Lountzis Asset Management LLC reduced its position in shares of The Progressive Co. (NYSE:PGR - Free Report) by 1.7% during the fourth quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 78,855 shares of the insurance provider's stock after selling 1,337 shares during the period. Progressive accounts for about 8.0% of Lountzis Asset Management LLC's holdings, making the stock its 2nd biggest position. Lountzis Asset Management LLC's holdings in Progressive were worth $18,894,000 at the end of the most recent reporting period.

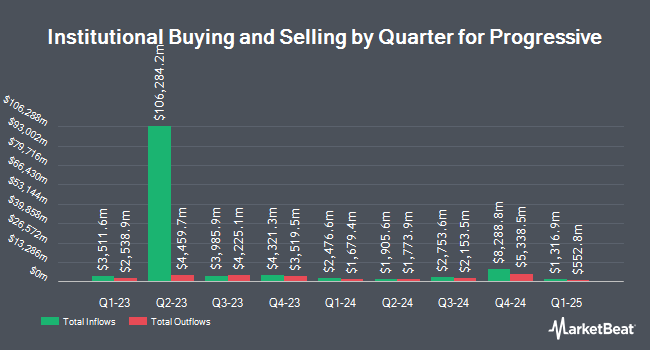

Several other hedge funds and other institutional investors have also added to or reduced their stakes in PGR. State Street Corp increased its stake in Progressive by 1.3% in the 3rd quarter. State Street Corp now owns 24,683,807 shares of the insurance provider's stock valued at $6,263,763,000 after buying an additional 315,411 shares during the last quarter. Geode Capital Management LLC increased its position in shares of Progressive by 13.2% during the third quarter. Geode Capital Management LLC now owns 14,425,792 shares of the insurance provider's stock valued at $3,652,235,000 after acquiring an additional 1,682,213 shares during the last quarter. FMR LLC increased its position in shares of Progressive by 1.6% during the third quarter. FMR LLC now owns 10,518,615 shares of the insurance provider's stock valued at $2,669,204,000 after acquiring an additional 170,618 shares during the last quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC lifted its holdings in Progressive by 7.0% during the third quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 5,067,924 shares of the insurance provider's stock worth $1,286,036,000 after acquiring an additional 330,667 shares during the period. Finally, Jennison Associates LLC boosted its position in Progressive by 21.6% in the third quarter. Jennison Associates LLC now owns 4,749,628 shares of the insurance provider's stock worth $1,205,266,000 after purchasing an additional 842,109 shares during the last quarter. 85.34% of the stock is currently owned by hedge funds and other institutional investors.

Wall Street Analyst Weigh In

Several brokerages have recently issued reports on PGR. Barclays raised their target price on Progressive from $261.00 to $264.00 and gave the company an "equal weight" rating in a research report on Tuesday. Morgan Stanley lifted their price objective on shares of Progressive from $300.00 to $307.00 and gave the stock an "overweight" rating in a research report on Friday, January 31st. Evercore ISI increased their target price on shares of Progressive from $277.00 to $285.00 and gave the company an "outperform" rating in a research report on Wednesday, November 6th. Bank of America raised their price target on shares of Progressive from $331.00 to $335.00 and gave the stock a "buy" rating in a research note on Monday, November 18th. Finally, Wells Fargo & Company upped their price objective on Progressive from $313.00 to $317.00 and gave the company an "overweight" rating in a research note on Thursday. Six research analysts have rated the stock with a hold rating and thirteen have issued a buy rating to the company's stock. Based on data from MarketBeat, the stock presently has an average rating of "Moderate Buy" and an average target price of $276.12.

View Our Latest Research Report on PGR

Insider Activity at Progressive

In other news, CFO John P. Sauerland sold 10,000 shares of the company's stock in a transaction dated Friday, November 29th. The stock was sold at an average price of $268.09, for a total value of $2,680,900.00. Following the completion of the transaction, the chief financial officer now directly owns 292,958 shares in the company, valued at approximately $78,539,110.22. This represents a 3.30 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. Also, CEO Susan Patricia Griffith sold 11,021 shares of the business's stock in a transaction dated Wednesday, January 22nd. The shares were sold at an average price of $243.29, for a total value of $2,681,299.09. Following the completion of the sale, the chief executive officer now directly owns 473,736 shares of the company's stock, valued at approximately $115,255,231.44. This trade represents a 2.27 % decrease in their position. The disclosure for this sale can be found here. Over the last quarter, insiders sold 56,361 shares of company stock valued at $13,983,575. Company insiders own 0.34% of the company's stock.

Progressive Price Performance

Shares of PGR traded down $1.68 during midday trading on Friday, hitting $265.99. 2,567,348 shares of the company traded hands, compared to its average volume of 2,505,890. The Progressive Co. has a one year low of $186.94 and a one year high of $270.79. The firm has a market cap of $155.82 billion, a P/E ratio of 18.47, a PEG ratio of 0.68 and a beta of 0.42. The company has a debt-to-equity ratio of 0.27, a current ratio of 0.31 and a quick ratio of 0.30. The stock has a 50-day moving average of $246.61 and a 200-day moving average of $248.49.

Progressive (NYSE:PGR - Get Free Report) last issued its quarterly earnings data on Wednesday, January 29th. The insurance provider reported $4.08 EPS for the quarter, beating the consensus estimate of $3.44 by $0.64. Progressive had a net margin of 11.25% and a return on equity of 33.79%. As a group, sell-side analysts predict that The Progressive Co. will post 14.5 EPS for the current fiscal year.

Progressive Announces Dividend

The firm also recently disclosed a quarterly dividend, which was paid on Thursday, January 16th. Investors of record on Thursday, January 9th were given a $0.10 dividend. The ex-dividend date of this dividend was Friday, January 10th. This represents a $0.40 dividend on an annualized basis and a dividend yield of 0.15%. Progressive's dividend payout ratio (DPR) is presently 2.78%.

About Progressive

(

Free Report)

The Progressive Corporation, an insurance holding company, provides personal and commercial auto, personal residential and commercial property, business related general liability, and other specialty property-casualty insurance products and related services in the United States. It operates in three segments: Personal Lines, Commercial Lines, and Property.

Recommended Stories

Before you consider Progressive, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Progressive wasn't on the list.

While Progressive currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report