Thrivent Financial for Lutherans raised its stake in shares of Darling Ingredients Inc. (NYSE:DAR - Free Report) by 24.2% during the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 91,958 shares of the company's stock after purchasing an additional 17,938 shares during the period. Thrivent Financial for Lutherans owned 0.06% of Darling Ingredients worth $3,417,000 as of its most recent SEC filing.

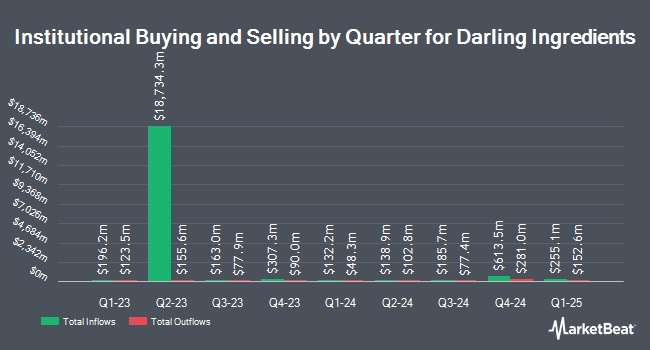

Other hedge funds and other institutional investors have also recently bought and sold shares of the company. Dimensional Fund Advisors LP raised its stake in Darling Ingredients by 52.4% during the second quarter. Dimensional Fund Advisors LP now owns 5,236,616 shares of the company's stock worth $192,445,000 after acquiring an additional 1,800,809 shares in the last quarter. ING Groep NV raised its position in shares of Darling Ingredients by 244.1% during the third quarter. ING Groep NV now owns 810,100 shares of the company's stock worth $30,103,000 after acquiring an additional 574,700 shares during the last quarter. Earnest Partners LLC lifted its position in Darling Ingredients by 14.0% in the 2nd quarter. Earnest Partners LLC now owns 3,829,265 shares of the company's stock valued at $140,725,000 after acquiring an additional 470,170 shares in the last quarter. Canada Pension Plan Investment Board bought a new position in Darling Ingredients in the second quarter valued at $15,406,000. Finally, Swedbank AB acquired a new stake in Darling Ingredients in the 1st quarter valued at about $14,676,000. 94.44% of the stock is owned by institutional investors.

Darling Ingredients Price Performance

NYSE:DAR traded up $1.07 during mid-day trading on Tuesday, hitting $41.11. 2,229,918 shares of the stock traded hands, compared to its average volume of 2,166,628. Darling Ingredients Inc. has a 12-month low of $32.67 and a 12-month high of $51.36. The company has a quick ratio of 0.83, a current ratio of 1.41 and a debt-to-equity ratio of 0.89. The company has a market cap of $6.54 billion, a PE ratio of 25.18 and a beta of 1.23. The business's 50-day moving average price is $38.54 and its 200 day moving average price is $38.48.

Darling Ingredients (NYSE:DAR - Get Free Report) last issued its quarterly earnings data on Thursday, October 24th. The company reported $0.11 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.40 by ($0.29). Darling Ingredients had a return on equity of 5.98% and a net margin of 4.42%. The business had revenue of $1.42 billion during the quarter, compared to analysts' expectations of $1.48 billion. During the same quarter last year, the business posted $0.77 EPS. The company's quarterly revenue was down 12.5% on a year-over-year basis. On average, analysts expect that Darling Ingredients Inc. will post 1.88 EPS for the current fiscal year.

Analyst Ratings Changes

A number of equities research analysts have weighed in on the company. JPMorgan Chase & Co. raised their target price on Darling Ingredients from $58.00 to $59.00 and gave the company an "overweight" rating in a report on Wednesday, October 30th. Jefferies Financial Group boosted their target price on Darling Ingredients from $44.00 to $46.00 and gave the stock a "buy" rating in a research note on Friday, October 25th. Piper Sandler reduced their price target on shares of Darling Ingredients from $50.00 to $48.00 and set an "overweight" rating on the stock in a research note on Friday, October 11th. Finally, TD Cowen dropped their price objective on shares of Darling Ingredients from $45.00 to $43.00 and set a "hold" rating for the company in a research note on Friday, September 13th. Two analysts have rated the stock with a hold rating and seven have issued a buy rating to the company's stock. According to data from MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and a consensus price target of $53.44.

Check Out Our Latest Stock Analysis on Darling Ingredients

About Darling Ingredients

(

Free Report)

Darling Ingredients Inc develops, produces, and sells natural ingredients from edible and inedible bio-nutrients in North America, Europe, China, South America, and internationally. The company operates through three segments: Feed Ingredients, Food Ingredients, and Fuel Ingredients. It offers ingredients and customized specialty solutions for customers in the pharmaceutical, food, pet food, feed, industrial, fuel, bioenergy, and fertilizer industries.

See Also

Before you consider Darling Ingredients, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Darling Ingredients wasn't on the list.

While Darling Ingredients currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.