Thompson Siegel & Walmsley LLC grew its stake in shares of Talos Energy Inc. (NYSE:TALO - Free Report) by 28.3% during the third quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The fund owned 1,129,757 shares of the company's stock after acquiring an additional 249,412 shares during the quarter. Thompson Siegel & Walmsley LLC owned about 0.63% of Talos Energy worth $11,693,000 as of its most recent SEC filing.

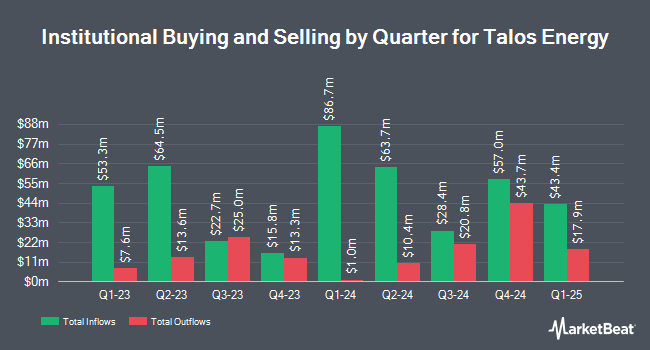

A number of other institutional investors and hedge funds also recently made changes to their positions in TALO. Vanguard Group Inc. raised its stake in Talos Energy by 23.7% during the 1st quarter. Vanguard Group Inc. now owns 9,793,618 shares of the company's stock worth $136,425,000 after acquiring an additional 1,873,537 shares during the period. Dimensional Fund Advisors LP raised its stake in Talos Energy by 2.8% during the 2nd quarter. Dimensional Fund Advisors LP now owns 6,546,942 shares of the company's stock worth $79,545,000 after acquiring an additional 179,181 shares during the period. American Century Companies Inc. raised its position in shares of Talos Energy by 26.2% during the second quarter. American Century Companies Inc. now owns 2,982,351 shares of the company's stock valued at $36,236,000 after buying an additional 619,169 shares during the last quarter. HITE Hedge Asset Management LLC raised its position in shares of Talos Energy by 78.0% during the second quarter. HITE Hedge Asset Management LLC now owns 2,546,425 shares of the company's stock valued at $30,939,000 after buying an additional 1,116,241 shares during the last quarter. Finally, Victory Capital Management Inc. grew its holdings in shares of Talos Energy by 1,557.7% in the second quarter. Victory Capital Management Inc. now owns 1,834,694 shares of the company's stock valued at $22,292,000 after purchasing an additional 1,724,014 shares in the last quarter. Hedge funds and other institutional investors own 89.35% of the company's stock.

Talos Energy Stock Down 1.0 %

Talos Energy stock traded down $0.12 during trading hours on Friday, reaching $11.45. The stock had a trading volume of 1,061,224 shares, compared to its average volume of 2,123,904. The company has a market cap of $2.06 billion, a price-to-earnings ratio of 21.20 and a beta of 1.92. The company has a debt-to-equity ratio of 0.47, a current ratio of 0.97 and a quick ratio of 0.97. The business's 50 day moving average price is $10.83 and its 200-day moving average price is $11.29. Talos Energy Inc. has a 52 week low of $9.44 and a 52 week high of $14.77.

Talos Energy (NYSE:TALO - Get Free Report) last posted its quarterly earnings data on Monday, November 11th. The company reported ($0.14) earnings per share (EPS) for the quarter, missing the consensus estimate of ($0.07) by ($0.07). Talos Energy had a net margin of 3.95% and a negative return on equity of 1.98%. The company had revenue of $509.29 million for the quarter, compared to analyst estimates of $504.44 million. During the same quarter last year, the company earned $0.14 EPS. The business's revenue was up 32.9% compared to the same quarter last year. Sell-side analysts anticipate that Talos Energy Inc. will post -0.2 EPS for the current year.

Insider Transactions at Talos Energy

In related news, insider Control Empresarial De Capital acquired 100,000 shares of the firm's stock in a transaction dated Friday, September 27th. The stock was acquired at an average price of $10.31 per share, for a total transaction of $1,031,000.00. Following the purchase, the insider now owns 43,545,604 shares of the company's stock, valued at $448,955,177.24. This represents a 0.23 % increase in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Insiders acquired a total of 1,220,000 shares of company stock valued at $13,135,560 in the last three months. 0.77% of the stock is currently owned by company insiders.

Analyst Ratings Changes

A number of research analysts recently weighed in on TALO shares. KeyCorp cut their target price on shares of Talos Energy from $21.00 to $16.00 and set an "overweight" rating for the company in a report on Wednesday, October 16th. BMO Capital Markets lowered their target price on shares of Talos Energy from $14.00 to $13.00 and set a "market perform" rating for the company in a research note on Friday, October 4th. Mizuho began coverage on shares of Talos Energy in a research note on Thursday, September 19th. They set an "outperform" rating and a $16.00 target price for the company. Citigroup lifted their price objective on Talos Energy from $12.50 to $14.50 and gave the company a "buy" rating in a report on Thursday, November 14th. Finally, Benchmark restated a "buy" rating and issued a $20.00 price objective on shares of Talos Energy in a report on Tuesday, November 12th. One equities research analyst has rated the stock with a hold rating and seven have issued a buy rating to the stock. According to data from MarketBeat, the company has a consensus rating of "Moderate Buy" and a consensus target price of $17.06.

Check Out Our Latest Analysis on Talos Energy

Talos Energy Profile

(

Free Report)

Talos Energy Inc, through its subsidiaries, engages in the exploration and production of oil, natural gas, and natural gas liquids in the United States and Mexico. It also engages in the development of carbon capture and sequestration. Talos Energy Inc was founded in 2011 and is headquartered in Houston, Texas.

See Also

Before you consider Talos Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Talos Energy wasn't on the list.

While Talos Energy currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.