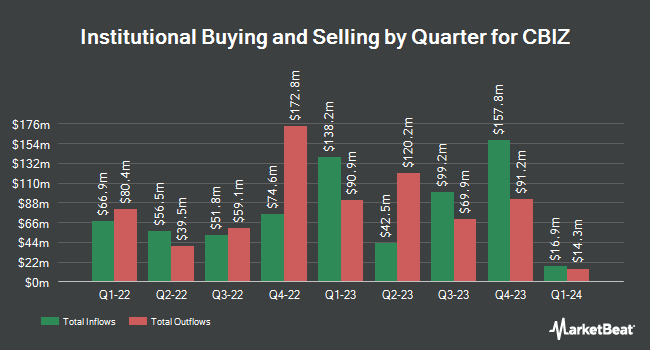

Thompson Siegel & Walmsley LLC trimmed its position in CBIZ, Inc. (NYSE:CBZ - Free Report) by 23.8% in the 3rd quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 43,912 shares of the business services provider's stock after selling 13,700 shares during the period. Thompson Siegel & Walmsley LLC owned 0.09% of CBIZ worth $2,955,000 at the end of the most recent reporting period.

Other hedge funds and other institutional investors have also added to or reduced their stakes in the company. Quest Partners LLC increased its position in shares of CBIZ by 2,980.0% during the 2nd quarter. Quest Partners LLC now owns 462 shares of the business services provider's stock valued at $34,000 after purchasing an additional 447 shares during the last quarter. Covestor Ltd lifted its holdings in shares of CBIZ by 45.5% in the 1st quarter. Covestor Ltd now owns 707 shares of the business services provider's stock worth $56,000 after acquiring an additional 221 shares during the last quarter. Signaturefd LLC grew its holdings in shares of CBIZ by 55.8% during the 3rd quarter. Signaturefd LLC now owns 961 shares of the business services provider's stock valued at $65,000 after purchasing an additional 344 shares during the last quarter. Picton Mahoney Asset Management purchased a new position in CBIZ in the 2nd quarter worth $82,000. Finally, KBC Group NV lifted its stake in CBIZ by 29.7% in the third quarter. KBC Group NV now owns 1,553 shares of the business services provider's stock worth $105,000 after purchasing an additional 356 shares during the last quarter. 87.44% of the stock is currently owned by hedge funds and other institutional investors.

CBIZ Stock Up 1.7 %

Shares of CBZ traded up $1.36 on Friday, hitting $80.79. 330,760 shares of the stock traded hands, compared to its average volume of 362,909. CBIZ, Inc. has a one year low of $57.01 and a one year high of $86.36. The company has a market capitalization of $4.05 billion, a PE ratio of 34.23 and a beta of 0.91. The business has a 50 day simple moving average of $69.74 and a 200 day simple moving average of $73.07. The company has a debt-to-equity ratio of 0.36, a quick ratio of 1.49 and a current ratio of 1.49.

CBIZ (NYSE:CBZ - Get Free Report) last released its quarterly earnings data on Tuesday, October 29th. The business services provider reported $0.84 earnings per share for the quarter, beating the consensus estimate of $0.76 by $0.08. The firm had revenue of $438.90 million during the quarter, compared to analysts' expectations of $440.16 million. CBIZ had a net margin of 7.08% and a return on equity of 15.12%. The firm's quarterly revenue was up 6.9% on a year-over-year basis. During the same period in the previous year, the company earned $0.66 earnings per share. As a group, equities analysts forecast that CBIZ, Inc. will post 2.65 earnings per share for the current fiscal year.

Analyst Upgrades and Downgrades

Several brokerages have weighed in on CBZ. Sidoti raised shares of CBIZ from a "neutral" rating to a "buy" rating and increased their price target for the company from $80.00 to $86.00 in a research report on Monday, August 12th. StockNews.com downgraded CBIZ from a "hold" rating to a "sell" rating in a report on Wednesday.

View Our Latest Report on CBZ

About CBIZ

(

Free Report)

CBIZ, Inc provides financial, insurance, and advisory services in the United States and Canada. It operates through Financial Services, Benefits and Insurance Services, and National Practices segments. The Financial Services segment offers accounting and tax, financial advisory, valuation, risk and advisory, and government healthcare consulting services.

Further Reading

Before you consider CBIZ, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CBIZ wasn't on the list.

While CBIZ currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.