Thrivent Financial for Lutherans grew its position in Tanger Inc. (NYSE:SKT - Free Report) by 13.6% during the third quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 418,712 shares of the real estate investment trust's stock after purchasing an additional 50,100 shares during the quarter. Thrivent Financial for Lutherans owned approximately 0.38% of Tanger worth $13,893,000 as of its most recent SEC filing.

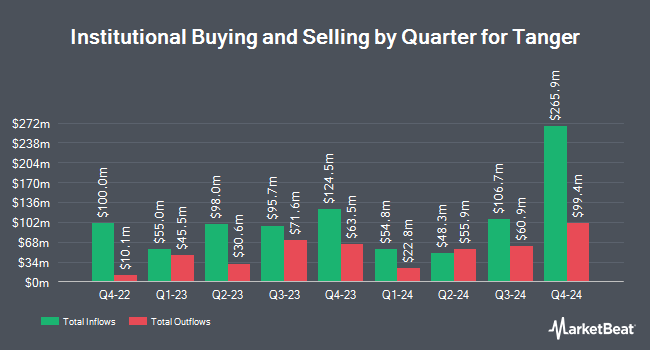

A number of other institutional investors and hedge funds have also modified their holdings of SKT. Vanguard Group Inc. raised its holdings in Tanger by 3.6% in the 1st quarter. Vanguard Group Inc. now owns 17,456,758 shares of the real estate investment trust's stock worth $515,498,000 after acquiring an additional 608,547 shares during the period. Land & Buildings Investment Management LLC increased its stake in shares of Tanger by 52.4% in the second quarter. Land & Buildings Investment Management LLC now owns 1,043,287 shares of the real estate investment trust's stock worth $28,284,000 after purchasing an additional 358,860 shares during the period. BROOKFIELD Corp ON acquired a new position in shares of Tanger during the 1st quarter worth about $10,441,000. Burney Co. bought a new stake in Tanger during the 1st quarter valued at approximately $7,158,000. Finally, Cubist Systematic Strategies LLC acquired a new stake in Tanger in the 2nd quarter valued at approximately $4,539,000. 85.23% of the stock is currently owned by institutional investors and hedge funds.

Insider Buying and Selling at Tanger

In other Tanger news, CAO Thomas Joseph Guerrieri, Jr. sold 3,000 shares of the business's stock in a transaction dated Tuesday, November 19th. The shares were sold at an average price of $36.27, for a total value of $108,810.00. Following the transaction, the chief accounting officer now directly owns 59,641 shares in the company, valued at $2,163,179.07. The trade was a 4.79 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink. Company insiders own 5.80% of the company's stock.

Tanger Price Performance

NYSE:SKT opened at $36.42 on Thursday. The company has a debt-to-equity ratio of 2.40, a quick ratio of 0.13 and a current ratio of 0.13. The company has a 50-day moving average of $33.73 and a 200-day moving average of $29.99. Tanger Inc. has a 52 week low of $24.72 and a 52 week high of $36.53. The company has a market capitalization of $4.03 billion, a price-to-earnings ratio of 42.35, a PEG ratio of 2.85 and a beta of 1.88.

Tanger (NYSE:SKT - Get Free Report) last announced its quarterly earnings results on Wednesday, November 6th. The real estate investment trust reported $0.22 EPS for the quarter, missing analysts' consensus estimates of $0.53 by ($0.31). The business had revenue of $133.00 million for the quarter, compared to the consensus estimate of $125.80 million. Tanger had a return on equity of 16.25% and a net margin of 18.55%. The firm's revenue for the quarter was up 13.3% on a year-over-year basis. During the same quarter in the prior year, the business earned $0.50 EPS. As a group, equities research analysts anticipate that Tanger Inc. will post 2.11 earnings per share for the current fiscal year.

Tanger Announces Dividend

The business also recently declared a quarterly dividend, which was paid on Friday, November 15th. Investors of record on Thursday, October 31st were paid a $0.275 dividend. This represents a $1.10 annualized dividend and a yield of 3.02%. The ex-dividend date was Thursday, October 31st. Tanger's dividend payout ratio is 127.91%.

Analysts Set New Price Targets

Several research firms have recently weighed in on SKT. Bank of America raised Tanger from a "neutral" rating to a "buy" rating and increased their price objective for the company from $35.00 to $40.00 in a research report on Monday, November 11th. Citigroup increased their price target on shares of Tanger from $34.00 to $41.00 and gave the company a "buy" rating in a report on Wednesday, November 13th. The Goldman Sachs Group boosted their price objective on shares of Tanger from $31.00 to $35.00 and gave the stock a "neutral" rating in a report on Friday, November 15th. Evercore ISI increased their target price on shares of Tanger from $31.00 to $33.00 and gave the company an "in-line" rating in a research note on Thursday, November 7th. Finally, Scotiabank boosted their price target on Tanger from $28.00 to $30.00 and gave the company a "sector perform" rating in a research note on Monday, August 26th. Three investment analysts have rated the stock with a hold rating and four have given a buy rating to the company's stock. Based on data from MarketBeat.com, the stock has an average rating of "Moderate Buy" and a consensus price target of $34.86.

Check Out Our Latest Research Report on SKT

About Tanger

(

Free Report)

Tanger Inc NYSE: SKT is a leading owner and operator of outlet and open-air retail shopping destinations, with over 43 years of expertise in the retail and outlet shopping industries. Tanger's portfolio of 38 outlet centers, one adjacent managed center and one open-air lifestyle center comprises over 15 million square feet well positioned across tourist destinations and vibrant markets in 20 U.S.

Read More

Before you consider Tanger, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tanger wasn't on the list.

While Tanger currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.