Kinsale Capital Group Inc. grew its stake in shares of The Progressive Co. (NYSE:PGR - Free Report) by 11.7% during the 3rd quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The institutional investor owned 34,611 shares of the insurance provider's stock after acquiring an additional 3,615 shares during the period. Progressive accounts for 2.6% of Kinsale Capital Group Inc.'s investment portfolio, making the stock its 4th biggest holding. Kinsale Capital Group Inc.'s holdings in Progressive were worth $8,783,000 as of its most recent filing with the Securities & Exchange Commission.

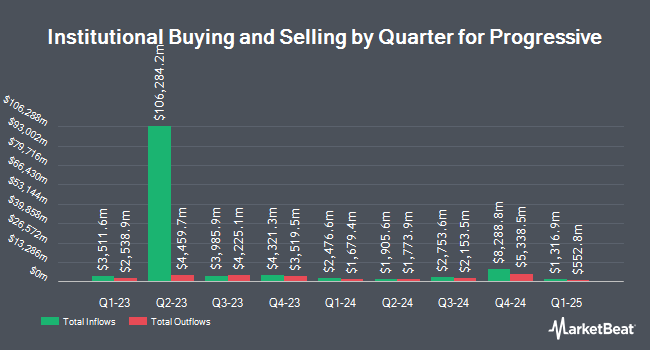

A number of other hedge funds have also modified their holdings of PGR. Capital International Investors increased its position in Progressive by 15.7% in the 1st quarter. Capital International Investors now owns 4,925,019 shares of the insurance provider's stock worth $1,018,592,000 after purchasing an additional 670,006 shares during the last quarter. Legal & General Group Plc increased its stake in shares of Progressive by 1.9% during the 2nd quarter. Legal & General Group Plc now owns 4,922,743 shares of the insurance provider's stock worth $1,022,507,000 after purchasing an additional 92,212 shares during the last quarter. American Century Companies Inc. raised its holdings in shares of Progressive by 3.0% during the 2nd quarter. American Century Companies Inc. now owns 2,392,773 shares of the insurance provider's stock valued at $497,003,000 after purchasing an additional 69,709 shares in the last quarter. 1832 Asset Management L.P. lifted its stake in shares of Progressive by 13.5% in the 1st quarter. 1832 Asset Management L.P. now owns 1,685,868 shares of the insurance provider's stock valued at $348,671,000 after purchasing an additional 200,118 shares during the last quarter. Finally, Dimensional Fund Advisors LP boosted its holdings in Progressive by 20.3% in the second quarter. Dimensional Fund Advisors LP now owns 1,467,191 shares of the insurance provider's stock worth $304,775,000 after purchasing an additional 247,144 shares in the last quarter. 85.34% of the stock is owned by institutional investors and hedge funds.

Insider Buying and Selling at Progressive

In other Progressive news, insider Patrick K. Callahan sold 7,696 shares of the business's stock in a transaction on Friday, September 20th. The stock was sold at an average price of $255.21, for a total value of $1,964,096.16. Following the transaction, the insider now owns 15,189 shares of the company's stock, valued at approximately $3,876,384.69. The trade was a 33.63 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, CEO Susan Patricia Griffith sold 43,370 shares of the firm's stock in a transaction on Tuesday, September 3rd. The shares were sold at an average price of $252.20, for a total value of $10,937,914.00. Following the completion of the sale, the chief executive officer now owns 473,735 shares of the company's stock, valued at approximately $119,475,967. This trade represents a 8.39 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last ninety days, insiders have sold 65,331 shares of company stock valued at $16,415,812. 0.34% of the stock is currently owned by corporate insiders.

Wall Street Analyst Weigh In

A number of brokerages have weighed in on PGR. The Goldman Sachs Group boosted their price target on Progressive from $262.00 to $280.00 and gave the stock a "buy" rating in a research report on Wednesday, September 18th. Evercore ISI upped their target price on Progressive from $277.00 to $285.00 and gave the stock an "outperform" rating in a research report on Wednesday, November 6th. Jefferies Financial Group increased their price target on Progressive from $257.00 to $295.00 and gave the company a "buy" rating in a report on Wednesday, October 9th. StockNews.com cut shares of Progressive from a "buy" rating to a "hold" rating in a research note on Monday, November 11th. Finally, TD Cowen raised their target price on shares of Progressive from $197.00 to $237.00 and gave the company a "hold" rating in a research note on Friday, November 8th. Seven investment analysts have rated the stock with a hold rating, twelve have issued a buy rating and one has issued a strong buy rating to the company's stock. According to data from MarketBeat.com, Progressive currently has a consensus rating of "Moderate Buy" and an average target price of $269.56.

Check Out Our Latest Report on Progressive

Progressive Stock Performance

PGR traded down $1.72 on Friday, hitting $255.78. 3,259,995 shares of the stock traded hands, compared to its average volume of 2,463,986. The business has a fifty day moving average price of $252.22 and a two-hundred day moving average price of $229.82. The company has a current ratio of 0.30, a quick ratio of 0.30 and a debt-to-equity ratio of 0.25. The firm has a market capitalization of $149.84 billion, a PE ratio of 18.59, a P/E/G ratio of 0.73 and a beta of 0.36. The Progressive Co. has a 52 week low of $149.14 and a 52 week high of $263.85.

Progressive (NYSE:PGR - Get Free Report) last released its quarterly earnings data on Tuesday, October 15th. The insurance provider reported $3.58 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $3.40 by $0.18. The business had revenue of $19.43 billion for the quarter, compared to analysts' expectations of $18.95 billion. Progressive had a return on equity of 33.10% and a net margin of 11.27%. On average, research analysts predict that The Progressive Co. will post 13.11 EPS for the current fiscal year.

Progressive Profile

(

Free Report)

The Progressive Corporation, an insurance holding company, provides personal and commercial auto, personal residential and commercial property, business related general liability, and other specialty property-casualty insurance products and related services in the United States. It operates in three segments: Personal Lines, Commercial Lines, and Property.

Featured Stories

Before you consider Progressive, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Progressive wasn't on the list.

While Progressive currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.