Primecap Management Co. CA reduced its holdings in shares of The Progressive Co. (NYSE:PGR - Free Report) by 0.8% during the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 1,421,080 shares of the insurance provider's stock after selling 11,200 shares during the period. Primecap Management Co. CA owned approximately 0.24% of Progressive worth $360,613,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

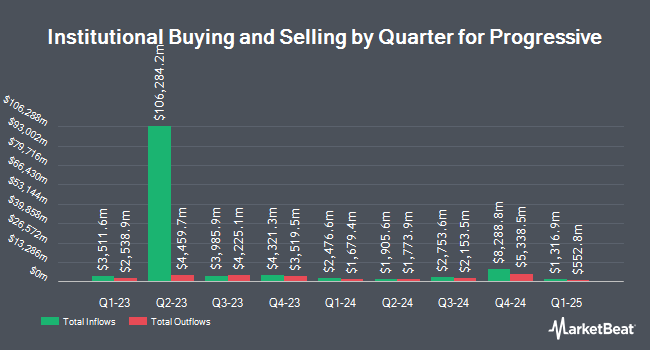

Other hedge funds also recently added to or reduced their stakes in the company. Diversified Trust Co increased its position in Progressive by 84.3% during the 3rd quarter. Diversified Trust Co now owns 25,738 shares of the insurance provider's stock valued at $6,531,000 after buying an additional 11,770 shares in the last quarter. Sycomore Asset Management grew its stake in Progressive by 9.5% during the 2nd quarter. Sycomore Asset Management now owns 28,128 shares of the insurance provider's stock valued at $5,856,000 after purchasing an additional 2,450 shares during the last quarter. Sumitomo Life Insurance Co. purchased a new stake in Progressive during the 2nd quarter valued at about $981,000. Tidal Investments LLC grew its stake in Progressive by 22.2% during the 1st quarter. Tidal Investments LLC now owns 31,330 shares of the insurance provider's stock valued at $6,480,000 after purchasing an additional 5,691 shares during the last quarter. Finally, Advisors Asset Management Inc. grew its stake in Progressive by 88.7% during the 1st quarter. Advisors Asset Management Inc. now owns 7,626 shares of the insurance provider's stock valued at $1,577,000 after purchasing an additional 3,585 shares during the last quarter. 85.34% of the stock is owned by institutional investors and hedge funds.

Insiders Place Their Bets

In other news, CEO Susan Patricia Griffith sold 43,370 shares of the firm's stock in a transaction on Tuesday, September 3rd. The stock was sold at an average price of $252.20, for a total transaction of $10,937,914.00. Following the completion of the transaction, the chief executive officer now directly owns 473,735 shares in the company, valued at $119,475,967. This trade represents a 8.39 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is available at the SEC website. Also, insider Steven Broz sold 2,981 shares of the firm's stock in a transaction on Monday, October 21st. The stock was sold at an average price of $251.15, for a total value of $748,678.15. Following the transaction, the insider now owns 26,353 shares of the company's stock, valued at approximately $6,618,555.95. This represents a 10.16 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 59,209 shares of company stock valued at $14,975,979 over the last quarter. 0.34% of the stock is owned by insiders.

Wall Street Analyst Weigh In

Several research firms have weighed in on PGR. Evercore ISI boosted their price target on Progressive from $277.00 to $285.00 and gave the company an "outperform" rating in a research note on Wednesday, November 6th. Piper Sandler upped their target price on Progressive from $250.00 to $252.00 and gave the stock an "overweight" rating in a research note on Thursday, August 15th. HSBC upgraded Progressive from a "hold" rating to a "buy" rating and set a $253.00 target price on the stock in a research note on Monday, August 12th. TD Cowen upped their target price on Progressive from $197.00 to $237.00 and gave the stock a "hold" rating in a research note on Friday, November 8th. Finally, StockNews.com upgraded Progressive from a "hold" rating to a "buy" rating in a research note on Tuesday. Five research analysts have rated the stock with a hold rating, thirteen have given a buy rating and one has assigned a strong buy rating to the company. According to MarketBeat.com, Progressive presently has an average rating of "Moderate Buy" and a consensus target price of $269.81.

View Our Latest Research Report on PGR

Progressive Price Performance

NYSE:PGR opened at $256.99 on Thursday. The Progressive Co. has a one year low of $149.14 and a one year high of $263.85. The company has a debt-to-equity ratio of 0.25, a quick ratio of 0.30 and a current ratio of 0.30. The stock has a market cap of $150.54 billion, a PE ratio of 18.68, a P/E/G ratio of 0.71 and a beta of 0.36. The stock has a 50 day moving average price of $252.58 and a 200 day moving average price of $230.94.

Progressive (NYSE:PGR - Get Free Report) last posted its quarterly earnings results on Tuesday, October 15th. The insurance provider reported $3.58 EPS for the quarter, beating the consensus estimate of $3.40 by $0.18. The firm had revenue of $19.43 billion during the quarter, compared to analysts' expectations of $18.95 billion. Progressive had a return on equity of 33.10% and a net margin of 11.27%. Equities research analysts expect that The Progressive Co. will post 13.09 EPS for the current fiscal year.

About Progressive

(

Free Report)

The Progressive Corporation, an insurance holding company, provides personal and commercial auto, personal residential and commercial property, business related general liability, and other specialty property-casualty insurance products and related services in the United States. It operates in three segments: Personal Lines, Commercial Lines, and Property.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Progressive, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Progressive wasn't on the list.

While Progressive currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.