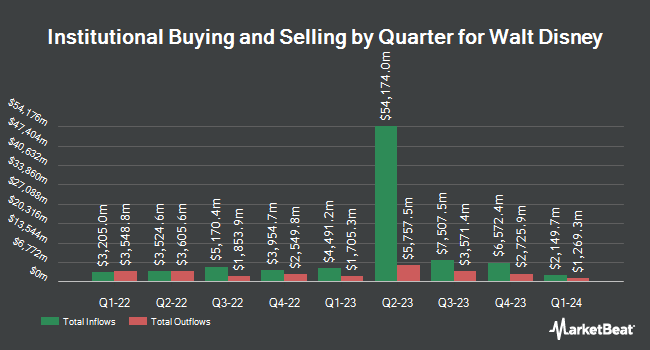

MetLife Investment Management LLC trimmed its stake in shares of The Walt Disney Company (NYSE:DIS - Free Report) by 3.0% during the third quarter, according to its most recent filing with the Securities and Exchange Commission. The institutional investor owned 471,993 shares of the entertainment giant's stock after selling 14,522 shares during the quarter. MetLife Investment Management LLC's holdings in Walt Disney were worth $45,401,000 as of its most recent filing with the Securities and Exchange Commission.

Other institutional investors also recently made changes to their positions in the company. RPg Family Wealth Advisory LLC acquired a new stake in shares of Walt Disney in the third quarter valued at $126,000. CreativeOne Wealth LLC raised its position in Walt Disney by 5.4% in the third quarter. CreativeOne Wealth LLC now owns 11,448 shares of the entertainment giant's stock worth $1,101,000 after acquiring an additional 590 shares in the last quarter. RS Crum Inc. lifted its holdings in Walt Disney by 0.8% in the 3rd quarter. RS Crum Inc. now owns 16,651 shares of the entertainment giant's stock valued at $1,602,000 after acquiring an additional 127 shares during the last quarter. RBO & Co. LLC boosted its position in shares of Walt Disney by 2.1% during the 3rd quarter. RBO & Co. LLC now owns 149,444 shares of the entertainment giant's stock valued at $14,375,000 after purchasing an additional 3,012 shares in the last quarter. Finally, Townsquare Capital LLC raised its holdings in shares of Walt Disney by 20.3% in the 3rd quarter. Townsquare Capital LLC now owns 192,719 shares of the entertainment giant's stock worth $18,538,000 after purchasing an additional 32,584 shares in the last quarter. 65.71% of the stock is owned by institutional investors and hedge funds.

Insider Activity at Walt Disney

In related news, EVP Brent Woodford sold 5,000 shares of the company's stock in a transaction on Wednesday, November 20th. The shares were sold at an average price of $113.62, for a total transaction of $568,100.00. Following the completion of the transaction, the executive vice president now directly owns 44,055 shares in the company, valued at $5,005,529.10. This represents a 10.19 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. Also, CEO Robert A. Iger sold 372,412 shares of the firm's stock in a transaction on Friday, November 22nd. The stock was sold at an average price of $114.57, for a total transaction of $42,667,242.84. Following the completion of the sale, the chief executive officer now owns 226,767 shares in the company, valued at $25,980,695.19. This represents a 62.15 % decrease in their ownership of the stock. The disclosure for this sale can be found here. 0.10% of the stock is owned by company insiders.

Analysts Set New Price Targets

DIS has been the topic of several recent research reports. Guggenheim lifted their price target on shares of Walt Disney from $110.00 to $130.00 and gave the stock a "buy" rating in a research report on Friday, November 15th. Raymond James reaffirmed a "market perform" rating on shares of Walt Disney in a research report on Tuesday, October 1st. UBS Group decreased their price target on Walt Disney from $130.00 to $120.00 and set a "buy" rating for the company in a research report on Thursday, August 8th. Sanford C. Bernstein upped their price objective on shares of Walt Disney from $115.00 to $120.00 and gave the company an "outperform" rating in a research note on Friday, November 15th. Finally, Wells Fargo & Company lifted their target price on shares of Walt Disney from $116.00 to $138.00 and gave the stock an "overweight" rating in a research report on Friday, November 15th. Five analysts have rated the stock with a hold rating, eighteen have given a buy rating and one has assigned a strong buy rating to the company's stock. According to data from MarketBeat, Walt Disney has a consensus rating of "Moderate Buy" and a consensus price target of $123.83.

Check Out Our Latest Stock Analysis on Walt Disney

Walt Disney Stock Up 0.8 %

Walt Disney stock traded up $0.98 during mid-day trading on Wednesday, hitting $116.43. 308,039 shares of the company's stock were exchanged, compared to its average volume of 10,941,364. The Walt Disney Company has a 1-year low of $83.91 and a 1-year high of $123.74. The stock has a 50 day moving average of $99.03 and a two-hundred day moving average of $96.86. The stock has a market cap of $210.85 billion, a P/E ratio of 42.60, a P/E/G ratio of 2.16 and a beta of 1.40. The company has a current ratio of 0.73, a quick ratio of 0.67 and a debt-to-equity ratio of 0.37.

Walt Disney Profile

(

Free Report)

The Walt Disney Company operates as an entertainment company worldwide. It operates through three segments: Entertainment, Sports, and Experiences. The company produces and distributes film and television video streaming content under the ABC Television Network, Disney, Freeform, FX, Fox, National Geographic, and Star brand television channels, as well as ABC television stations and A+E television networks; and produces original content under the ABC Signature, Disney Branded Television, FX Productions, Lucasfilm, Marvel, National Geographic Studios, Pixar, Searchlight Pictures, Twentieth Century Studios, 20th Television, and Walt Disney Pictures banners.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Walt Disney, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Walt Disney wasn't on the list.

While Walt Disney currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.