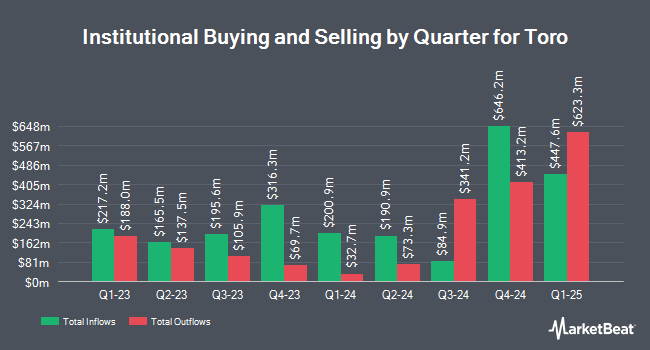

Point72 Asset Management L.P. reduced its stake in The Toro Company (NYSE:TTC - Free Report) by 31.7% during the third quarter, according to the company in its most recent 13F filing with the SEC. The fund owned 329,400 shares of the company's stock after selling 152,739 shares during the period. Point72 Asset Management L.P. owned approximately 0.32% of Toro worth $28,569,000 as of its most recent SEC filing.

Other hedge funds have also bought and sold shares of the company. UMB Bank n.a. raised its holdings in shares of Toro by 112.1% during the 3rd quarter. UMB Bank n.a. now owns 630 shares of the company's stock worth $55,000 after acquiring an additional 333 shares in the last quarter. Whittier Trust Co. of Nevada Inc. lifted its position in Toro by 850.0% during the third quarter. Whittier Trust Co. of Nevada Inc. now owns 855 shares of the company's stock valued at $74,000 after purchasing an additional 765 shares during the last quarter. Fifth Third Bancorp grew its stake in shares of Toro by 22.4% in the 2nd quarter. Fifth Third Bancorp now owns 908 shares of the company's stock worth $85,000 after buying an additional 166 shares in the last quarter. CWM LLC increased its holdings in shares of Toro by 15.5% in the 3rd quarter. CWM LLC now owns 1,063 shares of the company's stock worth $92,000 after buying an additional 143 shares during the last quarter. Finally, Rothschild Investment LLC purchased a new stake in shares of Toro during the 2nd quarter valued at about $94,000. Hedge funds and other institutional investors own 87.95% of the company's stock.

Toro Trading Up 0.1 %

Shares of NYSE TTC traded up $0.09 during midday trading on Friday, hitting $86.19. The company's stock had a trading volume of 516,335 shares, compared to its average volume of 851,069. The Toro Company has a 12-month low of $77.15 and a 12-month high of $102.00. The company has a current ratio of 1.94, a quick ratio of 0.85 and a debt-to-equity ratio of 0.59. The firm has a market cap of $8.84 billion, a P/E ratio of 22.62 and a beta of 0.70. The business's 50 day moving average is $84.00 and its two-hundred day moving average is $87.78.

Toro (NYSE:TTC - Get Free Report) last released its earnings results on Thursday, September 5th. The company reported $1.18 earnings per share for the quarter, missing the consensus estimate of $1.23 by ($0.05). The business had revenue of $1.16 billion for the quarter, compared to the consensus estimate of $1.26 billion. Toro had a return on equity of 25.94% and a net margin of 8.89%. The firm's revenue for the quarter was up 6.9% compared to the same quarter last year. During the same quarter last year, the business posted $0.95 earnings per share. As a group, equities research analysts expect that The Toro Company will post 4.16 EPS for the current year.

Toro Dividend Announcement

The business also recently announced a quarterly dividend, which was paid on Friday, October 11th. Stockholders of record on Monday, September 30th were given a dividend of $0.36 per share. This represents a $1.44 dividend on an annualized basis and a dividend yield of 1.67%. The ex-dividend date was Monday, September 30th. Toro's dividend payout ratio (DPR) is presently 37.80%.

Wall Street Analyst Weigh In

Several equities research analysts have weighed in on TTC shares. StockNews.com raised Toro from a "hold" rating to a "buy" rating in a research note on Monday, September 9th. DA Davidson decreased their price target on Toro from $103.00 to $88.00 and set a "neutral" rating on the stock in a report on Monday, September 9th. Northland Securities reaffirmed a "market perform" rating and set a $100.00 price objective on shares of Toro in a research note on Friday, September 6th. Finally, Robert W. Baird reduced their target price on shares of Toro from $102.00 to $92.00 and set a "neutral" rating on the stock in a research note on Friday, September 6th. Three equities research analysts have rated the stock with a hold rating and one has given a buy rating to the company. According to data from MarketBeat.com, the stock currently has a consensus rating of "Hold" and a consensus price target of $93.33.

View Our Latest Research Report on TTC

Toro Company Profile

(

Free Report)

The Toro Company designs, manufactures, markets, and sells professional turf maintenance equipment and services. It operates through two segments: Professional and Residential. The Professional segment offers turf and landscape equipment products, including sports fields and grounds mowing and maintenance equipment, golf course mowing and maintenance equipment, landscape contractor mowing equipment, landscape creation and renovation equipment, and other maintenance equipment; rental, specialty, and underground construction equipment, such as horizontal directional drills, walk and ride trenchers, stand-on skid steers, vacuum excavators, stump grinders, turf renovation products, asset locators, pipe rehabilitation solutions, materials handling equipment, and other after-market tools; and snow and ice management equipment, such as snowplows, as well as stand-on snow and ice removal equipment, such as snowplow, snow brush, and snow thrower attachments, salt and sand spreaders, and related parts and accessories for light and medium duty trucks, utility task vehicles, skid steers, and front-end loaders.

See Also

Before you consider Toro, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Toro wasn't on the list.

While Toro currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.