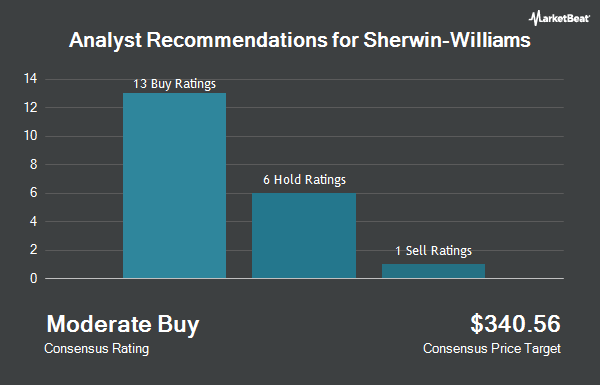

Shares of The Sherwin-Williams Company (NYSE:SHW - Get Free Report) have been given an average rating of "Moderate Buy" by the eighteen analysts that are currently covering the company, MarketBeat reports. Five investment analysts have rated the stock with a hold rating, eleven have given a buy rating and two have issued a strong buy rating on the company. The average twelve-month price objective among analysts that have issued a report on the stock in the last year is $391.25.

SHW has been the subject of several recent research reports. Barclays cut their price objective on Sherwin-Williams from $385.00 to $355.00 and set an "equal weight" rating for the company in a report on Tuesday, April 1st. Royal Bank of Canada lowered their price target on Sherwin-Williams from $438.00 to $415.00 and set an "outperform" rating for the company in a research note on Monday, February 3rd. Robert W. Baird set a $370.00 target price on shares of Sherwin-Williams in a research note on Friday, January 31st. Morgan Stanley cut their price target on shares of Sherwin-Williams from $405.00 to $385.00 and set an "overweight" rating on the stock in a report on Tuesday. Finally, Citigroup decreased their price objective on shares of Sherwin-Williams from $423.00 to $375.00 and set a "buy" rating for the company in a report on Tuesday, April 8th.

View Our Latest Research Report on SHW

Sherwin-Williams Trading Up 0.1 %

Shares of Sherwin-Williams stock traded up $0.40 during trading on Friday, hitting $332.36. The stock had a trading volume of 908,899 shares, compared to its average volume of 1,781,926. Sherwin-Williams has a 1 year low of $282.09 and a 1 year high of $400.42. The stock has a 50 day simple moving average of $343.54 and a 200 day simple moving average of $358.14. The company has a quick ratio of 0.46, a current ratio of 0.79 and a debt-to-equity ratio of 2.02. The company has a market capitalization of $83.59 billion, a PE ratio of 31.37, a P/E/G ratio of 2.98 and a beta of 1.26.

Sherwin-Williams (NYSE:SHW - Get Free Report) last issued its earnings results on Thursday, January 30th. The specialty chemicals company reported $2.09 earnings per share for the quarter, beating analysts' consensus estimates of $2.07 by $0.02. Sherwin-Williams had a return on equity of 74.50% and a net margin of 11.61%. During the same period in the prior year, the business posted $1.81 EPS. On average, research analysts expect that Sherwin-Williams will post 12 EPS for the current fiscal year.

Sherwin-Williams Dividend Announcement

The business also recently announced a quarterly dividend, which will be paid on Friday, June 6th. Investors of record on Friday, May 16th will be paid a dividend of $0.79 per share. This represents a $3.16 annualized dividend and a yield of 0.95%. The ex-dividend date is Friday, May 16th. Sherwin-Williams's payout ratio is currently 29.95%.

Insiders Place Their Bets

In other news, insider Colin M. Davie sold 2,799 shares of the business's stock in a transaction that occurred on Thursday, February 27th. The stock was sold at an average price of $360.30, for a total transaction of $1,008,479.70. Following the sale, the insider now directly owns 5,365 shares in the company, valued at approximately $1,933,009.50. The trade was a 34.28 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is accessible through the SEC website. Company insiders own 0.60% of the company's stock.

Institutional Investors Weigh In On Sherwin-Williams

A number of institutional investors have recently bought and sold shares of the business. Midwest Capital Advisors LLC bought a new stake in Sherwin-Williams in the fourth quarter valued at about $26,000. Park Square Financial Group LLC bought a new stake in shares of Sherwin-Williams in the 4th quarter worth about $27,000. Perkins Coie Trust Co acquired a new stake in shares of Sherwin-Williams during the 1st quarter worth about $27,000. Lee Danner & Bass Inc. bought a new position in Sherwin-Williams during the 4th quarter valued at about $28,000. Finally, Sierra Ocean LLC acquired a new position in shares of Sherwin-Williams in the 4th quarter worth approximately $36,000. Institutional investors and hedge funds own 77.67% of the company's stock.

Sherwin-Williams Company Profile

(

Get Free ReportThe Sherwin-Williams Company engages in the development, manufacture, distribution, and sale of paints, coating, and related products to professional, industrial, commercial, and retail customers. It operates through three segments: Paint Stores Group, Consumer Brands Group, and Performance Coatings Group.

Read More

Before you consider Sherwin-Williams, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sherwin-Williams wasn't on the list.

While Sherwin-Williams currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.