Associated Banc Corp lessened its position in The Southern Company (NYSE:SO - Free Report) by 7.8% in the third quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 98,620 shares of the utilities provider's stock after selling 8,332 shares during the period. Associated Banc Corp's holdings in Southern were worth $8,894,000 at the end of the most recent quarter.

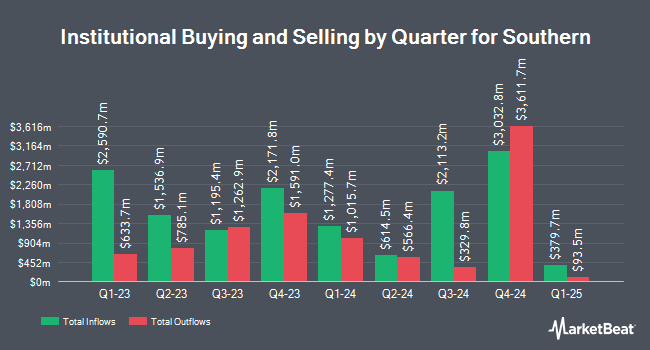

Other large investors have also recently bought and sold shares of the company. Frazier Financial Advisors LLC raised its holdings in Southern by 168.1% in the 3rd quarter. Frazier Financial Advisors LLC now owns 311 shares of the utilities provider's stock valued at $28,000 after buying an additional 195 shares during the last quarter. TruNorth Capital Management LLC acquired a new stake in Southern during the 2nd quarter valued at approximately $39,000. Versant Capital Management Inc raised its holdings in Southern by 31.8% during the 2nd quarter. Versant Capital Management Inc now owns 585 shares of the utilities provider's stock worth $45,000 after purchasing an additional 141 shares during the last quarter. West Branch Capital LLC lifted its position in shares of Southern by 34.7% in the 3rd quarter. West Branch Capital LLC now owns 501 shares of the utilities provider's stock worth $45,000 after purchasing an additional 129 shares during the period. Finally, Friedenthal Financial bought a new stake in shares of Southern in the 2nd quarter valued at $52,000. 64.10% of the stock is currently owned by institutional investors.

Insider Activity

In other news, CEO James Y. Kerr II sold 30,000 shares of the stock in a transaction that occurred on Friday, October 4th. The shares were sold at an average price of $89.64, for a total transaction of $2,689,200.00. Following the completion of the transaction, the chief executive officer now directly owns 145,088 shares of the company's stock, valued at $13,005,688.32. This represents a 17.13 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Also, EVP Bryan D. Anderson sold 6,565 shares of the company's stock in a transaction that occurred on Friday, September 6th. The shares were sold at an average price of $89.54, for a total value of $587,830.10. Following the completion of the transaction, the executive vice president now owns 44,467 shares in the company, valued at approximately $3,981,575.18. The trade was a 12.86 % decrease in their position. The disclosure for this sale can be found here. 0.18% of the stock is currently owned by corporate insiders.

Wall Street Analyst Weigh In

A number of brokerages recently weighed in on SO. Morgan Stanley lowered their target price on shares of Southern from $88.00 to $85.00 and set an "equal weight" rating for the company in a research note on Friday. BMO Capital Markets dropped their price objective on Southern from $99.00 to $97.00 and set an "outperform" rating on the stock in a research note on Friday, November 1st. UBS Group raised their target price on Southern from $90.00 to $91.00 and gave the stock a "neutral" rating in a research note on Friday, September 20th. Guggenheim boosted their price target on Southern from $93.00 to $97.00 and gave the company a "buy" rating in a research note on Wednesday, October 2nd. Finally, Scotiabank increased their price target on Southern from $87.00 to $96.00 and gave the stock a "sector outperform" rating in a report on Tuesday, August 20th. One equities research analyst has rated the stock with a sell rating, eight have given a hold rating and seven have given a buy rating to the company's stock. According to MarketBeat, Southern currently has a consensus rating of "Hold" and a consensus price target of $89.47.

Get Our Latest Stock Analysis on SO

Southern Stock Up 0.9 %

Shares of NYSE:SO traded up $0.81 during mid-day trading on Monday, hitting $88.41. 5,833,878 shares of the company traded hands, compared to its average volume of 4,447,653. The stock has a market cap of $96.87 billion, a P/E ratio of 20.56, a P/E/G ratio of 3.20 and a beta of 0.52. The stock has a 50-day moving average price of $89.73 and a two-hundred day moving average price of $84.79. The Southern Company has a 12-month low of $65.80 and a 12-month high of $94.45. The company has a current ratio of 0.91, a quick ratio of 0.66 and a debt-to-equity ratio of 1.66.

Southern (NYSE:SO - Get Free Report) last posted its earnings results on Thursday, October 31st. The utilities provider reported $1.43 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.33 by $0.10. Southern had a net margin of 17.87% and a return on equity of 12.78%. The firm had revenue of $7.27 billion during the quarter, compared to analyst estimates of $7.14 billion. During the same quarter in the prior year, the business posted $1.42 EPS. The business's revenue was up 4.2% compared to the same quarter last year. On average, equities research analysts forecast that The Southern Company will post 4.03 earnings per share for the current year.

Southern Dividend Announcement

The firm also recently announced a quarterly dividend, which will be paid on Friday, December 6th. Stockholders of record on Monday, November 18th will be paid a $0.72 dividend. The ex-dividend date is Monday, November 18th. This represents a $2.88 dividend on an annualized basis and a dividend yield of 3.26%. Southern's payout ratio is presently 66.98%.

About Southern

(

Free Report)

The Southern Company, through its subsidiaries, engages in the generation, transmission, and distribution of electricity. The company also develops, constructs, acquires, owns, and manages power generation assets, including renewable energy projects and sells electricity in the wholesale market; and distributes natural gas in Illinois, Georgia, Virginia, and Tennessee, as well as provides gas marketing services, gas distribution operations, and gas pipeline investments operations.

Featured Articles

Before you consider Southern, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Southern wasn't on the list.

While Southern currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.