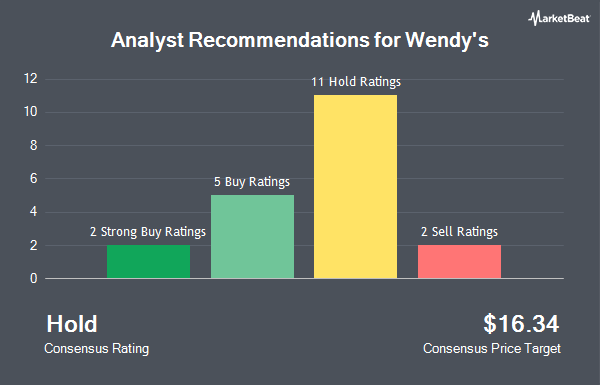

The Wendy's Company (NASDAQ:WEN - Get Free Report) has earned a consensus recommendation of "Hold" from the twenty research firms that are covering the firm, MarketBeat.com reports. One equities research analyst has rated the stock with a sell rating, fourteen have assigned a hold rating, four have issued a buy rating and one has assigned a strong buy rating to the company. The average 1-year price target among analysts that have updated their coverage on the stock in the last year is $20.36.

Several brokerages recently issued reports on WEN. Citigroup lifted their target price on Wendy's from $18.00 to $18.75 and gave the company a "neutral" rating in a research note on Tuesday, October 8th. BMO Capital Markets lifted their price objective on shares of Wendy's from $19.00 to $20.00 and gave the company a "market perform" rating in a research report on Friday, November 1st. Stephens restated an "equal weight" rating and set a $19.00 target price on shares of Wendy's in a research report on Tuesday, November 19th. TD Cowen lifted their price target on shares of Wendy's from $17.00 to $19.00 and gave the company a "hold" rating in a report on Wednesday, October 16th. Finally, Truist Financial increased their price objective on shares of Wendy's from $21.00 to $22.00 and gave the company a "buy" rating in a report on Friday, November 1st.

View Our Latest Stock Analysis on WEN

Hedge Funds Weigh In On Wendy's

Several institutional investors have recently bought and sold shares of WEN. Tidal Investments LLC boosted its position in Wendy's by 10.9% during the first quarter. Tidal Investments LLC now owns 16,079 shares of the restaurant operator's stock valued at $303,000 after purchasing an additional 1,577 shares in the last quarter. CWM LLC grew its position in shares of Wendy's by 312.2% in the 2nd quarter. CWM LLC now owns 49,436 shares of the restaurant operator's stock worth $838,000 after buying an additional 37,443 shares during the last quarter. SG Americas Securities LLC raised its stake in shares of Wendy's by 221.0% during the 2nd quarter. SG Americas Securities LLC now owns 41,094 shares of the restaurant operator's stock worth $697,000 after acquiring an additional 28,294 shares in the last quarter. Granite Bay Wealth Management LLC purchased a new stake in Wendy's during the second quarter valued at approximately $1,718,000. Finally, Wealth Enhancement Advisory Services LLC boosted its stake in Wendy's by 52.0% in the second quarter. Wealth Enhancement Advisory Services LLC now owns 40,044 shares of the restaurant operator's stock valued at $679,000 after acquiring an additional 13,703 shares in the last quarter. 85.96% of the stock is owned by hedge funds and other institutional investors.

Wendy's Stock Performance

Wendy's stock traded down $0.21 during mid-day trading on Friday, reaching $17.48. 3,326,622 shares of the stock traded hands, compared to its average volume of 3,274,168. The business's 50-day moving average is $18.69 and its 200-day moving average is $17.59. Wendy's has a 12-month low of $15.61 and a 12-month high of $20.65. The company has a debt-to-equity ratio of 12.64, a current ratio of 2.10 and a quick ratio of 2.08. The stock has a market capitalization of $3.56 billion, a PE ratio of 18.40, a price-to-earnings-growth ratio of 2.50 and a beta of 0.77.

Wendy's (NASDAQ:WEN - Get Free Report) last issued its quarterly earnings data on Thursday, October 31st. The restaurant operator reported $0.25 earnings per share (EPS) for the quarter, meeting analysts' consensus estimates of $0.25. Wendy's had a net margin of 8.76% and a return on equity of 70.02%. The firm had revenue of $566.70 million during the quarter, compared to the consensus estimate of $560.50 million. During the same quarter in the previous year, the firm posted $0.27 EPS. The company's revenue for the quarter was up 2.9% compared to the same quarter last year. As a group, sell-side analysts predict that Wendy's will post 0.99 EPS for the current fiscal year.

Wendy's Announces Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Monday, December 16th. Investors of record on Monday, December 2nd will be paid a $0.25 dividend. This represents a $1.00 dividend on an annualized basis and a yield of 5.72%. The ex-dividend date is Monday, December 2nd. Wendy's's dividend payout ratio (DPR) is presently 105.26%.

Wendy's Company Profile

(

Get Free ReportThe Wendy's Company, together with its subsidiaries, operates as a quick-service restaurant company in the United States and internationally. It operates through Wendy's U.S., Wendy's International, and Global Real Estate & Development segments. The company is involved in operating, developing, and franchising a system of quick-service restaurants specializing in hamburger sandwiches.

Recommended Stories

Before you consider Wendy's, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Wendy's wasn't on the list.

While Wendy's currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.