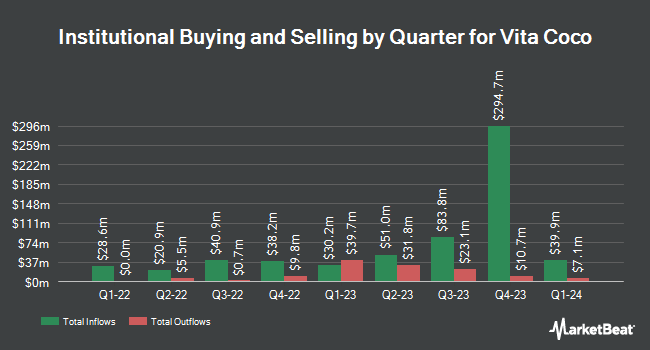

US Bancorp DE lessened its stake in The Vita Coco Company, Inc. (NASDAQ:COCO - Free Report) by 67.4% in the fourth quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The fund owned 4,883 shares of the company's stock after selling 10,085 shares during the period. US Bancorp DE's holdings in Vita Coco were worth $180,000 as of its most recent SEC filing.

Several other institutional investors also recently bought and sold shares of COCO. GAMMA Investing LLC raised its stake in shares of Vita Coco by 84.9% during the fourth quarter. GAMMA Investing LLC now owns 784 shares of the company's stock valued at $29,000 after acquiring an additional 360 shares during the last quarter. E Fund Management Hong Kong Co. Ltd. bought a new position in Vita Coco during the 4th quarter valued at approximately $52,000. Venturi Wealth Management LLC purchased a new stake in Vita Coco in the 4th quarter worth approximately $66,000. Quest Partners LLC grew its position in shares of Vita Coco by 16,538.1% in the 3rd quarter. Quest Partners LLC now owns 3,494 shares of the company's stock worth $99,000 after buying an additional 3,473 shares during the last quarter. Finally, Zurcher Kantonalbank Zurich Cantonalbank increased its stake in shares of Vita Coco by 25.6% during the third quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 7,027 shares of the company's stock valued at $199,000 after buying an additional 1,434 shares during the period. 88.49% of the stock is currently owned by hedge funds and other institutional investors.

Wall Street Analysts Forecast Growth

COCO has been the subject of a number of research analyst reports. The Goldman Sachs Group lifted their price target on shares of Vita Coco from $34.00 to $38.00 and gave the company a "buy" rating in a report on Thursday, February 27th. Stephens lowered shares of Vita Coco from an "overweight" rating to an "equal weight" rating and set a $36.00 target price on the stock. in a research note on Monday, January 27th. Wells Fargo & Company decreased their price target on shares of Vita Coco from $40.00 to $39.00 and set an "overweight" rating for the company in a research note on Thursday, February 27th. Finally, Bank of America lifted their price objective on Vita Coco from $30.00 to $38.00 and gave the company a "neutral" rating in a research report on Friday, December 6th. Three analysts have rated the stock with a hold rating and four have assigned a buy rating to the stock. According to MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and an average price target of $35.14.

Check Out Our Latest Report on COCO

Vita Coco Stock Up 0.9 %

Shares of NASDAQ COCO traded up $0.32 on Wednesday, reaching $34.94. 280,191 shares of the company's stock traded hands, compared to its average volume of 549,029. The business's 50 day simple moving average is $36.22 and its two-hundred day simple moving average is $33.54. The Vita Coco Company, Inc. has a 12 month low of $23.00 and a 12 month high of $40.32. The company has a market cap of $1.99 billion, a price-to-earnings ratio of 35.20, a price-to-earnings-growth ratio of 2.25 and a beta of 0.34.

Insider Activity at Vita Coco

In other Vita Coco news, Director Ira Liran sold 30,000 shares of the firm's stock in a transaction dated Thursday, December 19th. The shares were sold at an average price of $35.58, for a total transaction of $1,067,400.00. Following the completion of the sale, the director now directly owns 853,729 shares in the company, valued at approximately $30,375,677.82. This trade represents a 3.39 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, COO Jonathan Burth sold 700 shares of the company's stock in a transaction that occurred on Friday, February 14th. The stock was sold at an average price of $40.25, for a total transaction of $28,175.00. Following the completion of the transaction, the chief operating officer now owns 104,108 shares in the company, valued at approximately $4,190,347. This represents a 0.67 % decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 107,410 shares of company stock valued at $3,875,211 in the last 90 days. Corporate insiders own 34.20% of the company's stock.

Vita Coco Company Profile

(

Free Report)

The Vita Coco Company, Inc develops, markets, and distributes coconut water products under the Vita Coco brand name in the United States, Canada, Europe, the Middle East, Africa, and the Asia Pacific. The company offers coconut oil and coconut milk; juice; Runa, a plant-based energy drink; packaged water under the Ever & Ever brand name; and PWR LIFT, a protein-infused fitness drink.

See Also

Before you consider Vita Coco, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vita Coco wasn't on the list.

While Vita Coco currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.