the company's stock. Based on data from MarketBeat.com, The Pennant Group currently has an average rating of "Moderate Buy" and a consensus price target of $37.20.

Get Our Latest Stock Analysis on PNTG

The Pennant Group Stock Performance

The Pennant Group stock traded down $0.85 during midday trading on Thursday, reaching $27.30. 366,800 shares of the company traded hands, compared to its average volume of 200,958. The company has a debt-to-equity ratio of 0.58, a current ratio of 1.12 and a quick ratio of 1.12. The Pennant Group has a 12 month low of $13.64 and a 12 month high of $37.13. The firm has a market capitalization of $937.70 million, a price-to-earnings ratio of 40.15, a price-to-earnings-growth ratio of 2.99 and a beta of 1.95. The business has a 50 day moving average of $32.04 and a two-hundred day moving average of $30.19.

Institutional Investors Weigh In On The Pennant Group

Institutional investors and hedge funds have recently added to or reduced their stakes in the company. Quarry LP grew its position in shares of The Pennant Group by 371.6% during the third quarter. Quarry LP now owns 1,014 shares of the company's stock worth $36,000 after purchasing an additional 799 shares in the last quarter. Point72 Asia Singapore Pte. Ltd. increased its holdings in shares of The Pennant Group by 460.2% in the third quarter. Point72 Asia Singapore Pte. Ltd. now owns 3,311 shares of the company's stock worth $118,000 after purchasing an additional 2,720 shares during the last quarter. USA Financial Formulas purchased a new stake in The Pennant Group during the 3rd quarter valued at $121,000. Intech Investment Management LLC bought a new position in The Pennant Group during the third quarter valued at $232,000. Finally, Bailard Inc. bought a new stake in shares of The Pennant Group in the 2nd quarter worth about $253,000. Institutional investors own 85.88% of the company's stock.

The Pennant Group Company Profile

(

Get Free Report)

The Pennant Group, Inc provides healthcare services in the United States. It operates in two segments, Home Health and Hospice Services, and Senior Living Services. The company offers home health services, including clinical services, such as nursing, speech, occupational and physical therapy, medical social work, and home health aide services; and hospice services comprising clinical care, education, and counseling services for the physical, spiritual, and psychosocial needs of terminally ill patients and their families.

Further Reading

Before you consider The Pennant Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and The Pennant Group wasn't on the list.

While The Pennant Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.