Arrowstreet Capital Limited Partnership lowered its position in The RMR Group Inc. (NASDAQ:RMR - Free Report) by 64.5% during the 4th quarter, according to the company in its most recent Form 13F filing with the SEC. The firm owned 65,796 shares of the financial services provider's stock after selling 119,723 shares during the quarter. Arrowstreet Capital Limited Partnership owned about 0.21% of The RMR Group worth $1,358,000 at the end of the most recent quarter.

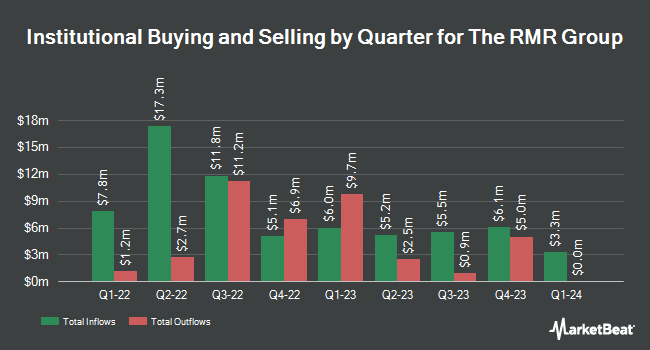

A number of other institutional investors and hedge funds also recently made changes to their positions in RMR. Franklin Resources Inc. grew its position in The RMR Group by 12.9% in the third quarter. Franklin Resources Inc. now owns 24,838 shares of the financial services provider's stock worth $625,000 after acquiring an additional 2,831 shares in the last quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC boosted its holdings in shares of The RMR Group by 13.7% in the 3rd quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 36,496 shares of the financial services provider's stock worth $926,000 after purchasing an additional 4,390 shares in the last quarter. JPMorgan Chase & Co. increased its position in shares of The RMR Group by 36.6% during the 3rd quarter. JPMorgan Chase & Co. now owns 112,982 shares of the financial services provider's stock valued at $2,867,000 after purchasing an additional 30,258 shares during the last quarter. Proficio Capital Partners LLC purchased a new position in shares of The RMR Group during the 4th quarter valued at about $319,000. Finally, Barclays PLC lifted its position in The RMR Group by 55.6% in the 3rd quarter. Barclays PLC now owns 50,674 shares of the financial services provider's stock worth $1,286,000 after buying an additional 18,100 shares during the last quarter. Hedge funds and other institutional investors own 42.31% of the company's stock.

The RMR Group Trading Up 0.7 %

Shares of NASDAQ:RMR traded up $0.10 on Thursday, reaching $15.12. 36,757 shares of the company traded hands, compared to its average volume of 110,799. The stock has a market capitalization of $481.51 million, a P/E ratio of 11.41 and a beta of 1.08. The business's 50-day simple moving average is $17.13 and its 200 day simple moving average is $20.33. The company has a current ratio of 0.89, a quick ratio of 0.89 and a debt-to-equity ratio of 0.10. The RMR Group Inc. has a 52 week low of $14.52 and a 52 week high of $26.43.

The RMR Group Announces Dividend

The business also recently declared a quarterly dividend, which will be paid on Thursday, May 15th. Investors of record on Tuesday, April 22nd will be given a dividend of $0.45 per share. The ex-dividend date of this dividend is Tuesday, April 22nd. This represents a $1.80 annualized dividend and a yield of 11.90%. The RMR Group's payout ratio is 135.34%.

Wall Street Analysts Forecast Growth

Separately, StockNews.com raised shares of The RMR Group from a "hold" rating to a "buy" rating in a research note on Tuesday, March 25th.

Read Our Latest Stock Report on The RMR Group

The RMR Group Profile

(

Free Report)

The RMR Group Inc, through its subsidiary, The RMR Group LLC, provides asset management services in the United States. The company offers management services to its four publicly traded real estate investment trusts, three real estate operating companies, and private capital vehicles. It also provides advisory services to publicly traded mortgage real estate investment trust.

See Also

Before you consider The RMR Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and The RMR Group wasn't on the list.

While The RMR Group currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.