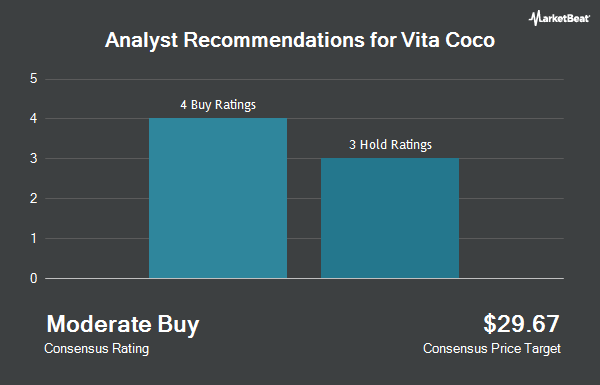

Shares of The Vita Coco Company, Inc. (NASDAQ:COCO - Get Free Report) have received an average rating of "Moderate Buy" from the eight analysts that are currently covering the firm, MarketBeat reports. Three investment analysts have rated the stock with a hold recommendation and five have issued a buy recommendation on the company. The average twelve-month target price among brokerages that have covered the stock in the last year is $31.00.

Separately, Craig Hallum upped their price objective on shares of Vita Coco from $33.00 to $36.00 and gave the company a "buy" rating in a report on Thursday, October 31st.

Get Our Latest Analysis on Vita Coco

Vita Coco Stock Up 0.6 %

Shares of Vita Coco stock traded up $0.22 during trading hours on Monday, reaching $36.34. 349,035 shares of the company's stock were exchanged, compared to its average volume of 617,398. Vita Coco has a 1 year low of $19.41 and a 1 year high of $37.05. The company has a market capitalization of $2.06 billion, a P/E ratio of 36.48, a price-to-earnings-growth ratio of 2.36 and a beta of 0.22. The business has a fifty day moving average of $30.85 and a two-hundred day moving average of $28.25.

Vita Coco (NASDAQ:COCO - Get Free Report) last released its earnings results on Wednesday, October 30th. The company reported $0.32 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.26 by $0.06. Vita Coco had a net margin of 11.99% and a return on equity of 26.49%. The business had revenue of $133.00 million during the quarter, compared to analyst estimates of $138.56 million. During the same quarter in the prior year, the firm earned $0.26 earnings per share. The company's revenue for the quarter was down 3.6% compared to the same quarter last year. As a group, research analysts predict that Vita Coco will post 1.07 EPS for the current year.

Insider Buying and Selling at Vita Coco

In other Vita Coco news, Director Ira Liran sold 27,176 shares of the company's stock in a transaction dated Friday, November 8th. The shares were sold at an average price of $36.04, for a total value of $979,423.04. Following the transaction, the director now owns 883,729 shares of the company's stock, valued at $31,849,593.16. This represents a 2.98 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is available through this link. Also, CMO Jane Prior sold 3,888 shares of the company's stock in a transaction dated Thursday, November 21st. The shares were sold at an average price of $37.01, for a total transaction of $143,894.88. Following the completion of the transaction, the chief marketing officer now directly owns 131,834 shares in the company, valued at $4,879,176.34. The trade was a 2.86 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold 51,313 shares of company stock valued at $1,813,768 over the last 90 days. 34.20% of the stock is owned by insiders.

Institutional Trading of Vita Coco

Hedge funds have recently made changes to their positions in the business. nVerses Capital LLC lifted its position in shares of Vita Coco by 271.4% during the second quarter. nVerses Capital LLC now owns 2,600 shares of the company's stock worth $72,000 after purchasing an additional 1,900 shares in the last quarter. CWM LLC lifted its position in shares of Vita Coco by 40.7% during the second quarter. CWM LLC now owns 2,720 shares of the company's stock worth $76,000 after purchasing an additional 787 shares in the last quarter. Comerica Bank lifted its position in shares of Vita Coco by 1,155.7% during the first quarter. Comerica Bank now owns 3,993 shares of the company's stock worth $98,000 after purchasing an additional 3,675 shares in the last quarter. Quest Partners LLC lifted its position in shares of Vita Coco by 16,538.1% during the third quarter. Quest Partners LLC now owns 3,494 shares of the company's stock worth $99,000 after purchasing an additional 3,473 shares in the last quarter. Finally, ProShare Advisors LLC acquired a new stake in shares of Vita Coco during the second quarter worth about $141,000. Institutional investors and hedge funds own 88.49% of the company's stock.

Vita Coco Company Profile

(

Get Free ReportThe Vita Coco Company, Inc develops, markets, and distributes coconut water products under the Vita Coco brand name in the United States, Canada, Europe, the Middle East, Africa, and the Asia Pacific. The company offers coconut oil and coconut milk; juice; Runa, a plant-based energy drink; packaged water under the Ever & Ever brand name; and PWR LIFT, a protein-infused fitness drink.

Read More

Before you consider Vita Coco, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vita Coco wasn't on the list.

While Vita Coco currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.