Thrivent Financial for Lutherans lowered its stake in shares of Kyndryl Holdings, Inc. (NYSE:KD - Free Report) by 8.6% in the third quarter, according to its most recent 13F filing with the SEC. The firm owned 181,595 shares of the company's stock after selling 17,128 shares during the period. Thrivent Financial for Lutherans owned approximately 0.08% of Kyndryl worth $4,173,000 at the end of the most recent reporting period.

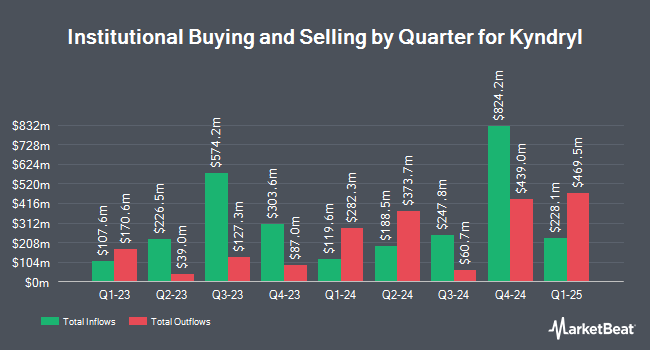

Several other institutional investors have also recently added to or reduced their stakes in the stock. Great Lakes Advisors LLC acquired a new stake in shares of Kyndryl during the second quarter worth about $19,996,000. Renaissance Technologies LLC lifted its holdings in Kyndryl by 32.3% during the 2nd quarter. Renaissance Technologies LLC now owns 2,765,800 shares of the company's stock worth $72,768,000 after buying an additional 675,800 shares in the last quarter. Cortland Associates Inc. MO boosted its position in Kyndryl by 35.7% in the 3rd quarter. Cortland Associates Inc. MO now owns 2,150,614 shares of the company's stock valued at $49,421,000 after buying an additional 565,263 shares during the period. Millennium Management LLC grew its stake in shares of Kyndryl by 101.1% in the second quarter. Millennium Management LLC now owns 1,011,420 shares of the company's stock worth $26,610,000 after acquiring an additional 508,553 shares in the last quarter. Finally, AQR Capital Management LLC increased its position in shares of Kyndryl by 392.1% during the second quarter. AQR Capital Management LLC now owns 631,299 shares of the company's stock worth $16,578,000 after acquiring an additional 503,020 shares during the period. Institutional investors and hedge funds own 71.53% of the company's stock.

Kyndryl Stock Up 1.7 %

Shares of NYSE KD opened at $33.05 on Monday. The business has a 50-day moving average of $24.99 and a two-hundred day moving average of $25.25. The company has a market capitalization of $7.68 billion, a price-to-earnings ratio of -84.74, a price-to-earnings-growth ratio of 7.83 and a beta of 1.63. Kyndryl Holdings, Inc. has a 1 year low of $17.64 and a 1 year high of $33.62. The company has a debt-to-equity ratio of 2.65, a current ratio of 1.03 and a quick ratio of 1.03.

Analyst Ratings Changes

A number of research analysts recently issued reports on the company. Bank of America started coverage on Kyndryl in a report on Friday. They issued a "buy" rating and a $40.00 target price for the company. Oppenheimer lifted their price objective on Kyndryl from $33.00 to $37.00 and gave the company an "outperform" rating in a research note on Friday. Finally, Susquehanna upped their target price on shares of Kyndryl from $33.00 to $40.00 and gave the stock a "positive" rating in a research note on Friday. Six investment analysts have rated the stock with a buy rating, According to data from MarketBeat.com, Kyndryl has an average rating of "Buy" and a consensus price target of $33.00.

Read Our Latest Stock Report on Kyndryl

Kyndryl Company Profile

(

Free Report)

Kyndryl Holdings, Inc operates as a technology services company and IT infrastructure services provider worldwide. The company offers cloud services; core enterprise and zCloud services; application, data, and artificial intelligence services; digital workplace services; security and resiliency services; and network services and edge services.

Read More

Before you consider Kyndryl, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kyndryl wasn't on the list.

While Kyndryl currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.