Cullen Capital Management LLC reduced its holdings in The Travelers Companies, Inc. (NYSE:TRV - Free Report) by 4.9% in the fourth quarter, according to its most recent filing with the Securities & Exchange Commission. The institutional investor owned 706,849 shares of the insurance provider's stock after selling 36,487 shares during the period. Travelers Companies makes up 1.9% of Cullen Capital Management LLC's portfolio, making the stock its 25th largest holding. Cullen Capital Management LLC owned approximately 0.31% of Travelers Companies worth $170,273,000 as of its most recent SEC filing.

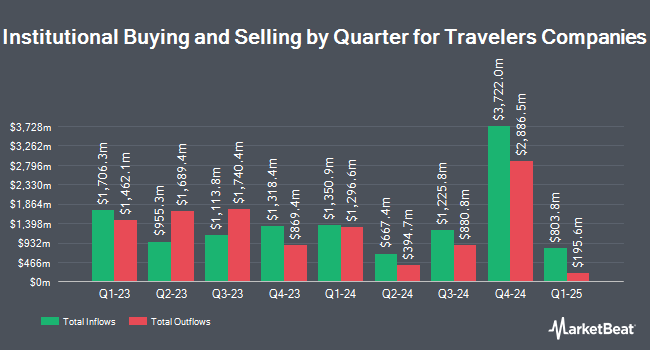

A number of other hedge funds have also bought and sold shares of TRV. Norges Bank purchased a new position in Travelers Companies in the 4th quarter worth $560,918,000. Raymond James Financial Inc. purchased a new position in Travelers Companies during the fourth quarter worth approximately $138,619,000. Proficio Capital Partners LLC purchased a new stake in shares of Travelers Companies during the fourth quarter worth about $96,012,000. Bryn Mawr Capital Management LLC boosted its stake in shares of Travelers Companies by 15,056.4% in the fourth quarter. Bryn Mawr Capital Management LLC now owns 238,258 shares of the insurance provider's stock worth $57,394,000 after acquiring an additional 236,686 shares during the last quarter. Finally, Teacher Retirement System of Texas lifted its stake in shares of Travelers Companies by 148.0% in the fourth quarter. Teacher Retirement System of Texas now owns 334,053 shares of the insurance provider's stock worth $80,470,000 after buying an additional 199,340 shares in the last quarter. Institutional investors own 82.45% of the company's stock.

Travelers Companies Stock Performance

Shares of NYSE:TRV traded down $5.72 during trading on Thursday, reaching $242.38. 618,964 shares of the company's stock traded hands, compared to its average volume of 1,425,888. The stock has a market capitalization of $54.95 billion, a P/E ratio of 11.29, a price-to-earnings-growth ratio of 4.65 and a beta of 0.48. The Travelers Companies, Inc. has a 12 month low of $200.21 and a 12 month high of $269.55. The company has a 50 day moving average of $251.57 and a 200-day moving average of $248.74. The company has a debt-to-equity ratio of 0.29, a current ratio of 0.33 and a quick ratio of 0.33.

Travelers Companies (NYSE:TRV - Get Free Report) last posted its earnings results on Wednesday, January 22nd. The insurance provider reported $9.15 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $6.50 by $2.65. The company had revenue of $12.01 billion for the quarter, compared to analysts' expectations of $10.80 billion. Travelers Companies had a return on equity of 19.06% and a net margin of 10.77%. The firm's quarterly revenue was up 9.9% compared to the same quarter last year. During the same period last year, the business posted $7.01 earnings per share. On average, equities analysts expect that The Travelers Companies, Inc. will post 17.02 EPS for the current year.

Travelers Companies Announces Dividend

The firm also recently declared a quarterly dividend, which was paid on Monday, March 31st. Stockholders of record on Monday, March 10th were paid a $1.05 dividend. The ex-dividend date was Monday, March 10th. This represents a $4.20 annualized dividend and a dividend yield of 1.73%. Travelers Companies's payout ratio is 19.56%.

Analysts Set New Price Targets

TRV has been the topic of a number of recent analyst reports. JPMorgan Chase & Co. upped their price objective on Travelers Companies from $260.00 to $271.00 and gave the company an "underweight" rating in a report on Tuesday. Piper Sandler upgraded shares of Travelers Companies from a "neutral" rating to an "overweight" rating and boosted their price target for the stock from $259.00 to $310.00 in a research note on Friday, January 24th. StockNews.com downgraded shares of Travelers Companies from a "buy" rating to a "hold" rating in a research report on Thursday, January 23rd. Keefe, Bruyette & Woods lowered their price target on Travelers Companies from $286.00 to $274.00 and set an "outperform" rating for the company in a report on Wednesday. Finally, Wells Fargo & Company upgraded Travelers Companies from an "underweight" rating to an "equal weight" rating and lifted their target price for the stock from $225.00 to $247.00 in a research report on Wednesday. Three investment analysts have rated the stock with a sell rating, thirteen have given a hold rating and seven have given a buy rating to the company. According to data from MarketBeat.com, Travelers Companies currently has a consensus rating of "Hold" and a consensus target price of $261.89.

Get Our Latest Research Report on TRV

About Travelers Companies

(

Free Report)

The Travelers Companies, Inc, through its subsidiaries, provides a range of commercial and personal property, and casualty insurance products and services to businesses, government units, associations, and individuals in the United States and internationally. The company operates through three segments: Business Insurance, Bond & Specialty Insurance, and Personal Insurance.

See Also

Before you consider Travelers Companies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Travelers Companies wasn't on the list.

While Travelers Companies currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.