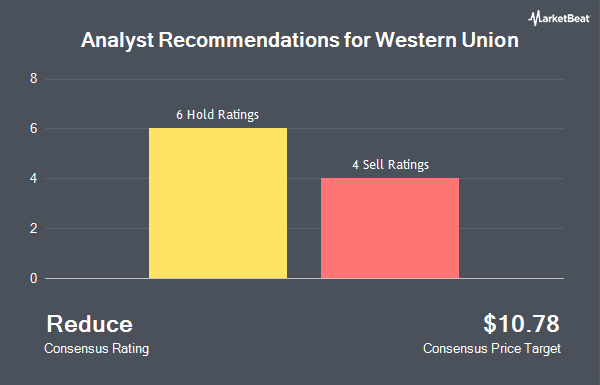

Shares of The Western Union Company (NYSE:WU - Get Free Report) have earned an average rating of "Reduce" from the ten brokerages that are currently covering the stock, MarketBeat.com reports. Three equities research analysts have rated the stock with a sell rating and seven have given a hold rating to the company. The average 1 year price objective among analysts that have issued ratings on the stock in the last year is $12.11.

Several research analysts have recently issued reports on the stock. Morgan Stanley decreased their price objective on shares of Western Union from $10.00 to $9.00 and set an "underweight" rating for the company in a report on Wednesday, February 5th. Keefe, Bruyette & Woods decreased their price target on Western Union from $13.00 to $12.00 and set a "market perform" rating for the company in a research note on Monday, December 9th. JMP Securities reissued a "market perform" rating on shares of Western Union in a research note on Thursday, February 6th. Barclays decreased their target price on Western Union from $11.00 to $10.00 and set an "underweight" rating for the company in a research note on Friday, December 13th. Finally, Susquehanna dropped their price target on shares of Western Union from $13.00 to $12.00 and set a "neutral" rating on the stock in a research report on Wednesday, February 5th.

Check Out Our Latest Stock Report on Western Union

Western Union Stock Performance

Western Union stock traded down $0.06 during mid-day trading on Tuesday, hitting $10.43. 5,838,276 shares of the company's stock traded hands, compared to its average volume of 4,277,679. The company has a quick ratio of 1.10, a current ratio of 1.20 and a debt-to-equity ratio of 3.04. Western Union has a one year low of $10.04 and a one year high of $14.00. The firm has a 50 day moving average price of $10.62 and a 200 day moving average price of $10.98. The company has a market cap of $3.52 billion, a PE ratio of 3.82, a price-to-earnings-growth ratio of 1.32 and a beta of 0.79.

Western Union (NYSE:WU - Get Free Report) last posted its quarterly earnings data on Tuesday, February 4th. The credit services provider reported $0.40 earnings per share for the quarter, missing the consensus estimate of $0.42 by ($0.02). Western Union had a return on equity of 96.90% and a net margin of 22.19%. On average, equities analysts forecast that Western Union will post 1.79 EPS for the current year.

Western Union declared that its board has authorized a stock repurchase program on Friday, December 13th that permits the company to repurchase $1.00 billion in outstanding shares. This repurchase authorization permits the credit services provider to purchase up to 27.5% of its shares through open market purchases. Shares repurchase programs are typically an indication that the company's board of directors believes its stock is undervalued.

Western Union Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Monday, March 31st. Shareholders of record on Monday, March 17th will be paid a dividend of $0.235 per share. This represents a $0.94 dividend on an annualized basis and a yield of 9.01%. The ex-dividend date is Monday, March 17th. Western Union's dividend payout ratio is presently 34.43%.

Institutional Investors Weigh In On Western Union

Hedge funds have recently made changes to their positions in the company. Empowered Funds LLC raised its stake in Western Union by 52.2% during the 3rd quarter. Empowered Funds LLC now owns 15,433 shares of the credit services provider's stock valued at $184,000 after purchasing an additional 5,292 shares during the period. Pathstone Holdings LLC raised its position in Western Union by 90.8% during the third quarter. Pathstone Holdings LLC now owns 162,403 shares of the credit services provider's stock valued at $1,937,000 after buying an additional 77,290 shares during the period. Citigroup Inc. lifted its stake in Western Union by 19.0% in the 3rd quarter. Citigroup Inc. now owns 523,676 shares of the credit services provider's stock worth $6,247,000 after acquiring an additional 83,715 shares in the last quarter. Kingsview Wealth Management LLC boosted its position in Western Union by 293.3% during the 3rd quarter. Kingsview Wealth Management LLC now owns 198,002 shares of the credit services provider's stock worth $2,362,000 after acquiring an additional 147,658 shares during the period. Finally, Algert Global LLC grew its stake in Western Union by 48.7% during the 3rd quarter. Algert Global LLC now owns 284,904 shares of the credit services provider's stock valued at $3,399,000 after acquiring an additional 93,280 shares in the last quarter. Hedge funds and other institutional investors own 91.81% of the company's stock.

Western Union Company Profile

(

Get Free ReportThe Western Union Company provides money movement and payment services worldwide. The company operates through Consumer Money Transfer and Consumer Services segments. The Consumer Money Transfer segment facilitates money transfers for international cross-border and intra-country transfers, primarily through a network of retail agent locations, as well as through websites and mobile devices.

Read More

Before you consider Western Union, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Western Union wasn't on the list.

While Western Union currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.