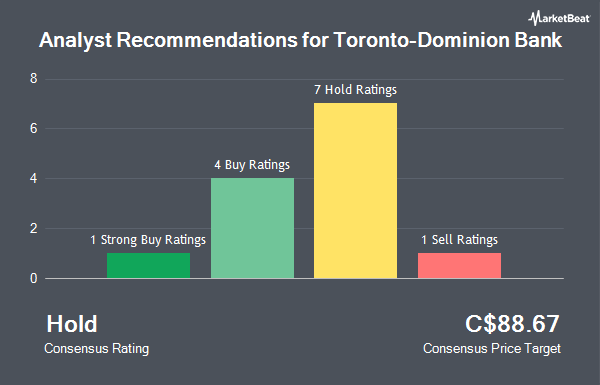

The Toronto-Dominion Bank (TSE:TD - Get Free Report) NYSE: TD has earned a consensus recommendation of "Hold" from the thirteen research firms that are presently covering the company, MarketBeat.com reports. One research analyst has rated the stock with a sell rating, seven have assigned a hold rating, four have assigned a buy rating and one has assigned a strong buy rating to the company. The average 12-month price target among brokers that have issued ratings on the stock in the last year is C$88.75.

A number of research analysts have commented on TD shares. Scotiabank reduced their price objective on shares of Toronto-Dominion Bank from C$83.00 to C$82.00 and set a "sector perform" rating on the stock in a research note on Thursday, February 20th. BMO Capital Markets upgraded Toronto-Dominion Bank from a "market perform" rating to an "outperform" rating and set a C$90.00 price target for the company in a research note on Thursday, December 19th. Jefferies Financial Group cut Toronto-Dominion Bank from a "buy" rating to a "hold" rating and upped their price objective for the company from C$90.00 to C$99.00 in a research note on Tuesday, February 18th. UBS Group lifted their target price on Toronto-Dominion Bank from C$83.00 to C$90.00 in a research report on Friday, February 14th. Finally, CIBC lowered their price target on Toronto-Dominion Bank from C$96.00 to C$95.00 in a report on Thursday, March 6th.

View Our Latest Stock Analysis on Toronto-Dominion Bank

Insider Transactions at Toronto-Dominion Bank

In related news, Director Theresa Lynn Currie sold 45,172 shares of the stock in a transaction dated Monday, March 3rd. The shares were sold at an average price of C$86.50, for a total transaction of C$3,907,378.00. Following the completion of the sale, the director now owns 163 shares in the company, valued at C$14,099.50. This trade represents a 99.64 % decrease in their position. Also, Director Michael A. French sold 9,288 shares of the firm's stock in a transaction that occurred on Monday, March 17th. The stock was sold at an average price of C$85.25, for a total transaction of C$791,802.00. 0.08% of the stock is currently owned by corporate insiders.

Toronto-Dominion Bank Trading Up 1.9 %

Shares of TD traded up C$1.52 during midday trading on Friday, reaching C$81.19. 6,589,490 shares of the company were exchanged, compared to its average volume of 8,775,661. Toronto-Dominion Bank has a 1-year low of C$73.22 and a 1-year high of C$87.99. The stock has a 50-day moving average price of C$84.51 and a 200-day moving average price of C$81.27. The company has a market cap of C$142.44 billion, a price-to-earnings ratio of 16.09, a P/E/G ratio of 1.22 and a beta of 0.82.

Toronto-Dominion Bank Announces Dividend

The firm also recently announced a quarterly dividend, which will be paid on Wednesday, April 30th. Shareholders of record on Wednesday, April 30th will be issued a $1.05 dividend. This represents a $4.20 dividend on an annualized basis and a yield of 5.17%. The ex-dividend date of this dividend is Thursday, April 10th. Toronto-Dominion Bank's dividend payout ratio (DPR) is currently 80.84%.

About Toronto-Dominion Bank

(

Get Free ReportThe Toronto-Dominion Bank, together with its subsidiaries, provides various financial products and services in Canada, the United States, and internationally. It operates through four segments: Canadian Personal and Commercial Banking, U.S. Retail, Wealth Management and Insurance, and Wholesale Banking.

Read More

Before you consider Toronto-Dominion Bank, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Toronto-Dominion Bank wasn't on the list.

While Toronto-Dominion Bank currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.