Thompson Siegel & Walmsley LLC lessened its position in Check Point Software Technologies Ltd. (NASDAQ:CHKP - Free Report) by 1.2% in the fourth quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 536,670 shares of the technology company's stock after selling 6,700 shares during the period. Check Point Software Technologies comprises about 1.6% of Thompson Siegel & Walmsley LLC's portfolio, making the stock its 6th largest holding. Thompson Siegel & Walmsley LLC owned 0.49% of Check Point Software Technologies worth $100,196,000 at the end of the most recent reporting period.

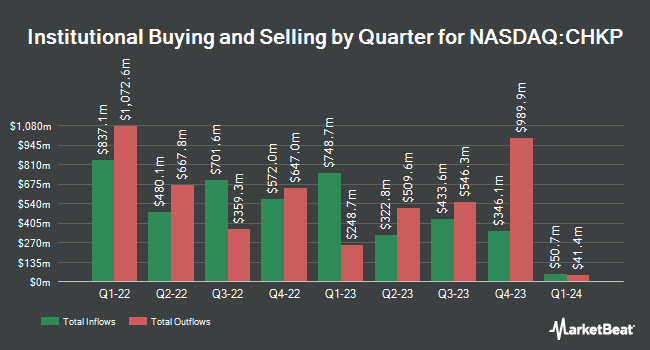

A number of other hedge funds and other institutional investors also recently modified their holdings of CHKP. FSA Wealth Management LLC bought a new position in shares of Check Point Software Technologies in the 3rd quarter valued at about $27,000. GAMMA Investing LLC boosted its holdings in shares of Check Point Software Technologies by 53.1% during the 4th quarter. GAMMA Investing LLC now owns 173 shares of the technology company's stock worth $32,000 after buying an additional 60 shares during the period. Golden State Wealth Management LLC bought a new stake in shares of Check Point Software Technologies during the 4th quarter worth about $35,000. Strategic Financial Concepts LLC bought a new stake in shares of Check Point Software Technologies during the 4th quarter worth about $35,000. Finally, Exchange Traded Concepts LLC boosted its holdings in shares of Check Point Software Technologies by 142.7% during the 4th quarter. Exchange Traded Concepts LLC now owns 233 shares of the technology company's stock worth $44,000 after buying an additional 137 shares during the period. Institutional investors own 98.51% of the company's stock.

Analyst Ratings Changes

Several analysts have weighed in on the stock. Citigroup lifted their price objective on shares of Check Point Software Technologies from $185.00 to $190.00 and gave the stock a "neutral" rating in a research note on Friday, January 17th. The Goldman Sachs Group cut shares of Check Point Software Technologies from a "buy" rating to a "neutral" rating and lifted their price objective for the stock from $204.00 to $207.00 in a research note on Thursday, January 2nd. Scotiabank boosted their target price on shares of Check Point Software Technologies from $215.00 to $250.00 and gave the company a "sector outperform" rating in a research report on Friday, January 31st. Arete Research upgraded shares of Check Point Software Technologies to a "hold" rating in a research report on Monday, February 24th. Finally, Barclays boosted their target price on shares of Check Point Software Technologies from $200.00 to $230.00 and gave the company an "equal weight" rating in a research report on Thursday, January 30th. Eighteen investment analysts have rated the stock with a hold rating, nine have given a buy rating and one has issued a strong buy rating to the company's stock. According to MarketBeat.com, the company presently has a consensus rating of "Hold" and a consensus target price of $224.86.

Get Our Latest Stock Report on Check Point Software Technologies

Check Point Software Technologies Trading Down 2.0 %

CHKP opened at $217.99 on Thursday. The company's fifty day moving average price is $206.90 and its two-hundred day moving average price is $195.36. Check Point Software Technologies Ltd. has a 1-year low of $145.75 and a 1-year high of $230.65. The company has a market cap of $23.98 billion, a price-to-earnings ratio of 29.18, a PEG ratio of 3.41 and a beta of 0.62.

Check Point Software Technologies Profile

(

Free Report)

Check Point Software Technologies Ltd. develops, markets, and supports a range of products and services for IT security worldwide. The company offers a multilevel security architecture, cloud, network, mobile devices, endpoints information, and IOT solutions. It provides Check Point Infinity Architecture, a cyber security architecture that protects against fifth generation cyber-attacks across various networks, endpoint, cloud, workloads, Internet of Things, and mobile.

Read More

Want to see what other hedge funds are holding CHKP? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Check Point Software Technologies Ltd. (NASDAQ:CHKP - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Check Point Software Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Check Point Software Technologies wasn't on the list.

While Check Point Software Technologies currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.