Thomson Reuters (NYSE:TRI - Get Free Report) TSE: TRI was upgraded by StockNews.com from a "sell" rating to a "hold" rating in a research note issued to investors on Wednesday.

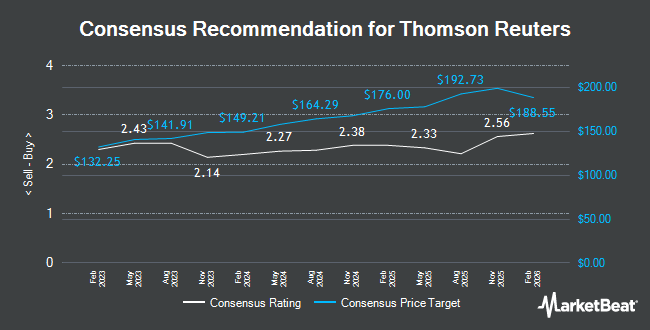

Other analysts have also issued research reports about the stock. Wells Fargo & Company started coverage on shares of Thomson Reuters in a research report on Tuesday, November 26th. They set an "equal weight" rating and a $165.00 target price on the stock. Scotiabank boosted their price objective on shares of Thomson Reuters from $182.00 to $187.00 and gave the stock a "sector outperform" rating in a report on Wednesday, November 6th. Royal Bank of Canada raised their target price on Thomson Reuters from $171.00 to $173.00 and gave the company a "sector perform" rating in a research note on Wednesday, November 6th. Finally, CIBC boosted their price target on Thomson Reuters from $164.00 to $165.00 and gave the stock a "neutral" rating in a research note on Friday, January 3rd. Eight analysts have rated the stock with a hold rating and four have issued a buy rating to the company. According to MarketBeat.com, the stock presently has a consensus rating of "Hold" and a consensus price target of $176.10.

Read Our Latest Report on Thomson Reuters

Thomson Reuters Stock Down 0.5 %

NYSE TRI traded down $0.85 during trading hours on Wednesday, hitting $159.64. The company had a trading volume of 313,609 shares, compared to its average volume of 270,642. The firm's 50 day moving average is $164.41 and its 200 day moving average is $165.89. The company has a debt-to-equity ratio of 0.16, a current ratio of 0.94 and a quick ratio of 0.94. Thomson Reuters has a fifty-two week low of $142.80 and a fifty-two week high of $176.03. The company has a market capitalization of $71.83 billion, a price-to-earnings ratio of 31.43, a P/E/G ratio of 5.69 and a beta of 0.72.

Thomson Reuters (NYSE:TRI - Get Free Report) TSE: TRI last issued its earnings results on Tuesday, November 5th. The business services provider reported $0.80 earnings per share for the quarter, topping the consensus estimate of $0.77 by $0.03. The company had revenue of $1.72 billion during the quarter, compared to the consensus estimate of $1.71 billion. Thomson Reuters had a return on equity of 14.85% and a net margin of 32.12%. The company's revenue was up 8.2% compared to the same quarter last year. During the same quarter in the prior year, the business earned $0.82 earnings per share. Sell-side analysts anticipate that Thomson Reuters will post 3.69 earnings per share for the current fiscal year.

Hedge Funds Weigh In On Thomson Reuters

A number of hedge funds have recently added to or reduced their stakes in TRI. World Investment Advisors LLC acquired a new position in shares of Thomson Reuters in the 3rd quarter valued at about $6,649,000. SkyView Investment Advisors LLC lifted its holdings in Thomson Reuters by 1.6% in the third quarter. SkyView Investment Advisors LLC now owns 4,235 shares of the business services provider's stock worth $722,000 after acquiring an additional 66 shares during the last quarter. Toronto Dominion Bank boosted its stake in Thomson Reuters by 1.8% in the third quarter. Toronto Dominion Bank now owns 514,250 shares of the business services provider's stock valued at $87,731,000 after acquiring an additional 9,200 shares during the period. Geode Capital Management LLC grew its holdings in shares of Thomson Reuters by 9.2% during the third quarter. Geode Capital Management LLC now owns 754,630 shares of the business services provider's stock valued at $130,341,000 after purchasing an additional 63,336 shares during the last quarter. Finally, Public Employees Retirement System of Ohio acquired a new stake in shares of Thomson Reuters during the 3rd quarter worth approximately $2,538,000. Institutional investors and hedge funds own 17.31% of the company's stock.

About Thomson Reuters

(

Get Free Report)

Thomson Reuters Corporation engages in the provision of business information services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific. It operates in five segments: Legal Professionals, Corporates, Tax & Accounting Professionals, Reuters News, and Global Print. The Legal Professionals segment offers research and workflow products focusing on legal research and integrated legal workflow solutions that combine content, tools, and analytics to law firms and governments.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Thomson Reuters, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Thomson Reuters wasn't on the list.

While Thomson Reuters currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.