State Street Corp increased its holdings in shares of The Simply Good Foods Company (NASDAQ:SMPL - Free Report) by 6.0% during the third quarter, according to the company in its most recent disclosure with the SEC. The institutional investor owned 3,666,190 shares of the financial services provider's stock after purchasing an additional 208,070 shares during the period. State Street Corp owned 3.66% of Simply Good Foods worth $127,473,000 as of its most recent SEC filing.

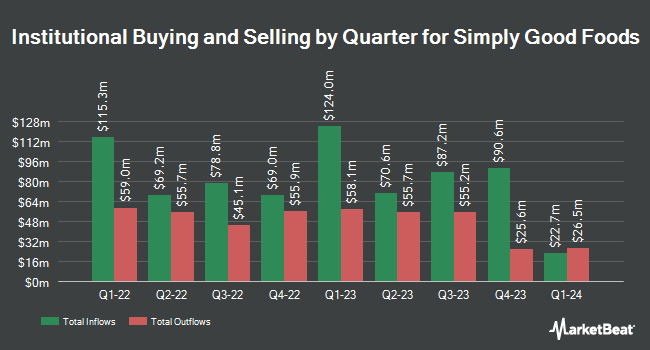

Several other institutional investors also recently bought and sold shares of SMPL. SG Americas Securities LLC increased its position in shares of Simply Good Foods by 671.9% during the second quarter. SG Americas Securities LLC now owns 30,697 shares of the financial services provider's stock worth $1,109,000 after purchasing an additional 26,720 shares in the last quarter. Sequoia Financial Advisors LLC purchased a new stake in shares of Simply Good Foods during the second quarter worth about $224,000. Blue Trust Inc. increased its holdings in shares of Simply Good Foods by 446.1% during the second quarter. Blue Trust Inc. now owns 12,166 shares of the financial services provider's stock valued at $414,000 after acquiring an additional 9,938 shares in the last quarter. Louisiana State Employees Retirement System raised its position in shares of Simply Good Foods by 1.8% in the 2nd quarter. Louisiana State Employees Retirement System now owns 45,800 shares of the financial services provider's stock valued at $1,655,000 after purchasing an additional 800 shares during the last quarter. Finally, Bank of New York Mellon Corp grew its position in Simply Good Foods by 2.7% during the 2nd quarter. Bank of New York Mellon Corp now owns 745,167 shares of the financial services provider's stock worth $26,923,000 after purchasing an additional 19,696 shares during the last quarter. 88.45% of the stock is owned by hedge funds and other institutional investors.

Simply Good Foods Stock Performance

Shares of NASDAQ:SMPL traded up $0.06 on Friday, reaching $39.67. The company's stock had a trading volume of 944,050 shares, compared to its average volume of 897,604. The Simply Good Foods Company has a 52-week low of $30.00 and a 52-week high of $43.00. The company has a debt-to-equity ratio of 0.23, a current ratio of 4.05 and a quick ratio of 2.75. The stock's 50-day moving average is $36.39 and its two-hundred day moving average is $35.24. The stock has a market capitalization of $3.98 billion, a P/E ratio of 28.75, a PEG ratio of 3.51 and a beta of 0.67.

Simply Good Foods (NASDAQ:SMPL - Get Free Report) last issued its quarterly earnings results on Thursday, October 24th. The financial services provider reported $0.50 earnings per share (EPS) for the quarter, hitting analysts' consensus estimates of $0.50. Simply Good Foods had a net margin of 10.46% and a return on equity of 10.23%. The business had revenue of $375.70 million for the quarter, compared to analyst estimates of $373.07 million. During the same period in the previous year, the business posted $0.41 earnings per share. The business's revenue was up 17.3% compared to the same quarter last year. As a group, sell-side analysts forecast that The Simply Good Foods Company will post 1.77 EPS for the current year.

Insider Buying and Selling at Simply Good Foods

In other news, Director Brian K. Ratzan sold 50,000 shares of Simply Good Foods stock in a transaction on Thursday, November 14th. The stock was sold at an average price of $37.38, for a total transaction of $1,869,000.00. Following the completion of the transaction, the director now owns 2,049,387 shares of the company's stock, valued at $76,606,086.06. The trade was a 2.38 % decrease in their position. The transaction was disclosed in a filing with the SEC, which is available through this hyperlink. Also, insider Timothy Richard Kraft sold 76,761 shares of the stock in a transaction dated Monday, November 18th. The shares were sold at an average price of $37.60, for a total transaction of $2,886,213.60. Following the completion of the sale, the insider now directly owns 40,068 shares in the company, valued at approximately $1,506,556.80. The trade was a 65.70 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last quarter, insiders sold 327,869 shares of company stock valued at $12,139,570. 10.98% of the stock is owned by company insiders.

Analysts Set New Price Targets

Several research firms have recently commented on SMPL. Stephens lowered their price objective on shares of Simply Good Foods from $44.00 to $42.00 and set an "overweight" rating for the company in a research note on Wednesday, October 23rd. Mizuho lifted their price objective on shares of Simply Good Foods from $40.00 to $45.00 and gave the company an "outperform" rating in a research note on Monday, December 9th. Finally, Citigroup cut their price objective on shares of Simply Good Foods from $46.00 to $43.00 and set a "buy" rating on the stock in a research note on Thursday, November 14th. Three analysts have rated the stock with a hold rating and six have given a buy rating to the company's stock. According to data from MarketBeat.com, the company has a consensus rating of "Moderate Buy" and a consensus target price of $40.22.

View Our Latest Report on SMPL

Simply Good Foods Profile

(

Free Report)

The Simply Good Foods Company operates as a consumer-packaged food and beverage company in North America and internationally. The company develops, markets, and sells snacks and meal replacements. It offers protein bars, ready-to-drink shakes, sweet and salty snacks, cookies, protein chips, and recipes under the Atkins and Quest brand names.

Read More

Before you consider Simply Good Foods, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Simply Good Foods wasn't on the list.

While Simply Good Foods currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.